海外研报

筛选

SocGen_Market Wrap-up Uniform performance is unlikely to last_20240924

Since the early August sell-off, we’ve seen financials outperform non-financials. However, since the weakness recorded two weeks ago, the market has seen all

海外研报

2024年09月27日

SocGen - Market Wrap-up - Rating changes remain at record highs

Credit quality continues to improve in both Europe and the US. And while it is

海外研报

2024年09月27日

SocGen - FX View - A surprisingly resilient euro

The RBA left rates on hold this morning and at first, the currency liked it. Some concerns about growth (stagflation was bandied around in the press) have taken the gloss off, though in general,

海外研报

2024年09月27日

SocGen - European Economic Outlook - Growth close to potential and diverging fortunes

GDP growth was weak between 4Q22 and 4Q23, while employment has held up. It recovered to 0.3% qoq in 1Q24 and 0.2% qoq in 2Q24 and we expect it to hover around

海外研报

2024年09月27日

Bitcoin – Rise of the phoenix

Digital asset markets, particularly Bitcoin (BTC), are focused on the 5 November

海外研报

2024年09月27日

GS--Riksbank — 25bp Cut and Dovish Guidance as Expected; We Stick to Sequential 25bp Cuts

BOTTOM LINE: The Riksbank’s Executive Board cut the policy rate by 25bp to3.25% today, in line with our and consensus expectations. The press release

海外研报

2024年09月27日

Pattern recognition (beyond rates) – How asset markets behave into and through a cutting cycle

This communication has been prepared by RBC Capital Markets Rates Trading/Sales personnel for your information only and is not a research report

海外研报

2024年09月27日

China Butterfly Effect: Upgrading Dealers; Downgrading F, GM, RIVN, MGA, PHIN

The China capacity ‘butterfly’ has emerged and is flapping its

海外研报

2024年09月27日

Daily Economic BriefingPBOC stimulus by a thousand cuts

Against the prospect ofalabor market-ledcooling in US consumption, we havelooked for signs of a recovery from China and

海外研报

2024年09月27日

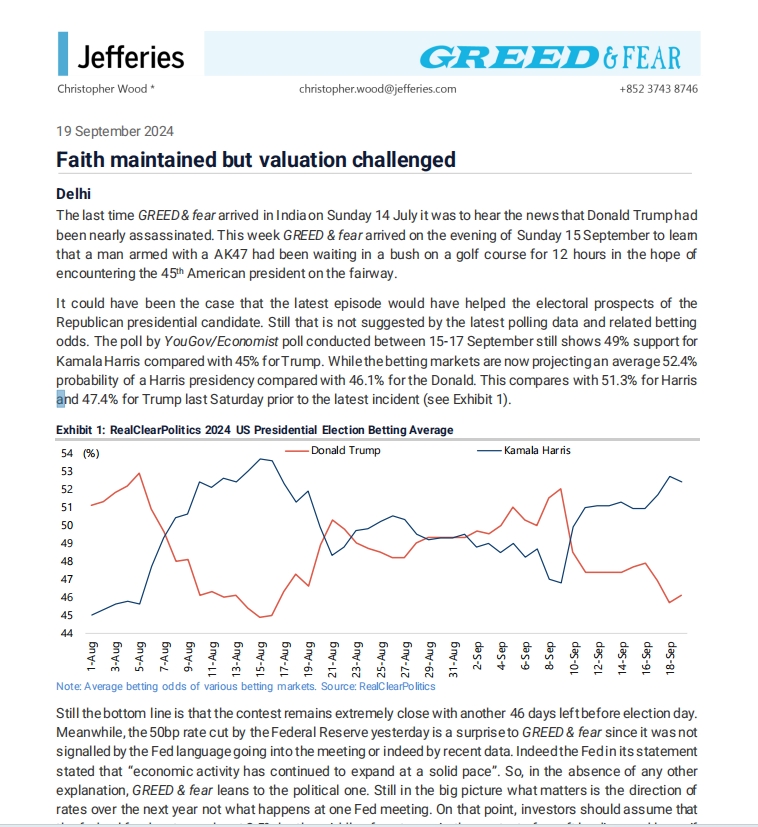

Faith maintained but valuation challenged

DelhiThe last time GREED & fear arrived in India on Sunday 14 July it was to hear the news that Donald Trump had

海外研报

2024年09月27日