海外研报

筛选

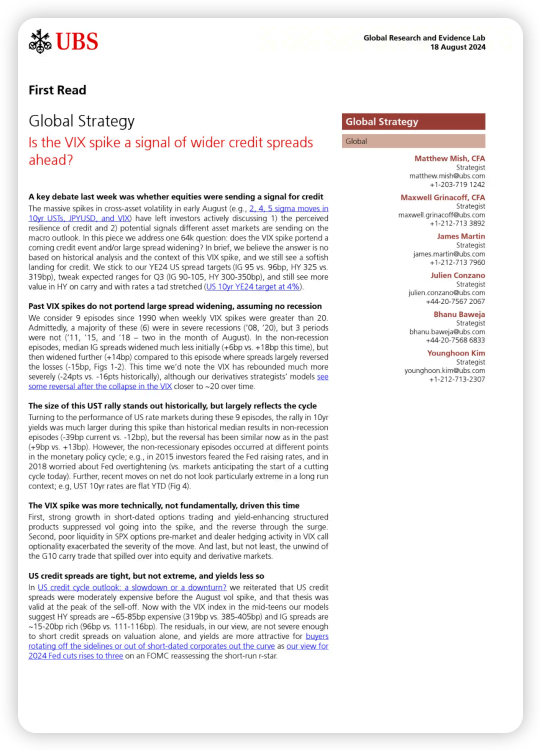

Is the VlX spike a signal of wider credit spreadsahead?

A key debate last week was whether equities were sending a signal for creditThe massive spikes in cross-asset volatility in early August (e.g., 2, 4, 5 sigma moves in1Oyr USTs, IPYUSD, and VlX) have left investors actively

海外研报

2024年08月20日

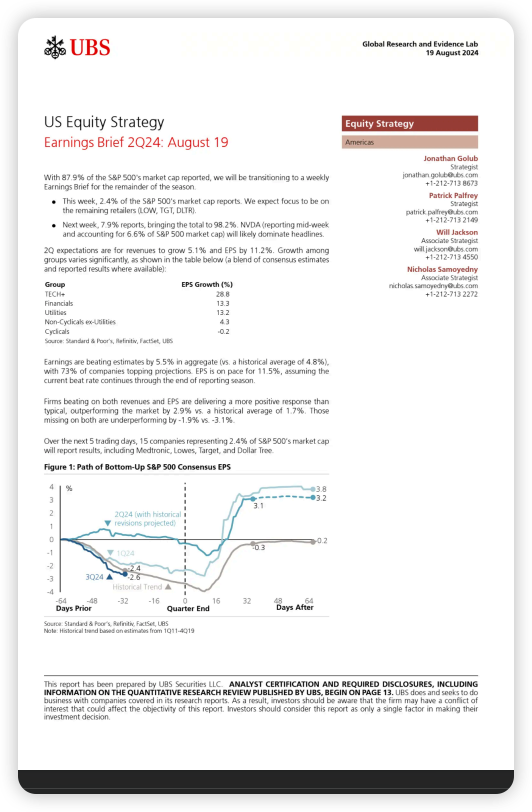

Us Equity StrategyEarnings Brief 2Q24: August 19

With 87.9% of the S&P 500's market cap reported, we will be transitioning to a weeklyEarnings Brief for the remainder of the season..

海外研报

2024年08月20日

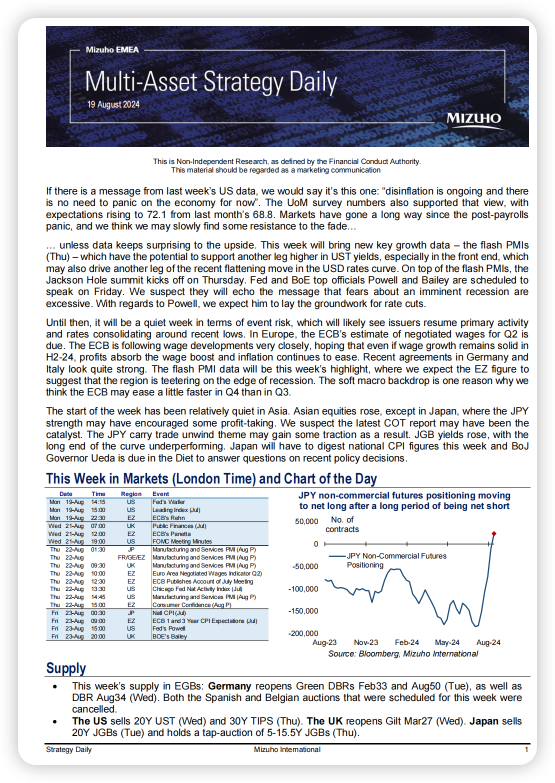

Multi-Asset Strategy Daily

If there is a message from last week’s US data, we would say it’s this one: “disinflation is ongoing and there is no need to panic on the economy for now”. The UoM survey numbers also supported that view, with

