海外研报

筛选

Quick RIC - Between a stock and a hard place

The teetering tactical case for stocksUntil the data improve or the Fed panics, we are tactically more cautious. Move up in

海外研报

2024年09月22日

Central_Bank_Weekly__20th_September_2024

RBA ANNOUNCEMENT (TUE): The RBA is likely to keep the Cash Rate Target unchanged at 4.35% at its meeting next week with all 45 economists surveyed by Reuters unanimously

海外研报

2024年09月22日

BofA_US Economic Weekly Softer growth and a more dovish Fed_20240920

Weekly viewpoint: A bumpier landingWe have tweaked our economic forecasts. In response to softer-than-expected labor

海外研报

2024年09月22日

precision-insights-em-august-2024

We outline our latest views on emerging market (EM) single countries, updated regularly to reflect the latest macro and .

海外研报

2024年09月22日

precision-insights-credit-sep-24

With most developed market (DM) central banks having kicked off their rate cutting cycles, high yield

海外研报

2024年09月22日

PreciousMetalsTradingDeskView_20240919_en

This publication was prepared by Bank J Safra Sarasin (BJSS) Trading department. The views or ideas expressed

海外研报

2024年09月22日

Remain LT bullish on Private Credit & less concerned with credit within our coverage

Remain bullish on private credit – long and short-termAs we prepare for lower interest rates, we have monitored an increase in investor inbound

海外研报

2024年09月22日

GS--KOSPI continued to gain by 1% despite semi sector volatility

KOSPI continued to gain by 1% despite semi sectorvolatility. The Pharmaceutical, Steel and Shipbuilding

海外研报

2024年09月22日

JPM_Thursday FAQs ... Wireless, Shorts, ABNB, CRM, Flows, Rebal Day, JPM EOF_20240919

Wireless: AT&'T -2% getting a lot of atiention... risk on rotation plus rates a touch higher today and T the most crowded is1.

海外研报

2024年09月22日

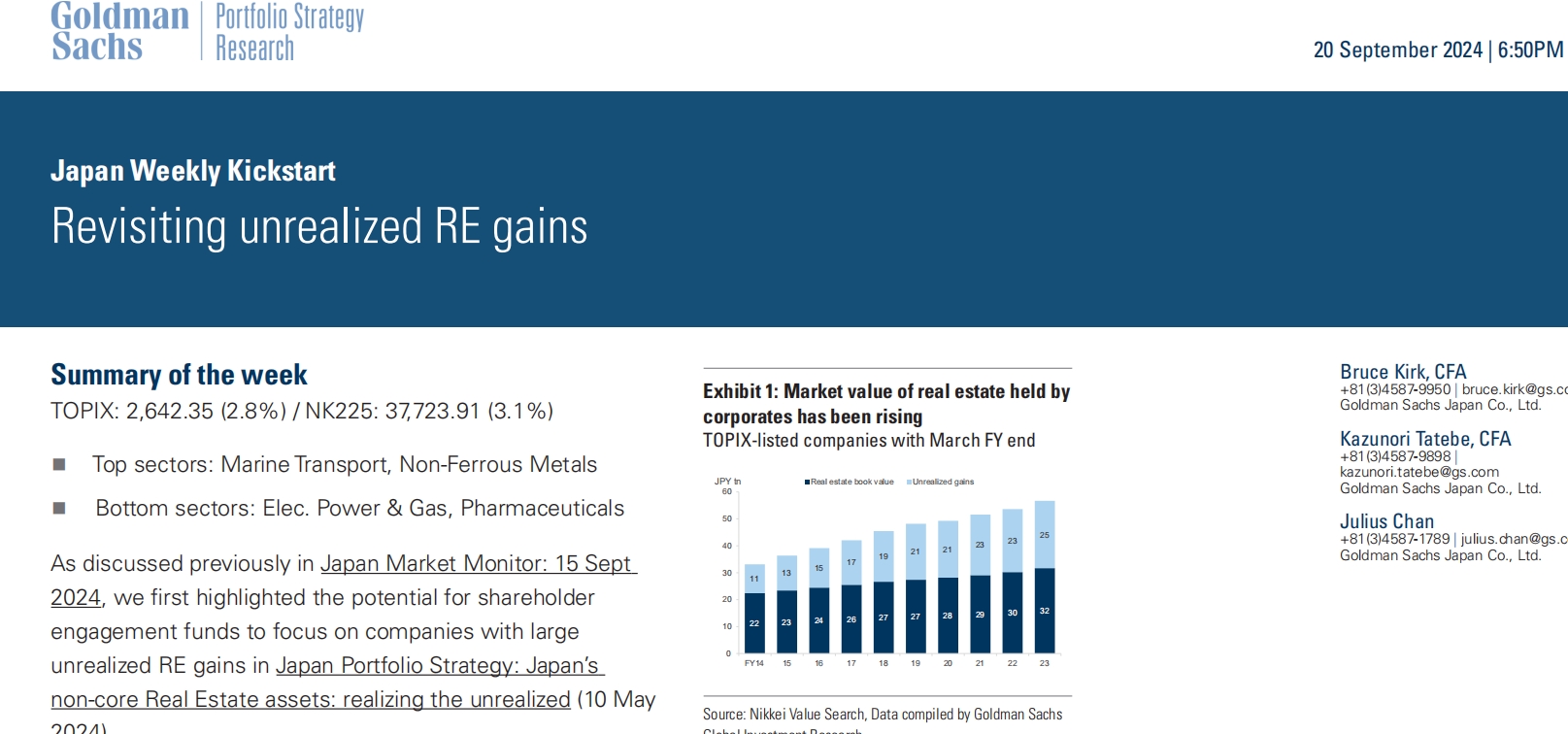

GS--Revisiting unrealized RE gains

TOPIX: 2,642.35 (2.8%) / NK225: 37,723.91 (3.1%)n Top sectors: Marine Transport, Non-Ferrous Metals

海外研报

2024年09月22日