海外研报

筛选

US July CPI preview: Further easing

KEY MESSAGES• We expect US core CPI to extend its recent run of favorable prints with a 0.19% m/m gain in July (report released on 14 August).

海外研报

2024年08月14日

Core CPI expected to have firmed in July

We look for firming in July core CPI inflation to 0.21% m/m SA,from an unusually soft 0.06% reading in June. We expect a

海外研报

2024年08月14日

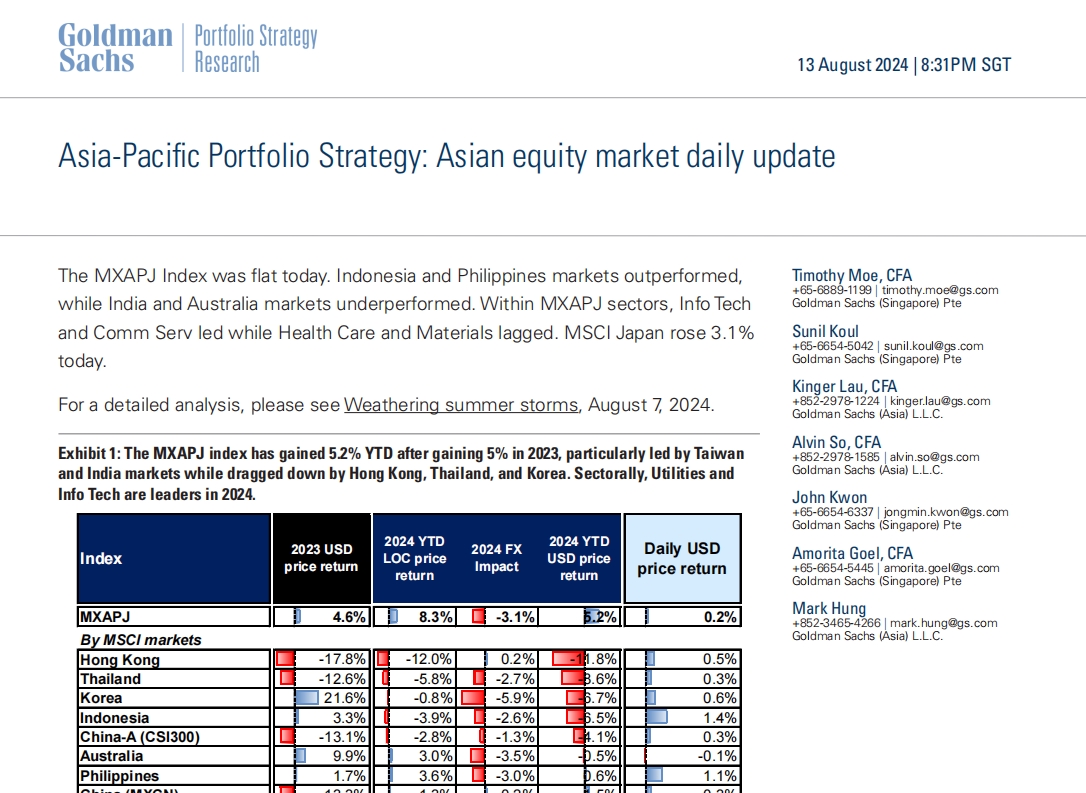

Asia-Pacific Portfolio Strategy: Asian equity market daily update

The MXAPJ Index was flat today. Indonesia and Philippines markets outperformed,while India and Australia markets underperformed. Within MXAPJ sectors, Info Tech

海外研报

2024年08月14日

Key learnings from earnings season that support The Future of Utilities Capex

With second quarter earnings season now behind us, we reflect on key learningsthat support The Future of Utilities Capex, our constructive view on Utilities, and our

