海外研报

筛选

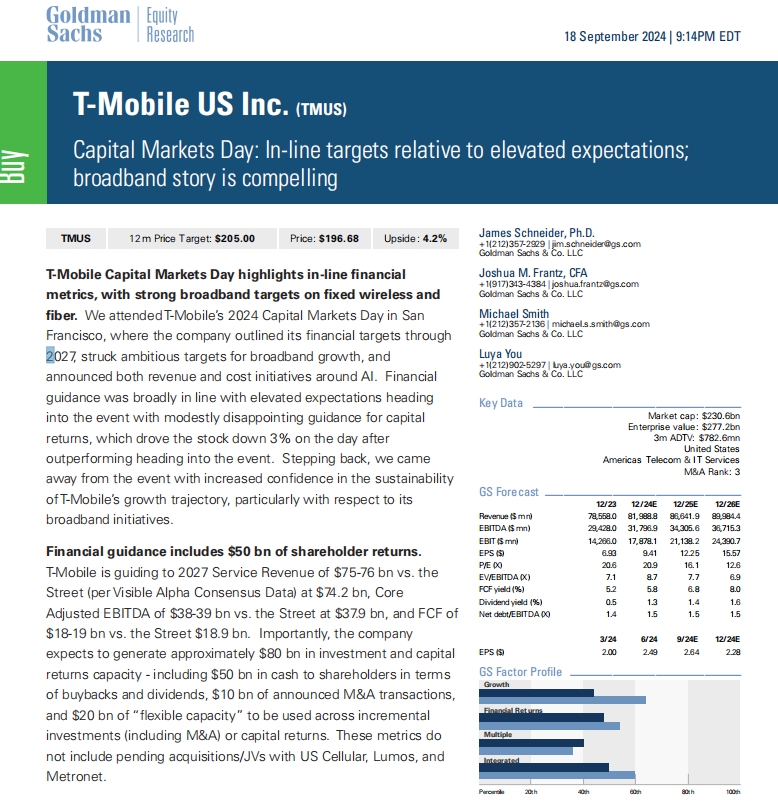

GS--Capital Markets Day: In-line targets relative to elevated expectations;

T-Mobile Capital Markets Day highlights in-line financialmetrics, with strong broadband targets on fixed wireless and

海外研报

2024年09月20日

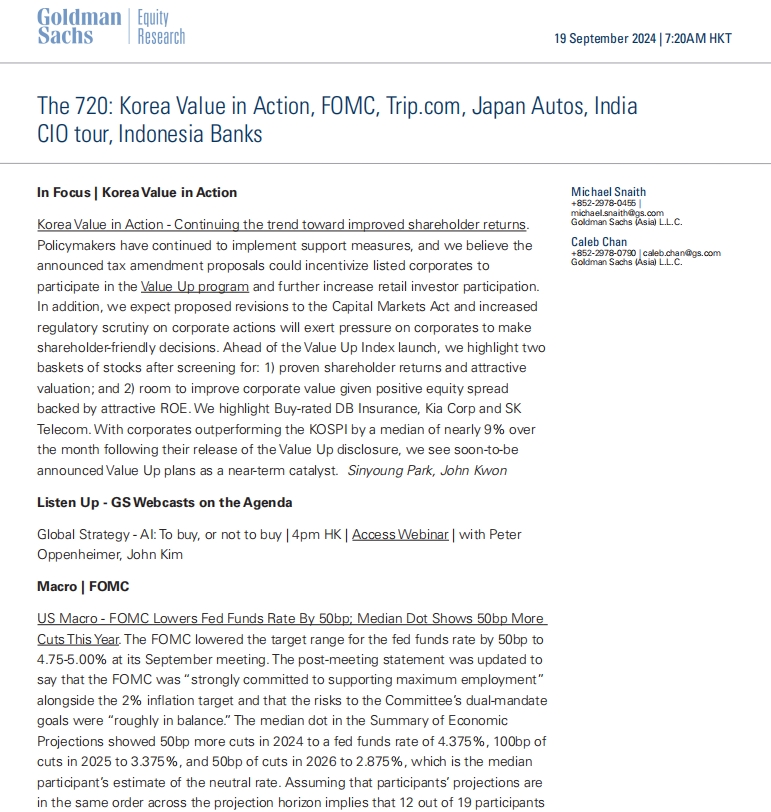

GS--The 720: Korea Value in Action, FOMC, Trip.com, Japan Autos, India CIO tour, Indonesia Banks

Korea Value in Action - Continuing the trend toward improved shareholder returns.Policymakers have continued to implement support measures, and we believe the1