海外研报

2024年08月20日

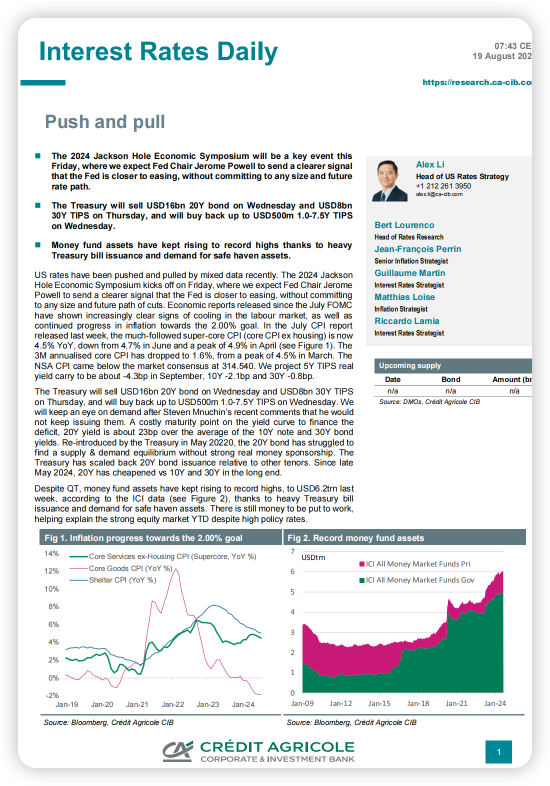

Interest Rates Daily-Push and pull

US rates have been pushed and pulled by mixed data recently. The 2024 Jackson Hole Economic Symposium kicks off on Friday, where we expect Fed Chair Jerome

海外研报

2024年08月20日

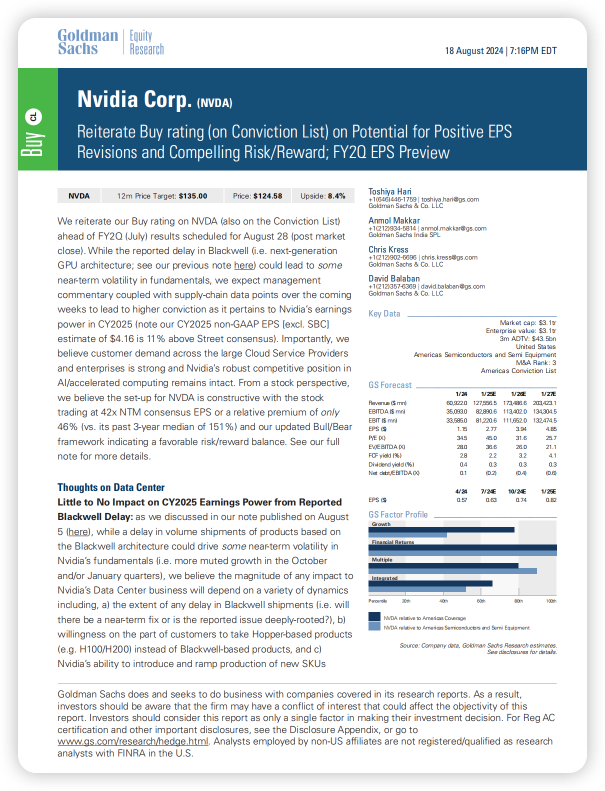

Reiterate Buy rating (on Conviction List) on Potential for Positive EPS Revisions and Compelling

We reiterate our Buy rating on NVDA (also on the Conviction List)ahead of FY2Q (July) results scheduled for August 28 (post market

