海外研报

筛选

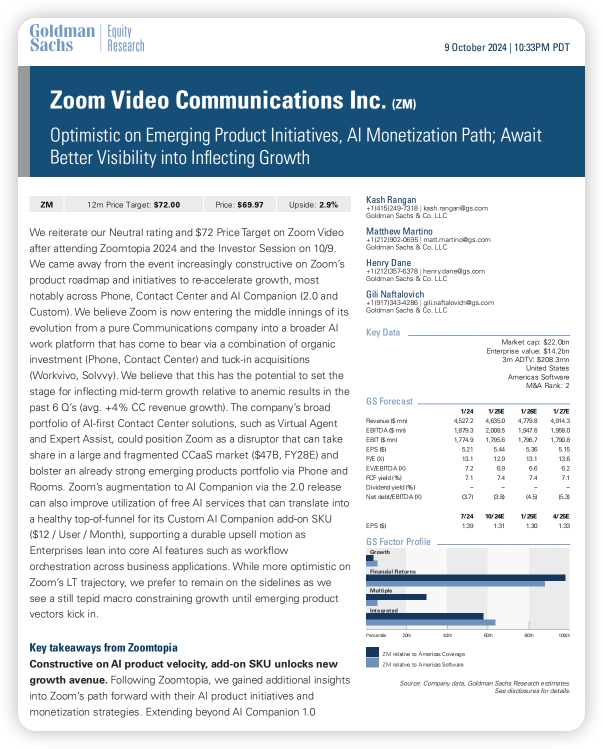

GS--Zoom Video Communications Inc

We reiterate our Neutral rating and $72 Price Target on Zoom Videoafter attending Zoomtopia 2024 and the Investor Session on 10/9.

海外研报

2024年10月11日

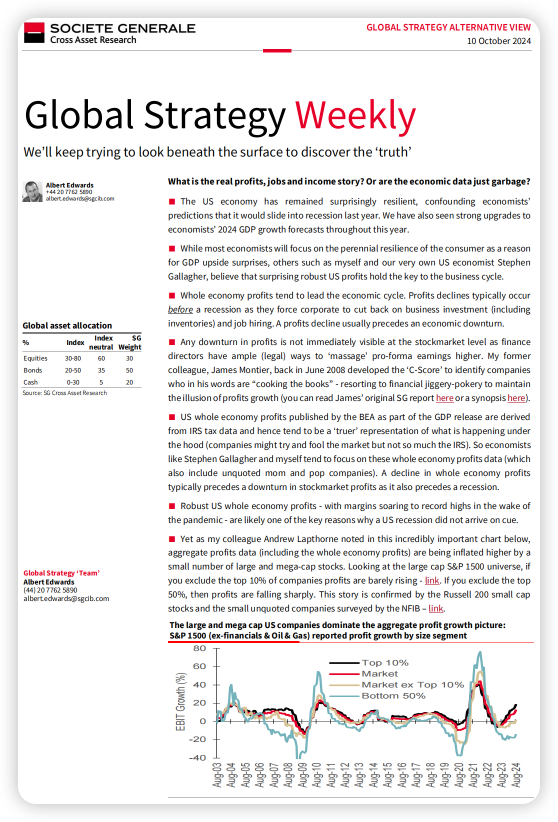

SocGen - Albert Edwards - We’ll keep trying to look beneath

The US economy has remained surprisingly resilient, confounding economists’ predictions that it would slide into recession last year. We have also seen strong upgrades to

海外研报

2024年10月11日

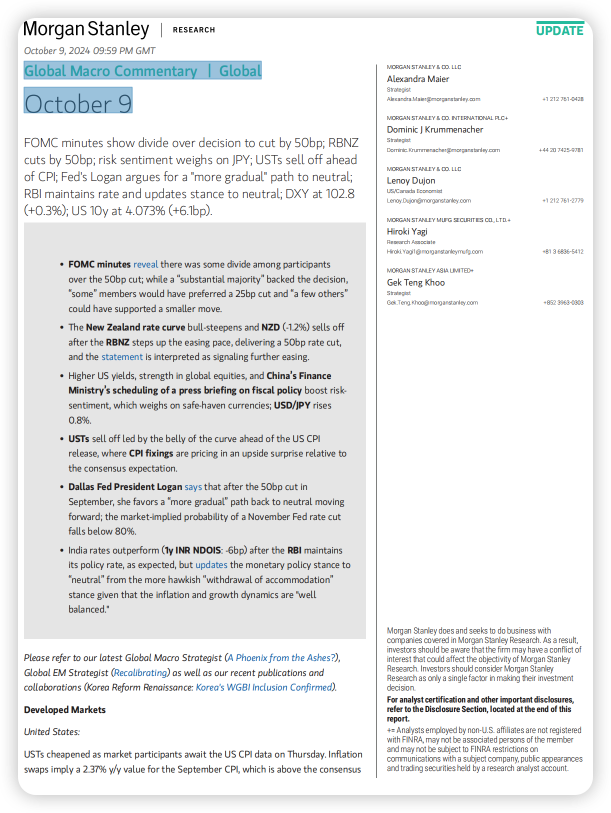

MS--Global Macro Commentary | Global October 9

FOMC minutes show divide over decision to cut by 50bp; RBNZ cuts by 50bp; risk sentiment weighs on JPY; USTs sell off ahead

