海外研报

筛选

GS--FAQs post Global Retail Conference; Trends at BBWI, FIVE, and ULTA

In this note, we highlight top questions we have received since hosting our GlobalRetail Conference. We also analyze Bloomberg Alternative Data to highlight

海外研报

2024年09月24日

GS--REIT valuations show upside opportunities remain

In this note, we assess REIT valuations from a four-pronged framework in an interestrate cutting environment: 1) FFO multiples, 2) implied cap rates, 3) equity risk

海外研报

2024年09月24日

MS - Michael J Wilson - Weekly Warm-up_ The Market Discounts an Outsized Cut and Waits

The Market Discounts An Outsized Cut...As we laid out last week, we thought that the best short-term case for equities was that the Fed could

海外研报

2024年09月24日

JPM_Equity Strategy Eurozone to keep lagging- UK stays a preferred exposure within Europe_20240923

• SX5E has failed to make ground ever since March - top chart. Even as Eurozone valuations are undemanding, trading at 12.8x forward P/E, we keep

海外研报

2024年09月24日

USB--Hong Kong utility stocks key beneficiaries of falling US Treasury yields

Hong Kong utility stocks are historically highlycorrelated to US Treasury yields. They are key

海外研报

2024年09月24日

Here we are--Interest Rates Daily

Finally! Eurozone headline inflation is expected to fall below the 2.0% target, after

海外研报

2024年09月24日

All That Glitters

Gold prices traded at fresh all-time highs on Friday, closing well above the $2600/oz barrier. The rally in gold seems unstoppable at this point and resets on the all-time-high are becoming a

海外研报

2024年09月24日

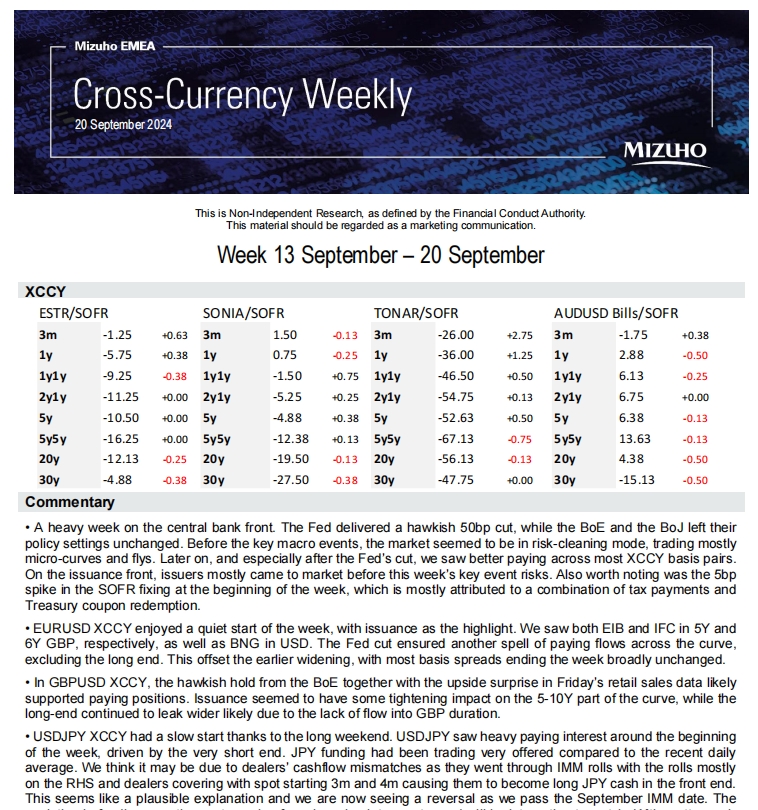

XCCY Weekly 2024-09-20

• A heavy week on the central bank front. The Fed delivered a hawkish 50bp cut, while the BoE and the BoJ left their

海外研报

2024年09月24日

GD--FED HELPS BUT EM EQUITY RISKS REMAIN

The Fed opens the door for reluctant EM amid disinflation and faltering growth◼ China and the dollar are now more serious risks to EM than a US recession

海外研报

2024年09月24日

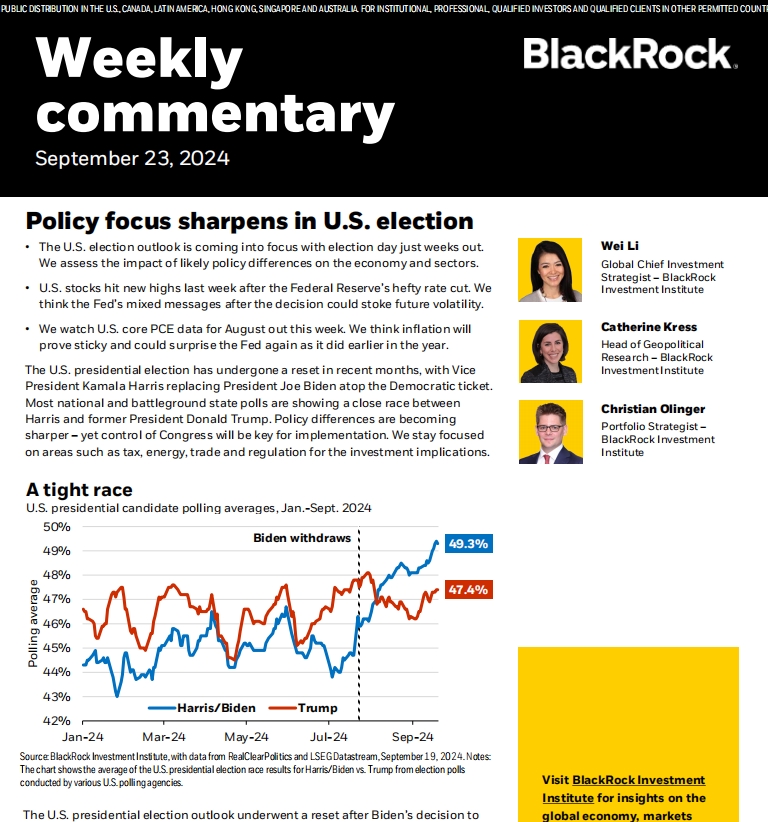

Weekly commentary

Policy focus sharpens in U.S. election• The U.S. election outlook is coming into focus with election day just weeks out.

海外研报

2024年09月24日