海外研报

筛选

PM_EMASIA18Sep24

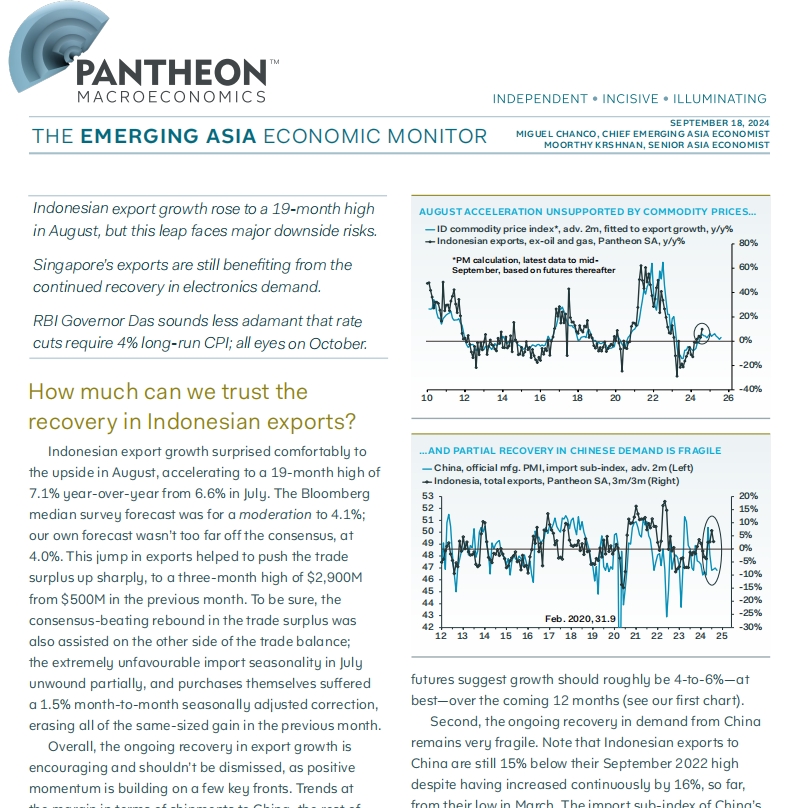

Indonesian export growth surprised comfortably to the upside in August, accelerating to a 19-month high of

海外研报

2024年09月19日

PM_China+18Sep24

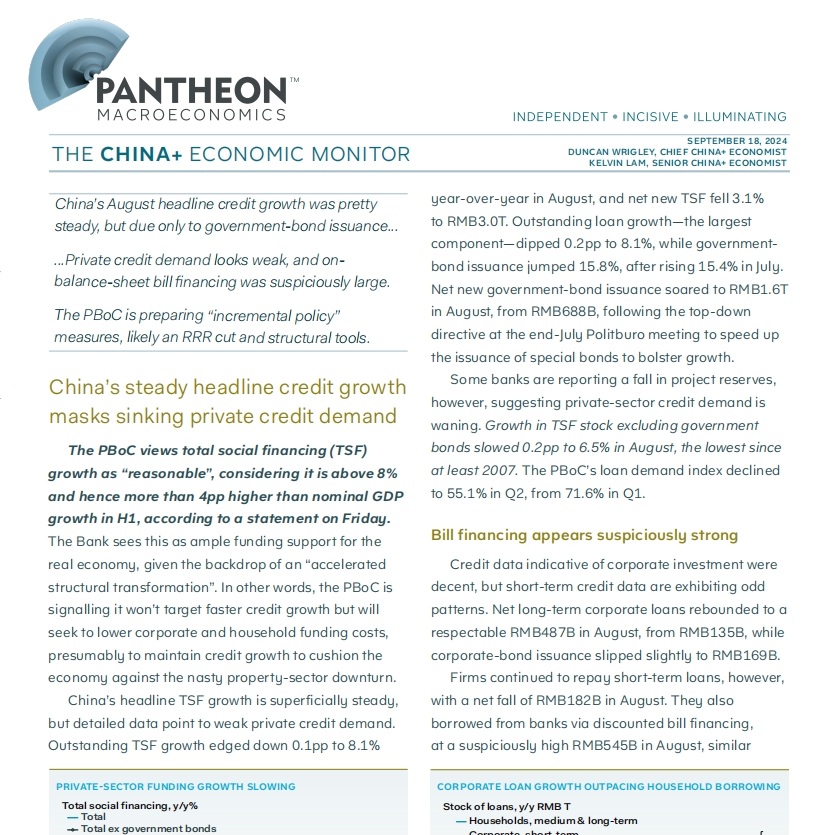

The PBoC views total social financing (TSF) growth as “reasonable”, considering it is above 8%