海外研报

2024年10月11日

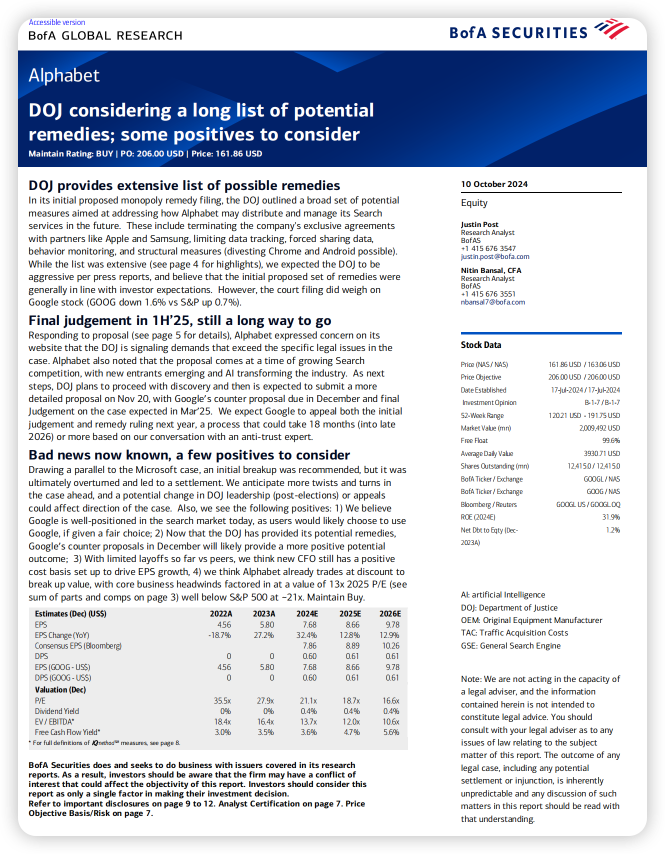

BofA_Alphabet DOJ considering a long list of potential remedies; some

DOJ provides extensive list of possible remedies In its initial proposed monopoly remedy filing, the DOJ outlined a broad set of potential measures aimed at addressing how Alphabet may distribute and manage its Search

海外研报

2024年10月11日

MIZUHO--Has the NDRC shut the door on additional fiscal stimulus?

Disappointing NDRC session. The National Development and Reform Commission (NDRC) conducted a press conference yesterday that fell short of market expectations. Instead of introducing new

海外研报

2024年10月11日

GS--Oil Tracker: Prices Retreat, Risks Remain

Brent crude prices retreated almost $4/bbl from Monday’s highs to $77/bbl as Chinapolicymakers did not provide details on the size of stimulus, and as Israel continues

海外研报

2024年10月11日

Jefferies--China Macro Chat: NDRC conference miss; what shall we expect?

Tuesday's NDRC conference disappointed investors on incrementalpolicies and dampened their expectations on potential fiscal stimulus.

海外研报

2024年10月11日

Global Metals & Mining_ Rio Tinto agrees counter-cyclical cash offer to acquire Arcadium Lithium

Rio Tinto has announced an agreement to acquire Arcadium Lithium (Not Rated).According to Rio, this represents a counter-cyclical expansion aligned with its

海外研报

2024年10月11日

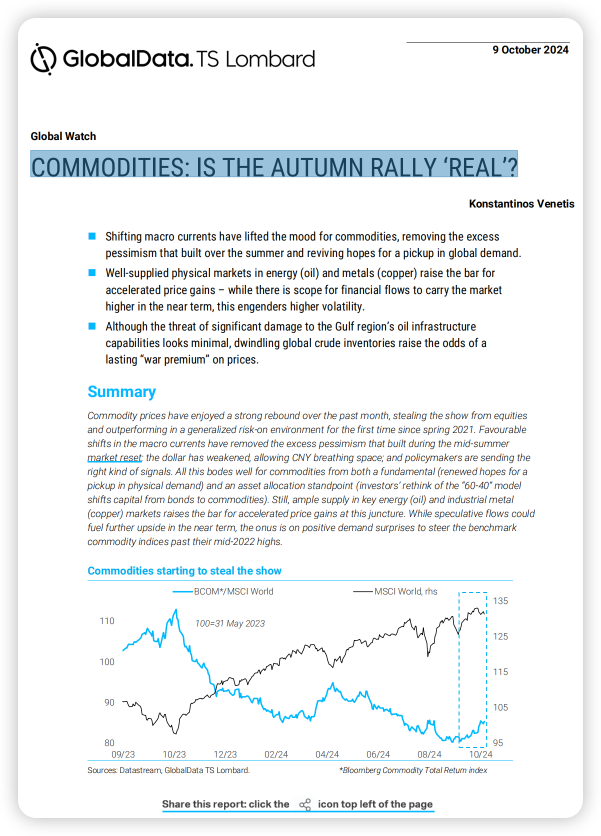

GD--COMMODITIES: IS THE AUTUMN RALLY ‘REAL’?

Shifting macro currents have lifted the mood for commodities, removing the excess pessimism that built over the summer and reviving hopes for a pickup in global demand.

海外研报

2024年10月11日