海外研报

2024年08月14日

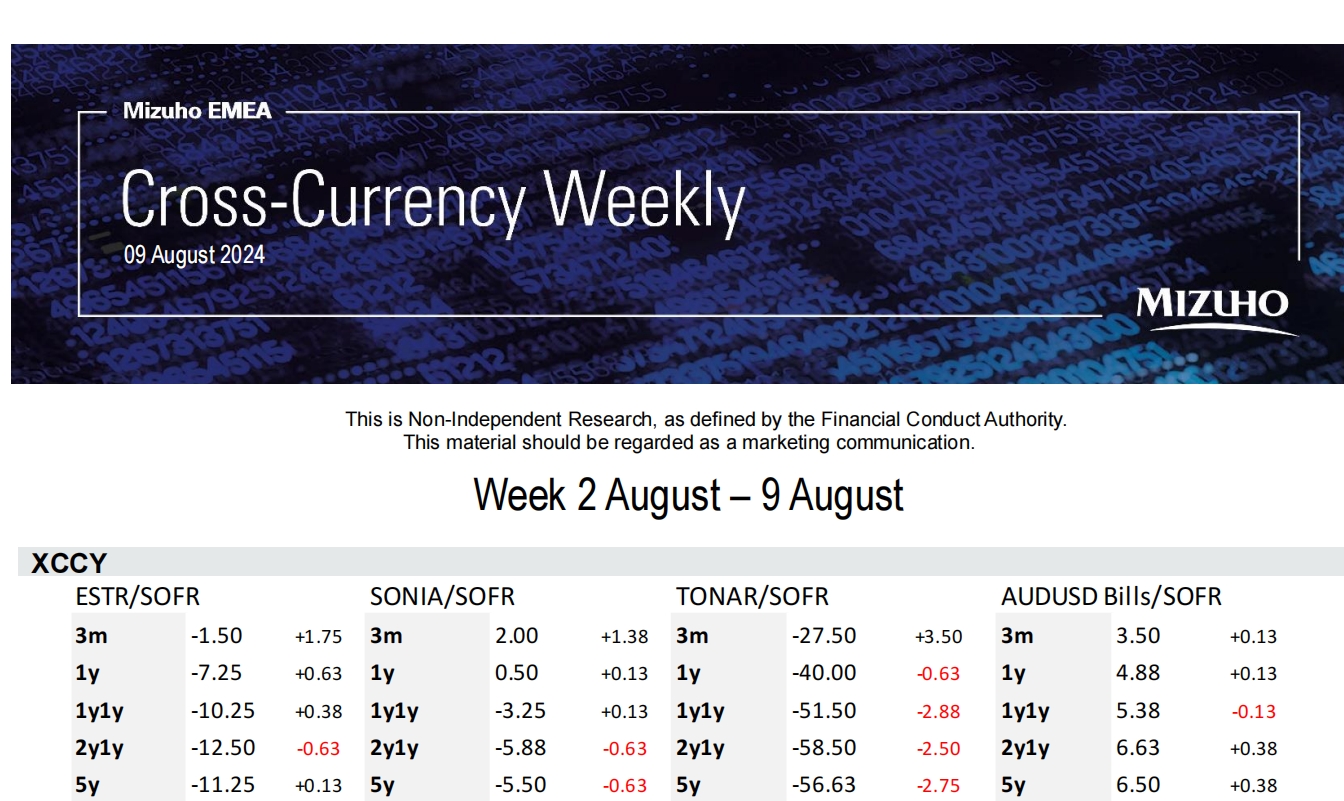

Week 2 August – 9 August

The risk-off sentiment that characterised the beginning of this week was also felt in XCCY markets. However, looking at the broader picture, XCCY spreads were relatively sheltered. This included USDJPY XCCY, despite

海外研报

2024年08月14日

US Pulse: Fed officials view the labour market as healthy

Financial market volatility has eased since the disappointing US nonfarm payrolls (NFP) data for July roiled markets. Better data and Fed speak last

