BCA--Is The Fed Asleep At The Wheel… Again?

The good news is that we should not fear an imminent US recession.• In the absence of recession though, the Fed cannot cut rates as aggressivelyas is priced if it wants to keep inflation and inflation expectations anchored at2 percent.

应用介绍

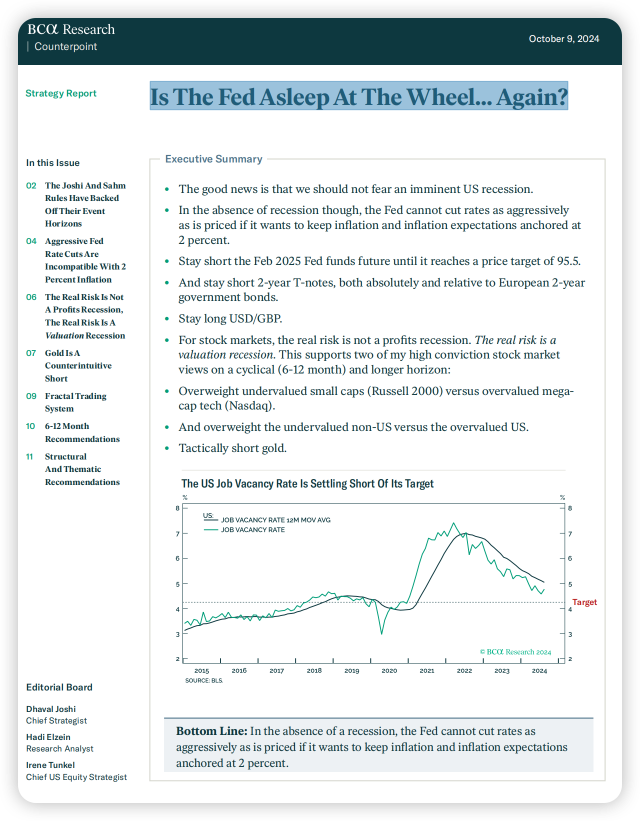

The good news is that we should not fear an imminent US recession.

• In the absence of recession though, the Fed cannot cut rates as aggressively

as is priced if it wants to keep inflation and inflation expectations anchored at

2 percent.

• Stay short the Feb 2025 Fed funds future until it reaches a price target of 95.5.

• And stay short 2-year T-notes, both absolutely and relative to European 2-year

government bonds.

• Stay long USD/GBP.

• For stock markets, the real risk is not a profits recession. The real risk is a

valuation recession. This supports two of my high conviction stock market

views on a cyclical (6-12 month) and longer horizon:

• Overweight undervalued small caps (Russell 2000) versus overvalued mega

cap tech (Nasdaq).

• And overweight the undervalued non-US versus the overvalued US.

• Tactically short gold

特别提示:英文研报翻译由于人手及工作量的问题为机器翻译,推荐阅读英文原版研报或下载后分段自行翻译,以达到良好的翻译效果和阅读体验。本站所有研报均来自网络,仅供学习使用,不具有任何投资之建议,严禁转载与分享,如违反后果自负。

发表评论 取消回复