海外研报

筛选

Exposure to Big Tech impacted 1H results

Our US Regime Indicator (based on a three month moving average of the underlying raw indicator) continued to improve in June, but the underlying raw time series declined for a

海外研报

2024年07月18日

Weekly commentary

Leaning into income in fixed income• Total income has returned to credit thanks to higher-for-longer interest rates.We prefer pockets of credit where investors are better compensated for risk.

海外研报

2024年07月04日

2H keeps winning after a positive 1H

SPX is stronger in 2H after a positive 1HThe S&P 500 (SPX) rallied 14.48% in the first half (1H) of 2024, which is the 16th best 1H return for all years going back to 1928. When the SPX rallies over the first six months

海外研报

2024年07月04日

Powell’s delicate balancing act

Market HighlightsThe Fed sees a two-way risk for its restrictive monetary policy stance. In his semiannual monetary policy testimony to Congress, Fed Chair Powell has acknowledged

海外研报

2024年07月11日

Emerging Markets mid-year 2024 outlook

Macro focus: At the start of this year, we had expected building drags from aslowing China and the 2021-23 global hiking cycle to pull down the EM complex.Yet, EMs defied expectations in H1 2024, buoyed by the resiliency in the consumer.

海外研报

2024年07月04日

MIZUHO--Has the NDRC shut the door on additional fiscal stimulus?

Disappointing NDRC session. The National Development and Reform Commission (NDRC) conducted a press conference yesterday that fell short of market expectations. Instead of introducing new

海外研报

2024年10月11日

BofA_Alphabet DOJ considering a long list of potential remedies; some

DOJ provides extensive list of possible remedies In its initial proposed monopoly remedy filing, the DOJ outlined a broad set of potential measures aimed at addressing how Alphabet may distribute and manage its Search

海外研报

2024年10月11日

MS--Global Macro Commentary | Global October 9

FOMC minutes show divide over decision to cut by 50bp; RBNZ cuts by 50bp; risk sentiment weighs on JPY; USTs sell off ahead

海外研报

2024年10月11日

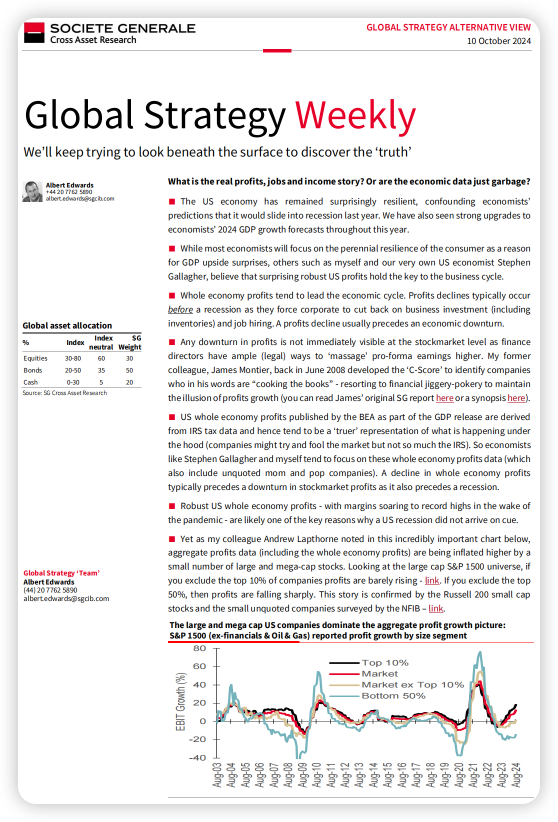

SocGen - Albert Edwards - We’ll keep trying to look beneath

The US economy has remained surprisingly resilient, confounding economists’ predictions that it would slide into recession last year. We have also seen strong upgrades to

海外研报

2024年10月11日