海外研报

2024年08月20日

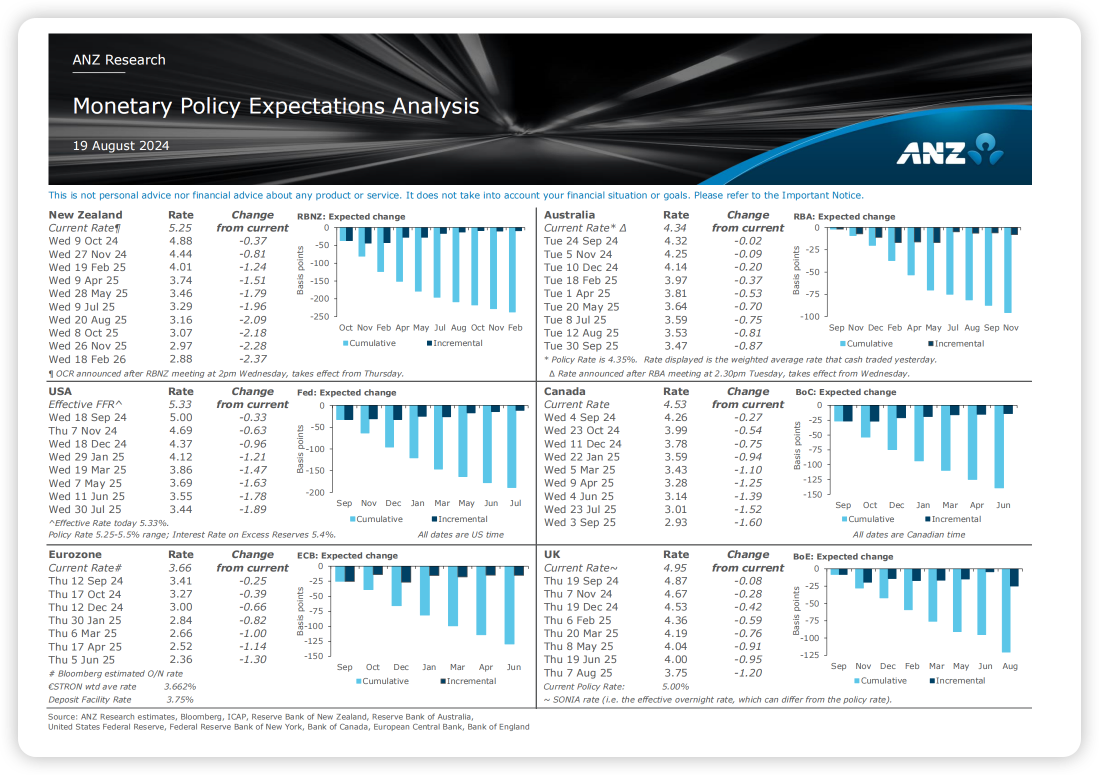

Monetary Policy Expectations Analysis

The opinions and research contained in this document (in the form of text, image, video or audio) are (a) not personal financial advice nor financial advice about any product or service; (b) provided for

海外研报

2024年08月20日

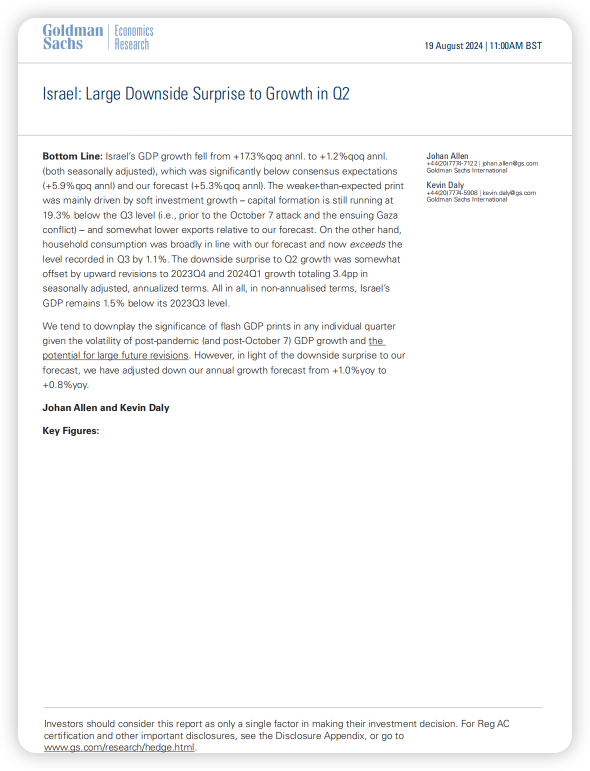

Israel: Large Downside Surprise to Growth in Q2

Bottom Line: Israel’s GDP growth fell from +17.3%qoq annl. to +1.2%qoq annl.(both seasonally adjusted), which was significantly below consensus expectations

