BofA Equity Vol Insights - Nervous Vol Still Underprices Election Week

Stressed vol still underprices rare election + FOMC weekUS equity vol has become notably stressed in recent days with geopolitical risks rising and the US election approaching. The VIX trades at a 14-point premium to S&P realized

应用介绍

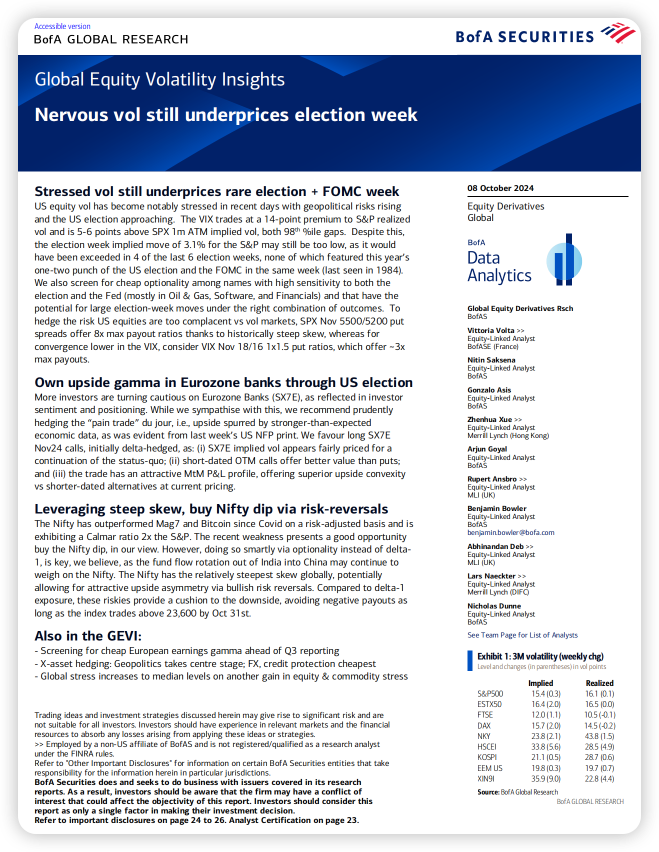

Stressed vol still underprices rare election + FOMC week

US equity vol has become notably stressed in recent days with geopolitical risks rising

and the US election approaching. The VIX trades at a 14-point premium to S&P realized

vol and is 5-6 points above SPX 1m ATM implied vol, both 98th %ile gaps. Despite this,

the election week implied move of 3.1% for the S&P may still be too low, as it would

have been exceeded in 4 of the last 6 election weeks, none of which featured this year’s

one-two punch of the US election and the FOMC in the same week (last seen in 1984).

We also screen for cheap optionality among names with high sensitivity to both the

election and the Fed (mostly in Oil & Gas, Software, and Financials) and that have the

potential for large election-week moves under the right combination of outcomes. To

hedge the risk US equities are too complacent vs vol markets, SPX Nov 5500/5200 put

spreads offer 8x max payout ratios thanks to historically steep skew, whereas for

convergence lower in the VIX, consider VIX Nov 18/16 1x1.5 put ratios, which offer ~3x

max payouts.

特别提示:英文研报翻译由于人手及工作量的问题为机器翻译,推荐阅读英文原版研报或下载后分段自行翻译,以达到良好的翻译效果和阅读体验。本站所有研报均来自网络,仅供学习使用,不具有任何投资之建议,严禁转载与分享,如违反后果自负。

发表评论 取消回复