海外研报

2024年09月19日

JPM_International Market Intell Morning Briefing_20240918

OVERNIGHT BRIEFEU/US trade: European Equities advanced after US retail sales (SXXP 0.4%, $X5E 0.7%) withCyclicals beating Defensives (0.8%, 1.1z). There was an element of short covering in the tapewith Most Short (2.3%, 2z) higher since the morning

海外研报

2024年09月19日

JPM_Credit Calls Wednesday, September 18, 2024

It is easy to be wise after the event, We attended the World Chemicals Forum inHouston hosted byChemical Market Analytics (OPiS) last week, The general tonewas relatively bearish in our view with recent (and planned) capacity expansionefforts and

海外研报

2024年09月19日

JPM - trading the easing cycle

A typical rate cutting cycle is not always positive though in each of the last 5 cutting cycles, we have seen the SPX higher on a 1M, 3M, 6M, and 12M basis. Is that the expectation for this cycle? Yes, as we think

海外研报

2024年09月19日

japan-insights-is-japan-multifamily-still-attractive

Is multifamily still an attractive investment in this

海外研报

2024年09月19日

India Economic Update

The abrupt widening of the goods trade deficit in August might have been due to a sudden gold rush and other seasonal factors, but the underlying

海外研报

2024年09月19日

GS--Global Tech: Smartphone updates: Tri-fold phones launched; rising

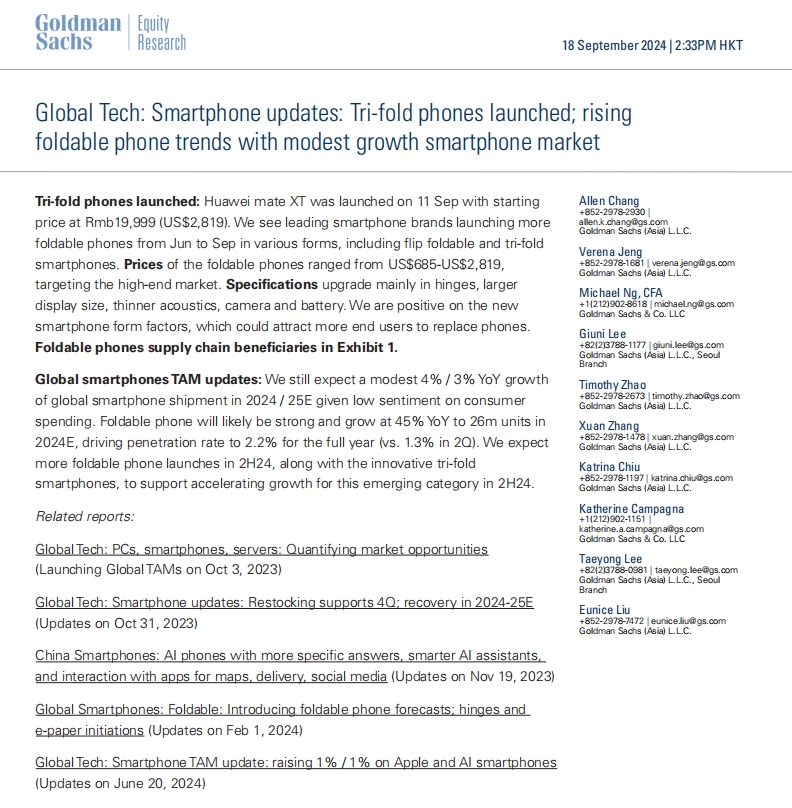

Tri-fold phones launched: Huawei mate XT was launched on 11 Sep with startingprice at Rmb19,999 (US$2,819). We see leading smartphone brands launching more

海外研报

2024年09月19日

GS--Global Markets Daily: What drove THB’s recent outperformance in EM FX an

The Thai Baht (THB) has been one of the best performing emerging market ncurrencies over the past three months. Beside the decline in the broad USD and

海外研报

2024年09月19日

GS--Global Markets Daily: Historical Yield Curve Dis-Inversion Episodes and Cross-Asset Performance

In the past couple of weeks, the US 10s2s yield curve dis-inverted for the first ntime since July 2022 following a more dovish repricing of central bank cutting

海外研报

2024年09月19日