海外研报

筛选

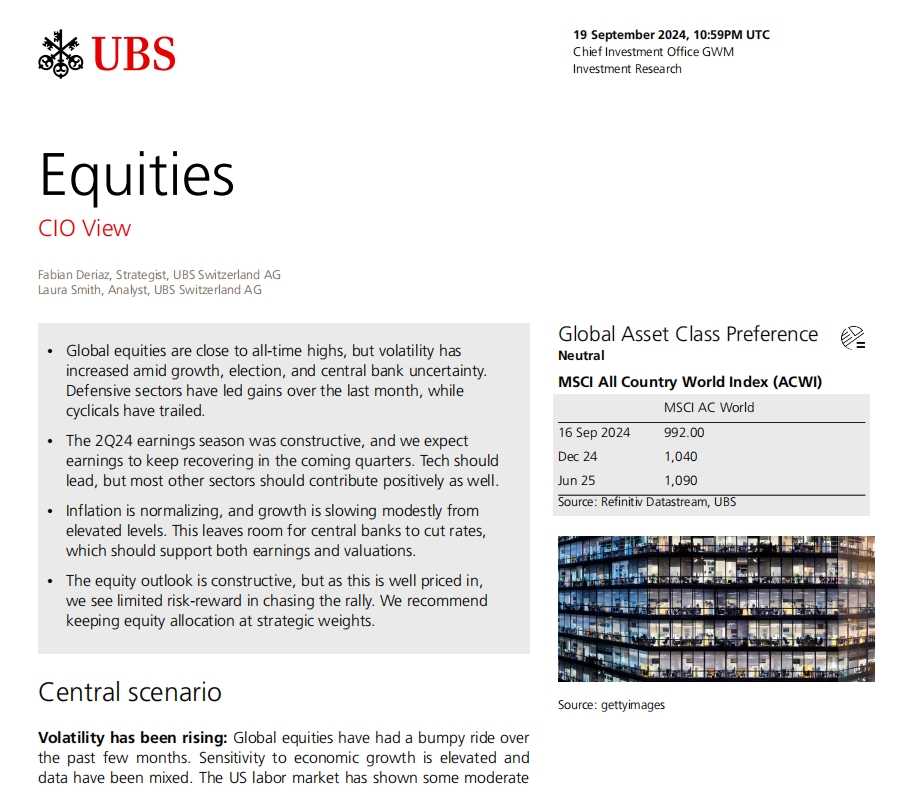

USB--Equities

Global equities are close to all-time highs, but volatility hasincreased amid growth, election, and central bank uncertainty.

海外研报

2024年09月22日

GS--Global Economics Wrap-Up: September 20, 2024

Dissecting the divergence in DM saving rates: o Headline saving rates across DMs have diverged recently: rising in most

海外研报

2024年09月22日

FXModelTrendStrategy_20240919_en

This publication was prepared by Bank J Safra Sarasin (BJSS) Trading department. The views or ideas expressed herein are those of the desk

海外研报

2024年09月22日

GS--FY1Q EPS: Mix Shift and Weak B2B Impact Margins Lower

Bottom Line: FDX reported FY1Q (Aug) operating EPS at $3.60 pershare, or well below our recently lowered $4.70 p/s and FacstSet

海外研报

2024年09月22日

GS--European September Flash PMI Preview

BOTTOM LINE: We expect the upcoming Euro area flash PMI (released on Monday,23 September) to decline to 50.6, slightly above consensus expectations of 50.5. We

海外研报

2024年09月22日

GS--European Daily: BoE Recap—The Limits to Gradualism (Moberly/Stehn)

The MPC held Bank Rate unchanged today with an 8-1 vote and decided tomaintain the pace of gilt stock reduction at £100bn. The Committee noted that

海外研报

2024年09月22日

GS--A top-down look at Renewable energy

We recently updated our sector recommendations to alignour views with the current economic trends and monetary

海外研报

2024年09月22日

Barclays_U.S. Equity Strategy Food for Thought- Value vs. Growth, Post-Rate

In past non-recessionary rate cutting cycles, median Valuereturns surpassed those of Growth immediately after the "first"

海外研报

2024年09月21日

BofA - Hartnett - The Flow Show 50 for the Little Guy_20240920

Scores on the Doors: gold 25.0%, crypto 17.3%, stocks 17.3%, HY bonds 8.3%, IG bonds 5.4%, cash 3.9%, commodities 2.6%, govt bonds 2.1%, oil 0.5%, US$ -0.7% YTD.

海外研报

2024年09月21日

GS--Australia Energy: WA domestic gas policy update allows 20%

The West Australian Government has released an update to the state’s domestic gaspolicy, allowing up to 20% of gas production from new onshore projects to be

海外研报

2024年09月21日