海外研报

筛选

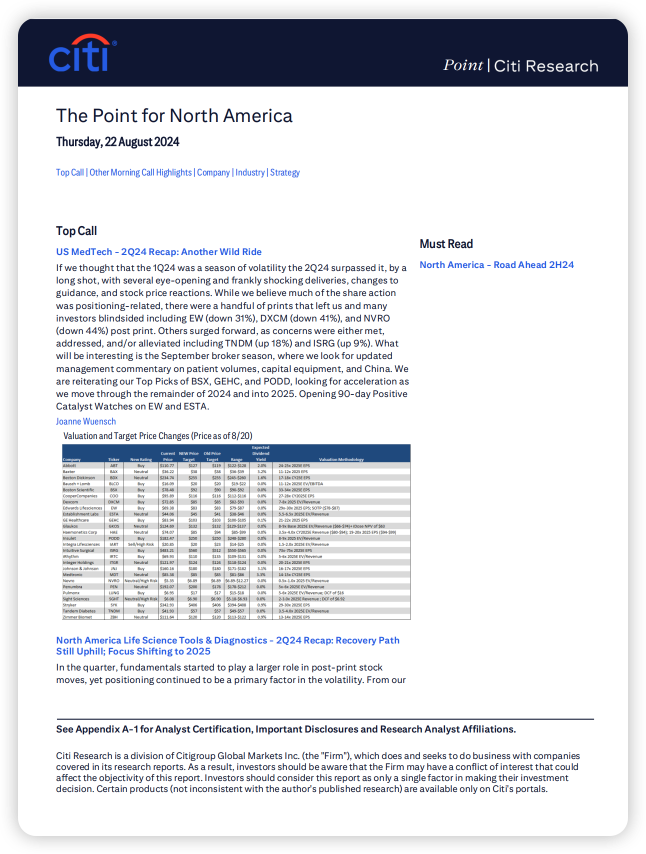

The Point for North America Thursday, 22 August 2024

US MedTech - 2Q24 Recap: Another Wild RideIf we thought that the 1Q24 was a season of volatility the 2Q24 surpassed it, by a

海外研报

2024年08月23日

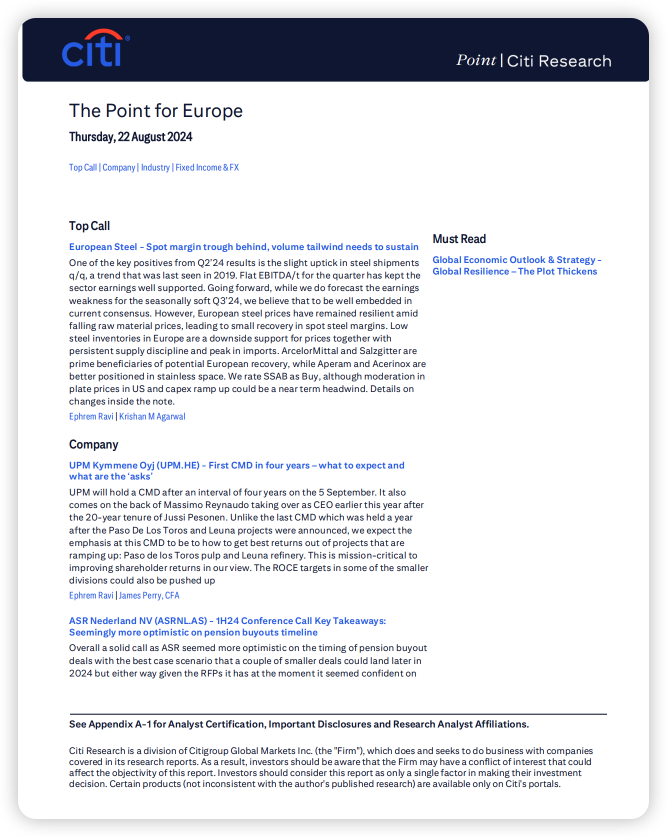

The Point for Europe Thursday, 22 August 2024

European Steel - Spot margin trough behind, volume tailwind needs to sustainOne of the key positives from Q2’24 results is the slight uptick in steel shipments

海外研报

2024年08月23日

World at a Glance Looking to autumn

Key forecasts in FX, rates and commoditiesAfter recent macro volatility, our Economics team expects a 25bp rate cut from the Fed

