海外研报

筛选

Weekly FX summary – 5 August 2024

quo on Wednesday. Mexico and India to stand pat on Thursday. China trade data on Wednesday and CPI on Friday.

海外研报

2024年08月08日

Cross-Asset Weekly

The financial market turbulences this week have highlighted that (1) macro risks are shifting from inflation to growth, (2) carry trades are vulnerable to sharp reversals in late cycle ear.

海外研报

2024年08月12日

Slash and Burn

Macro jitters and vol spike clear out an "overgrown"' equity rally. After a summer rallyfueled mostly by multiple expansion, recession fears are back and motivated LOs to cutequity exposure to 2021 lows. At the same time, Treasury futures positions

海外研报

2024年08月16日

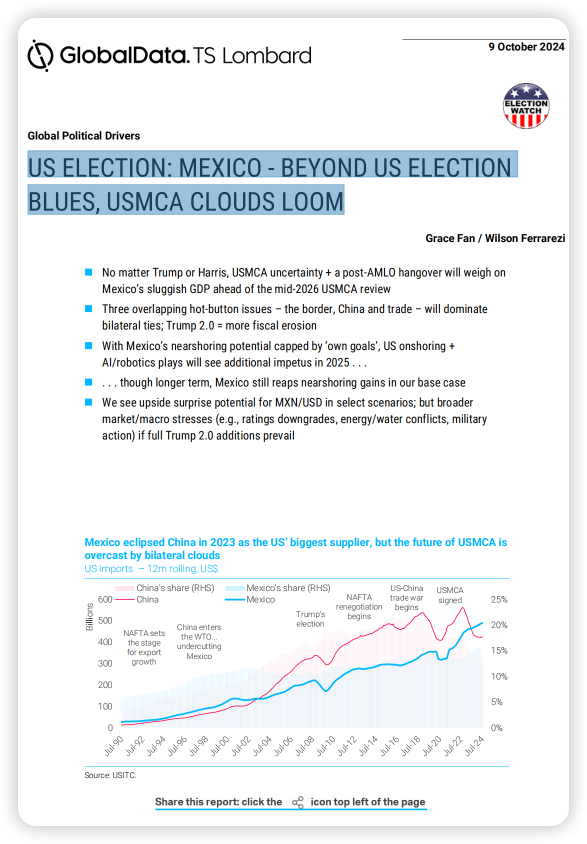

GD--US ELECTION: MEXICO - BEYOND US ELECTION BLUES, USMCA CLOUDS LOOM

◼ No matter Trump or Harris, USMCA uncertainty + a post-AMLO hangover will weigh on Mexico’s sluggish GDP ahead of the mid-2026 USMCA review◼ Three overlapping hot-button issues – the border, China and trade – will dominate

海外研报

2024年10月11日

GS--Aerospace & Defense_ 3Q24 earnings preview

Our 3Q24 A&D earnings preview provides our current thoughts on each sub-marketand single stock ideas into the results period. Aerospace OE is challenged by the

海外研报

2024年10月11日

BofA What Seasonality

S&P 500 defies gravity in the seasonally weakest monthThe S&P 500 gained 2.1% on a total return basis, the best September since 2013 and

海外研报

2024年10月11日

Global Metals & Mining_ Rio Tinto agrees counter-cyclical cash offer to acquire Arcadium Lithium

Rio Tinto has announced an agreement to acquire Arcadium Lithium (Not Rated).According to Rio, this represents a counter-cyclical expansion aligned with its

海外研报

2024年10月11日