海外研报

筛选

Buyer's markets-Global Daily-Market comments1

US producer price inflation was soft in July. Both headline (0.1% m/m and 2.2% y/y) and core (0.0% m/m and 2.4% y/y) PPI inflation came in below expectations. Goods prices rose by 0.6%

海外研报

2024年08月16日

The Hitchhiker’s Guide to the Investment Universe

Wall Street Life, the Universe, and EverythingOur latest edition of the Hitchhiker’s Guide provides an overview of the size and

海外研报

2024年08月16日

Asia Open - US core CPI endorses 50bp cut Sept

UST curves bull-flattened after the favorable US core CPI, prefaced by optimistic UK and Sweden core inflation figures. SPX futures

海外研报

2024年08月16日

WHAT COULD MOVE THE MARKET IN H2/24

Brazilian assets are finally showing more convincing signs of recovery. Following the sharp selloff during the first half of the year, the Brazilian market appears to have turned a corner, with

海外研报

2024年08月16日

TEN QUESTIONS ABOUT A 'FISCAL CRISIS'

It would be a wild exaggeration to say DM fiscal risks are always a pressing concern for global investors. But these days, questions about the “fiscal trajectory” (to use the economist’s

海外研报

2024年08月16日

Argentina Equity Strategy

Almost a year ago, we published the note Back to the Future? Similarities and Differences vs. 2015 Election, analyzing how Argentine equities behaved ahead of

海外研报

2024年08月15日

BofA on USA Payback, not a slowdown

We expect a consensus-like retail sales report for JulyTotal card spending per household (HH), as measured by BAC aggregated credit and

海外研报

2024年08月15日

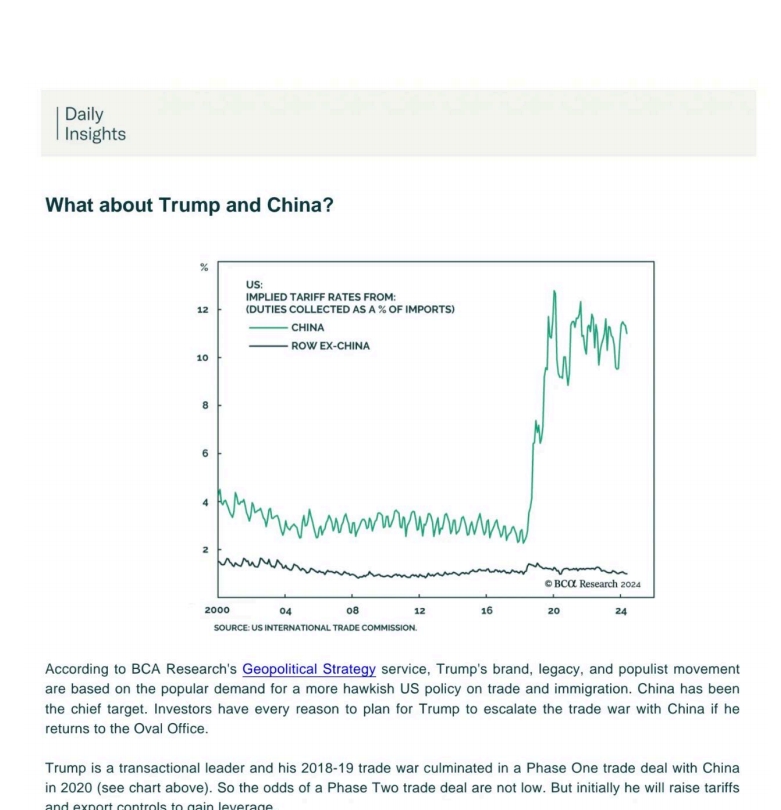

What about Trump and China?

According to BCA Research's Geopolitical Strategy service, Trump's brand, legacy, and populist movementare based on the

海外研报

2024年08月15日

Our forecast for BoJ's next hike frontloaded to January

We frontload our call for the next hike to Jan (from Apr) with arisk of an earlier move in Dec. Labor cost pass-through to

海外研报

2024年08月15日

Australian Economic Insight

Australian Economic Outlook: revised forecasts Our broad outlook remains that real household disposable incomes will get a

海外研报

2024年08月15日