海外研报

2024年08月23日

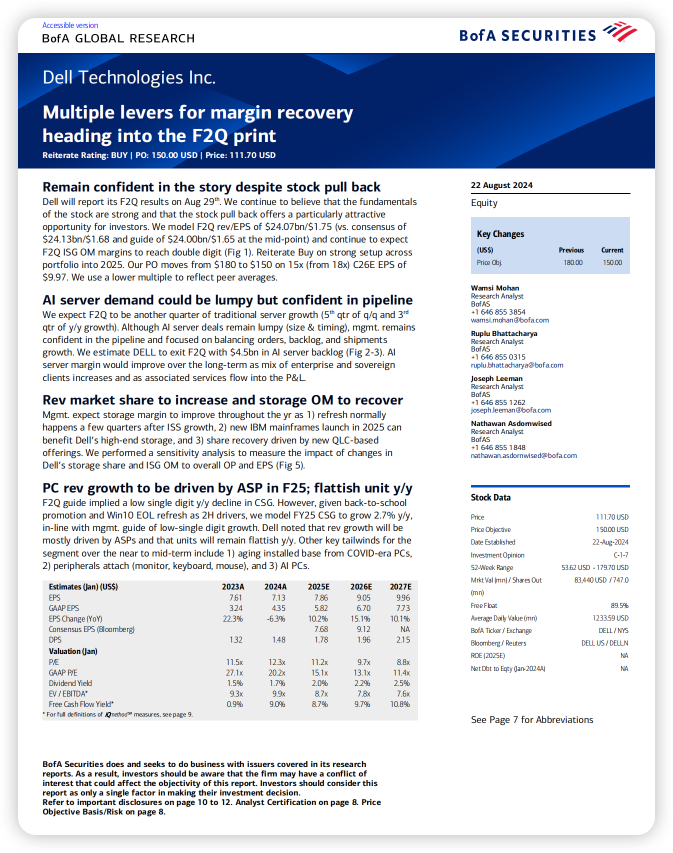

Multiple levers for margin recovery heading into the F2Q print

Remain confident in the story despite stock pull back Dell will report its F2Q results on Aug 29th. We continue to believe that the fundamentals

海外研报

2024年08月23日

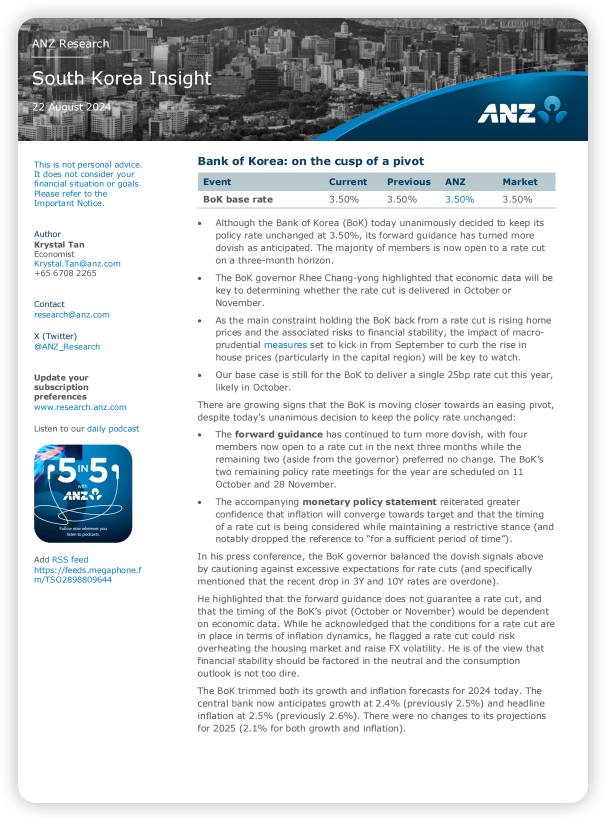

South Korea Insight-Bank of Korea: on the cusp of a pivot

Although the Bank of Korea (BoK) today unanimously decided to keep its policy rate unchanged at 3.50%, its forward guidance has turned more

