海外研报

筛选

SMCI: GM Headwinds Overshadow Better Revenue Guide

With June-Q GM miss and declining 430bps Q/Q, as well as guiding Sep-Q GM still at a low levelof 12%+, it raises the question of how fast GM ticks up, despite mgmt. guiding for 14% GM exit

海外研报

2024年08月08日

'IRAN-ISRAEL': AIRSTRIKES DON’T ALWAYS MEAN OIL SHOCKS

With Brent oil futures hovering near seven-month lows as recession fears vie with rising Iran-Israel-Hezbollah tensions, a top question for investors is: Are markets overly complacent about the

海外研报

2024年08月07日

FX Model Trend & Strategy

This publication was prepared by Bank J Safra Sarasin (BJSS) Trading department. The views or ideas expressed herein are those of the

海外研报

2024年08月07日

FX View The big carry unwind is underway

The unwind is real but this morning’s moves are overdone. You can’t unwind the biggest carry trade the world has ever seen without breaking a few

海外研报

2024年08月07日

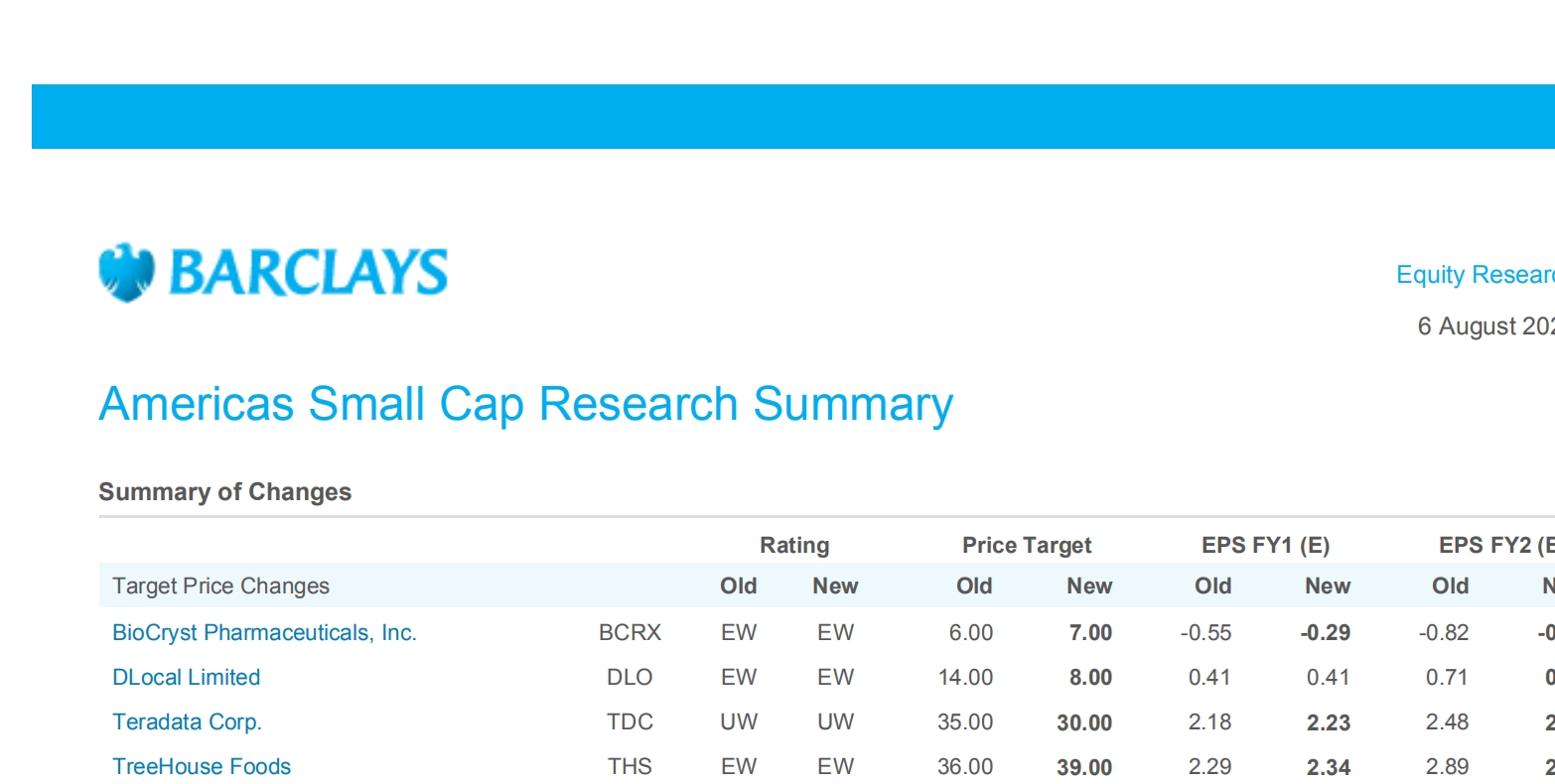

Americas Small Cap Research Summary

This summary is compiled from research reports previously published by Barclays Equity Research. A full list of all publications is available on

海外研报

2024年08月07日

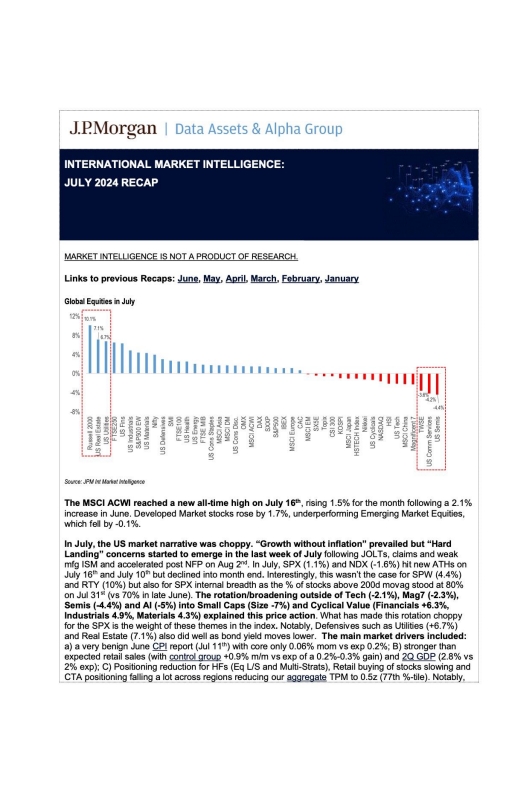

INTERNATIONAL MARKET INTELLIGENCE: JULY 2024 RECAP

In July, the US market narrative was choppy. “Growth without inflatlon" prevailed but "HardLanding" concerns started to emerge in the last week of Jjuly following JOLTs, ciaims and

海外研报

2024年08月07日

HOW INVESTABLE IS EUROPE?

Just as Europe emerged from two years of stagnation, weak survey data, increased political risk, and structural issues have put the region’s outlook back in question. So,

海外研报

2024年08月07日

Ratings and Target Price Changes - August 6, 2024 as of 5:30 AM ET

Goldman Sachs does and seeks to do business with companies covered in its research reports. As a result,

海外研报

2024年08月07日

Correction dissection - US growth concerns and carry trade unwinds drive sharp

Following the large equity drawdowns and sharp ‘risk off’ shifts across assetsglobally in the past few days, we publish a short cross-asset update. We

海外研报

2024年08月07日

VIX spike: ETP effect declines following an 8 point move in VIX futures

Large declines in global equity indexes over the past few days have led to anincrease in equity volatility and options prices. During normal market volatility, there

海外研报

2024年08月07日