海外研报

筛选

GS--September FOMC Preview: Shifting the Focus to Labor Market Risks (Mericle)

We interpret comments from Fed officials just ahead of the blackout period to nmean that the FOMC is more likely to cut by 25bp than 50bp at its September

海外研报

2024年09月19日

SocGen_Asia Equity Strategy 4Q24 Outlook – Don t chase returns in the late cycle_20240917

Societe Generale (“SG”) does and seeks to do business with companies covered in its research reports. As a result, investors should be aware that SG may

海外研报

2024年09月19日

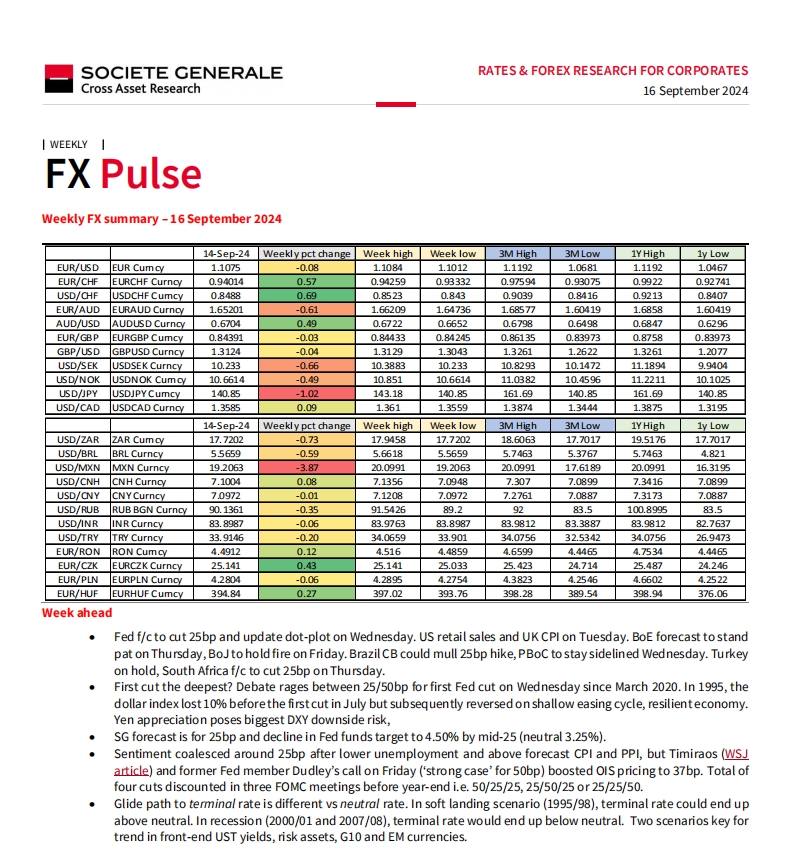

SocGen -FX Pulse - Weekly FX summary – 16 September 2024

Fed f/c to cut 25bp and update dot-plot on Wednesday. US retail sales and UK CPI on Tuesday. BoE forecast to stand pat on Thursday, BoJ to hold fire on Friday. Brazil CB could mull 25bp hike, PBoC to stay sidelined Wednesday. Turkey

海外研报

2024年09月19日

SocGen - FX View - Is the Fed a hare or a tortoise

Will Bill Dudley be on Jay Powell’s Christmas card list this year? Mr Dudley’s piece for Bloomberg, arguing for a 50bp rate cut tomorrow, has helped tilt the market a little further in

海外研报

2024年09月19日

SocGen - China Economic Update - Slipping into a downward spiral

Domestic activity data deteriorated more than market expectations in August again. With the data in hand, 3Q GDP growth is tracking at

海外研报

2024年09月19日

Rabo 2,750 beeps

The market is waiting for the Fed to cut rates today for the first time in years: the economistBloomberg survey expects 25bps; markets are split between pricing 25bps and 50bps, with the

海外研报

2024年09月19日

PM_US18Sep24

duce the funds rate by 25bp today, followed by 50bp easings at the November and December meetings, as

海外研报

2024年09月19日

PM_UK18Sep24

Last month, the Bank of England used GfK’s consumer confidence survey to justify rate-setters’ view

海外研报

2024年09月19日

PM_LATAM18Sep24

Argentina’s inflation battle remains intense, as the latest data show consumer prices increased more than expected

海外研报

2024年09月19日

PM_EZ18Sep24

Media reports suggest Rome thinks it will undershoot its deficit target this year, as revenues have come in

海外研报

2024年09月19日