海外研报

2024年09月20日

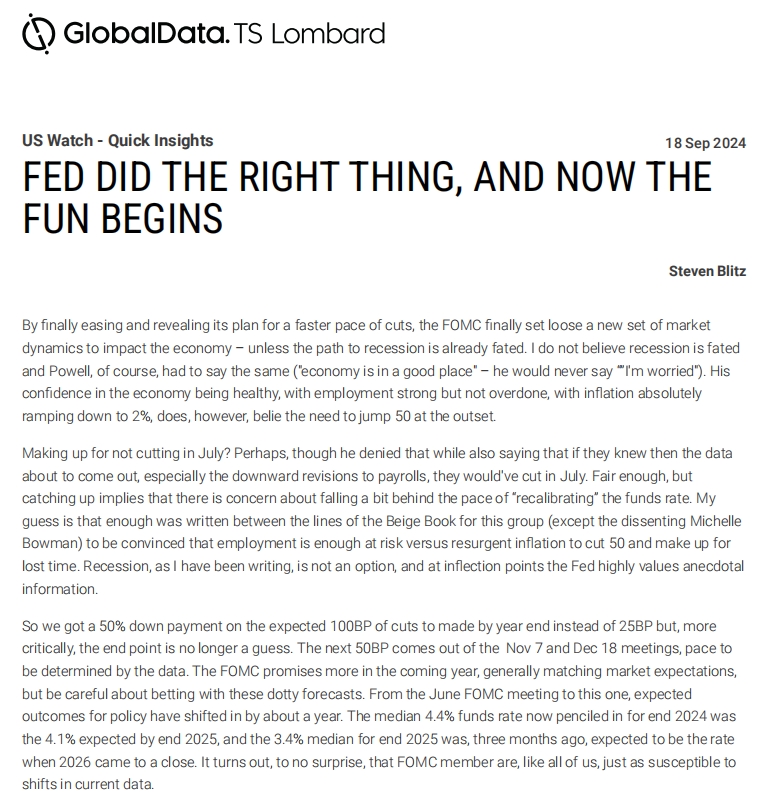

GD--FED DID THE RIGHT THING, AND NOW THE FUN BEGINS

By finally easing and revealing its plan for a faster pace of cuts, the FOMC finally set loose a new set of marketdynamics to impact the economy – unless the path to recession is already fated. I do not believe recession is fated

海外研报

2024年09月20日

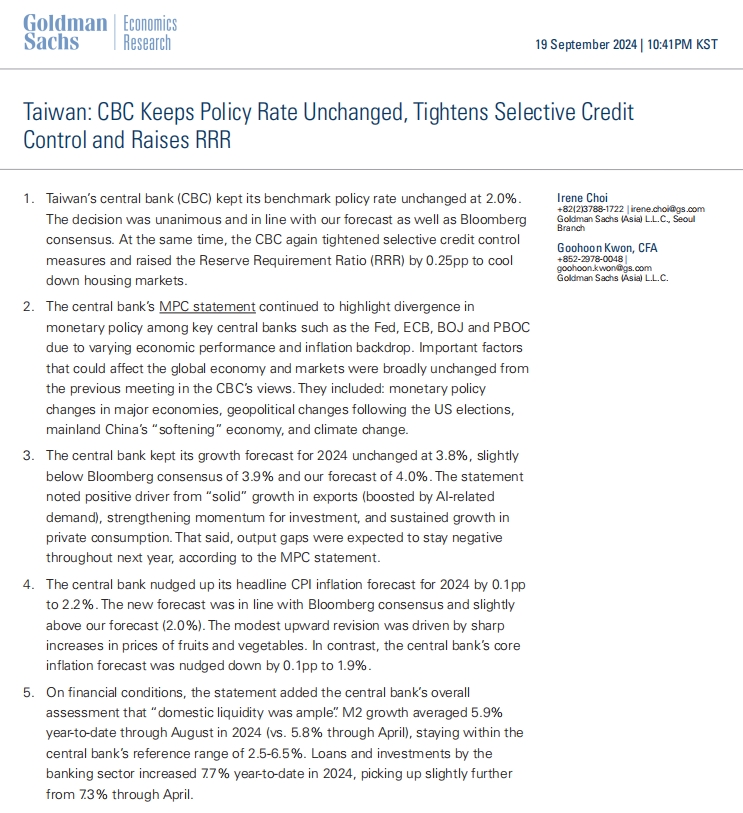

GS--Taiwan: CBC Keeps Policy Rate Unchanged, Tightens Selective Credit Control and Raises RRR

. Taiwan’s central bank (CBC) kept its benchmark policy rate unchanged at 2.0%.

海外研报

2024年09月20日

GS--Norges Bank—On Hold with Hawkish Guidance; We Now See One Cut in 2024

BOTTOM LINE: Norges Bank’s Monetary Policy Committee decided to keep thepolicy rate on hold at 4.5%, in line with our and consensus expectations. The

海外研报

2024年09月20日

GS--Nike Inc. (NKE): CEO transition announced

After market close on September 19th, NKE announced Mr. Elliott Hill will rejoin NKEas President and CEO effective October 14th, 2024. Current CEO and President Mr.

海外研报

2024年09月20日

MS_FOMC Reaction- September Meeting_20240919

The cycle begins with a 50bp cut and a stress on both sides of the dual mandate. Powell emphasized the FOMC's commitment

海外研报

2024年09月20日

MS_Charts That Caught My Eye_20240917

A guiding principle at Morgan Stanley Research is to enhance your investment process by delivering unique insights that

海外研报

2024年09月20日

GS--Macro at a Glance: Latest views and forecasts

n Revised our Fed policy rate forecast and now expect a longer string ofconsecutive 25bp cuts from November 2024 through June 2025 (vs. quarterly

海外研报

2024年09月20日