海外研报

2024年08月23日

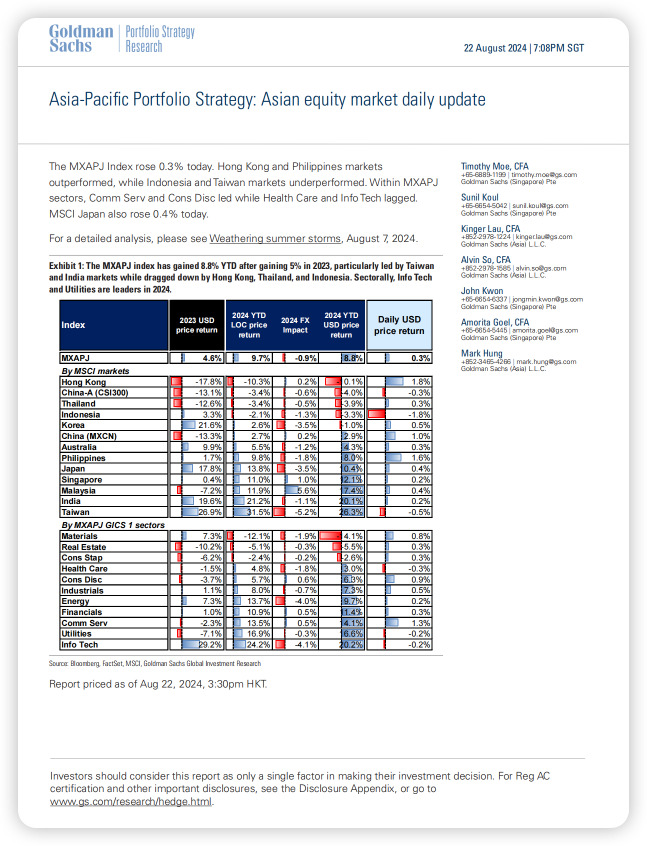

Asia-Pacific Portfolio Strategy: Asian equity market daily update

The MXAPJ Index rose 0.3% today. Hong Kong and Philippines marketsoutperformed, while Indonesia and Taiwan markets underperformed. Within MXAPJ

海外研报

2024年08月23日

Four in a rowJackson Hole Preview August 2024

On Friday, August 23, Fed Chair Powell is scheduled to talk about the economic outlook at the Jackson Hole symposium. Less than four weeks before the next FOMC meeting, on September 17-

海外研报

2024年08月23日

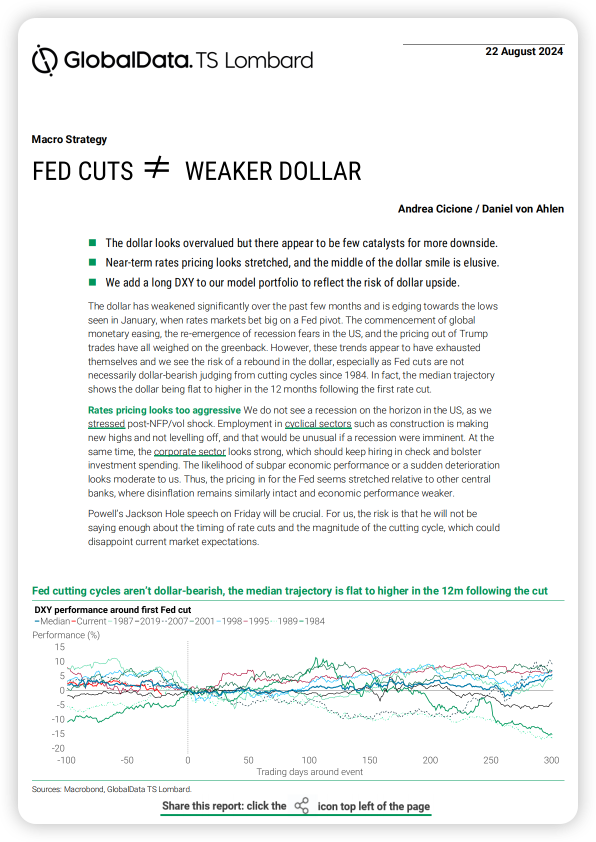

FED CUTS ≠ WEAKER DOLLAR

The dollar has weakened significantly over the past few months and is edging towards the lows seen in January, when rates markets bet big on a Fed pivot. The commencement of global

海外研报

2024年08月23日

MINUTES REVEAL LOST CONFIDENCE, BENCHMARK PAYROLL REVISION UNDERSCORES THE POINT

The FOMC is a lot less sure about whether policy is in the right spot than it was six weeks ago. Then, we read howmonetary policy was “well positioned” to handle whatever came next. No such phrasing in July, just handwringing

海外研报

2024年08月23日

Weekly Options Watch What’s priced in for Jackson Hole?

Ahead of the Aug 22-24 Jackson Hole symposium, option prices on US bankstocks and most ETFs are low relative to history, while investors are expecting

海外研报

2024年08月22日