海外研报

2024年08月20日

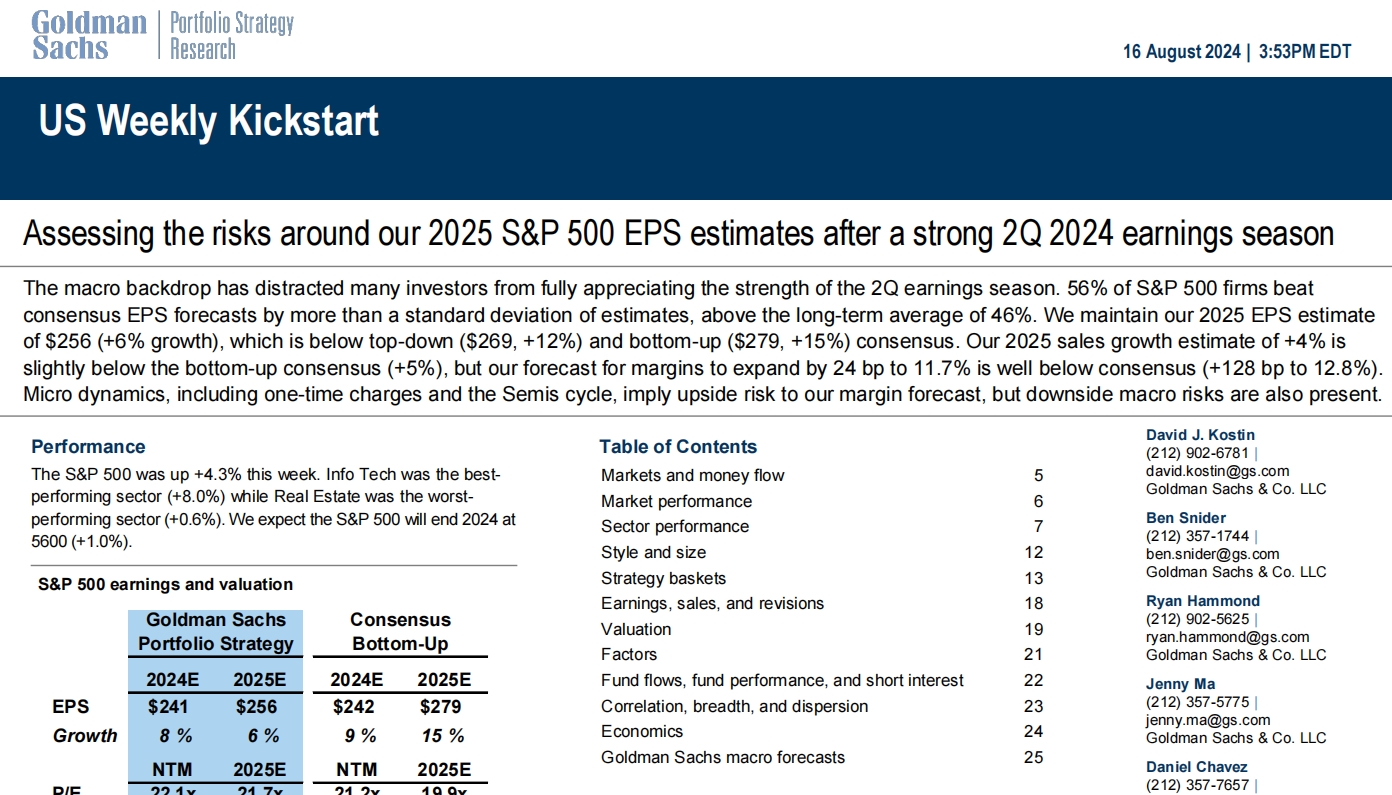

Assessing the risks around our 2025 S&P 500 EPS estimates after a strong 2Q 2024 earnings season

The macro backdrop has distracted many investors from fully appreciating the strength of the 2Q earnings season. 56% of S&P 500 firms beat

海外研报

2024年08月19日

US Week Ahead: August 19 - August 25

The key economic data releases this week are the jobless claims and existing homesales reports on Thursday. The minutes from the July FOMC meeting will be

海外研报

2024年08月19日

A truer signal from the unemployment rate

Historically, a substantial rise in the unemployment rate has been associated with a recession. But changes in the unemployment rate can be amplified or damped by

海外研报

2024年08月19日