海外研报

2024年08月14日

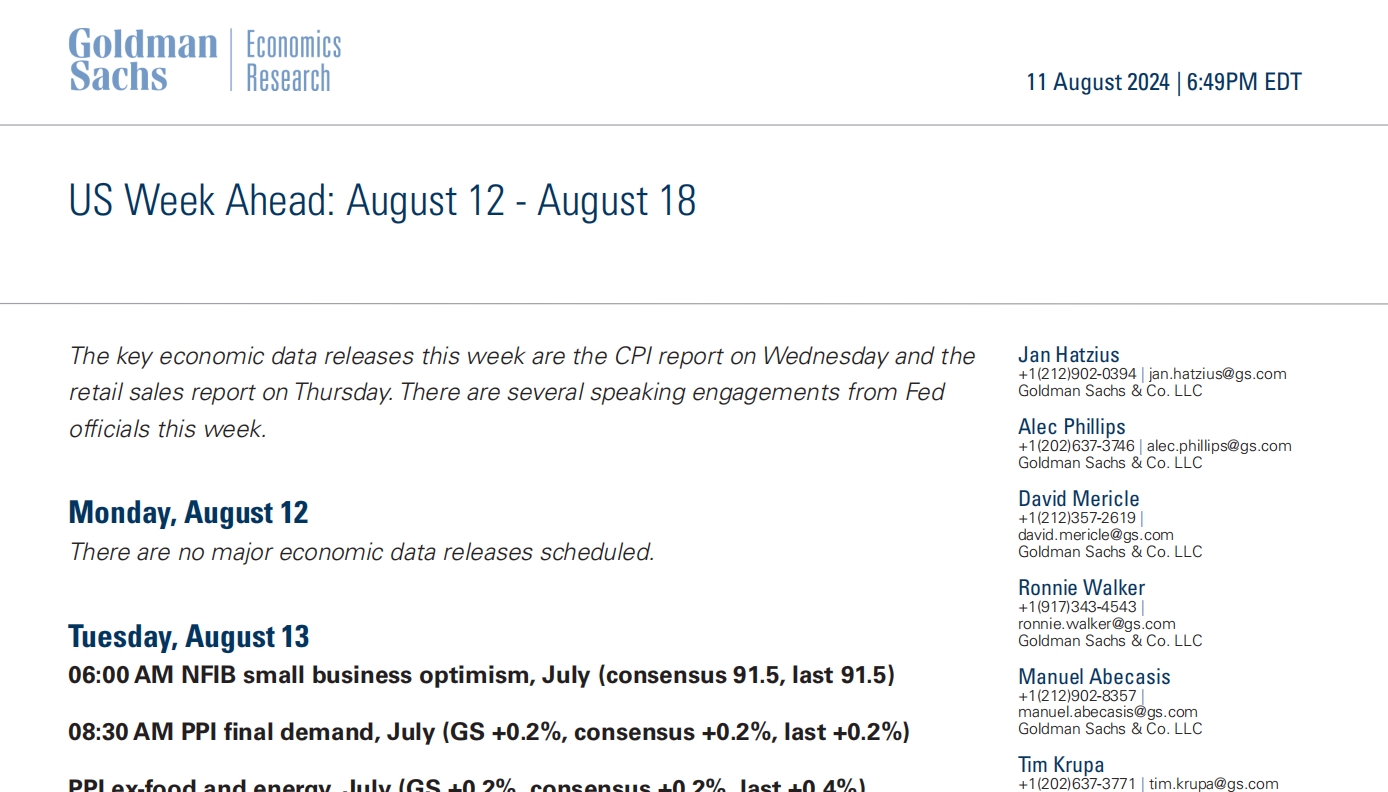

US Week Ahead: August 12 - August 18

Tuesday, August 1306:00 AM NFIB small business optimism, July (consensus 91.5, last 91.5)

海外研报

2024年08月14日

What Are Companies Saying?

Consumer Health remains disperse with companies citing various consumer health pictures, often varying by business lines.

海外研报

2024年08月14日

Interest Rates Daily

With summer, and the cusp of Fed easing upon us, lack of market depth has exacerbated market moves. Rates volatility has remained contained.

海外研报

2024年08月14日

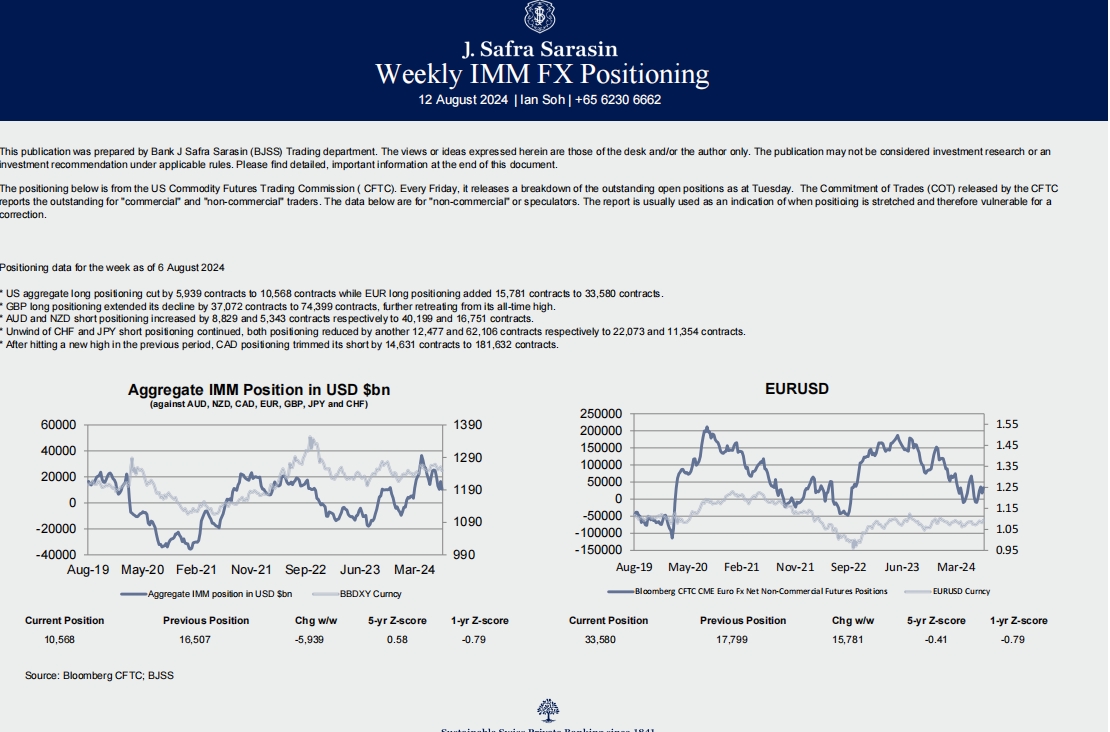

Weekly IMM FX Positioning

This publication was prepared by Bank J Safra Sarasin (BJSS) Trading department. The views or ideas expressed herein are those of the desk and/or the author only. The publication may not be considered investment research or an

海外研报

2024年08月14日