海外研报

筛选

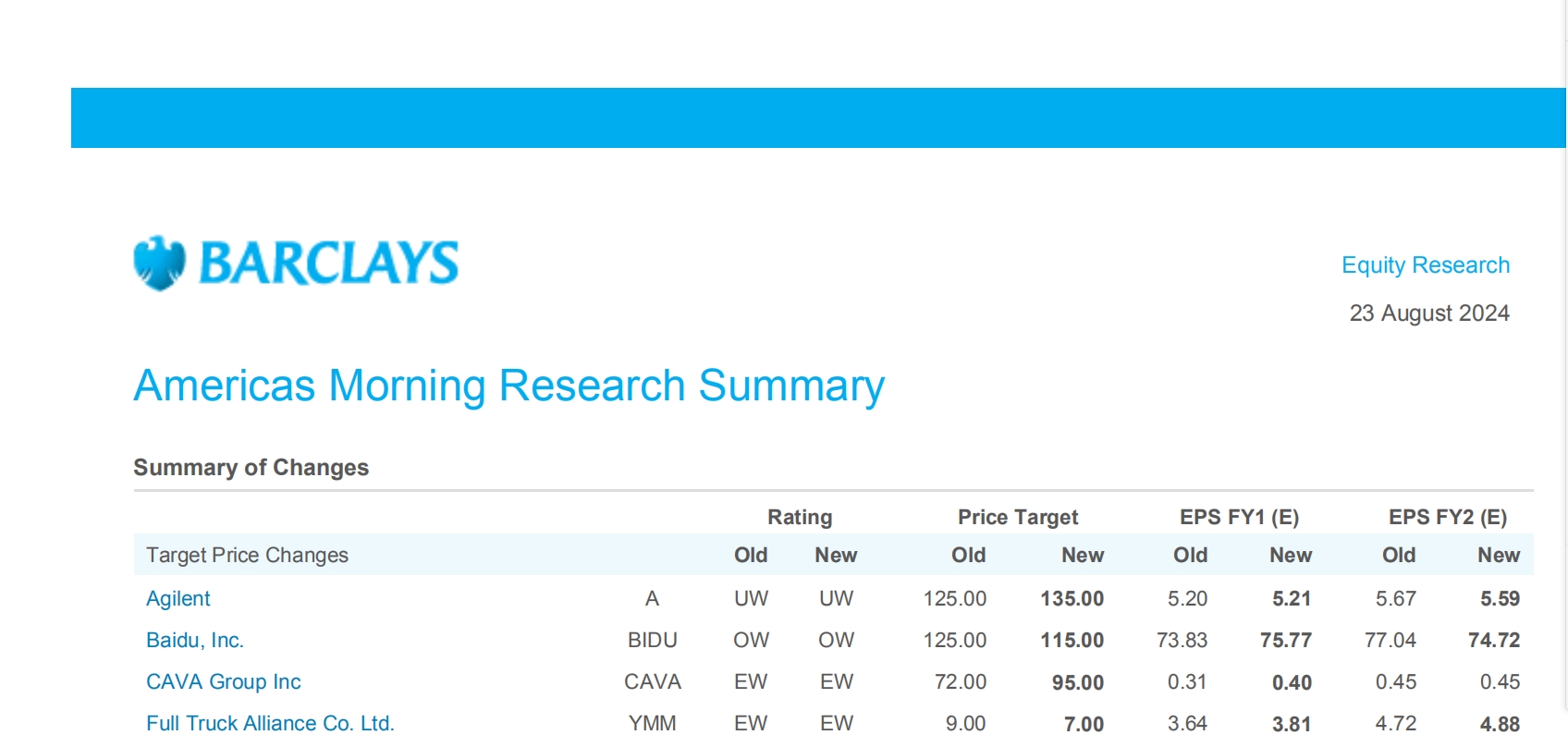

Americas Morning Research Summary

This summary is compiled from research reports previously published by Barclays Equity Research. A full list of all publications is available on

海外研报

2024年08月24日

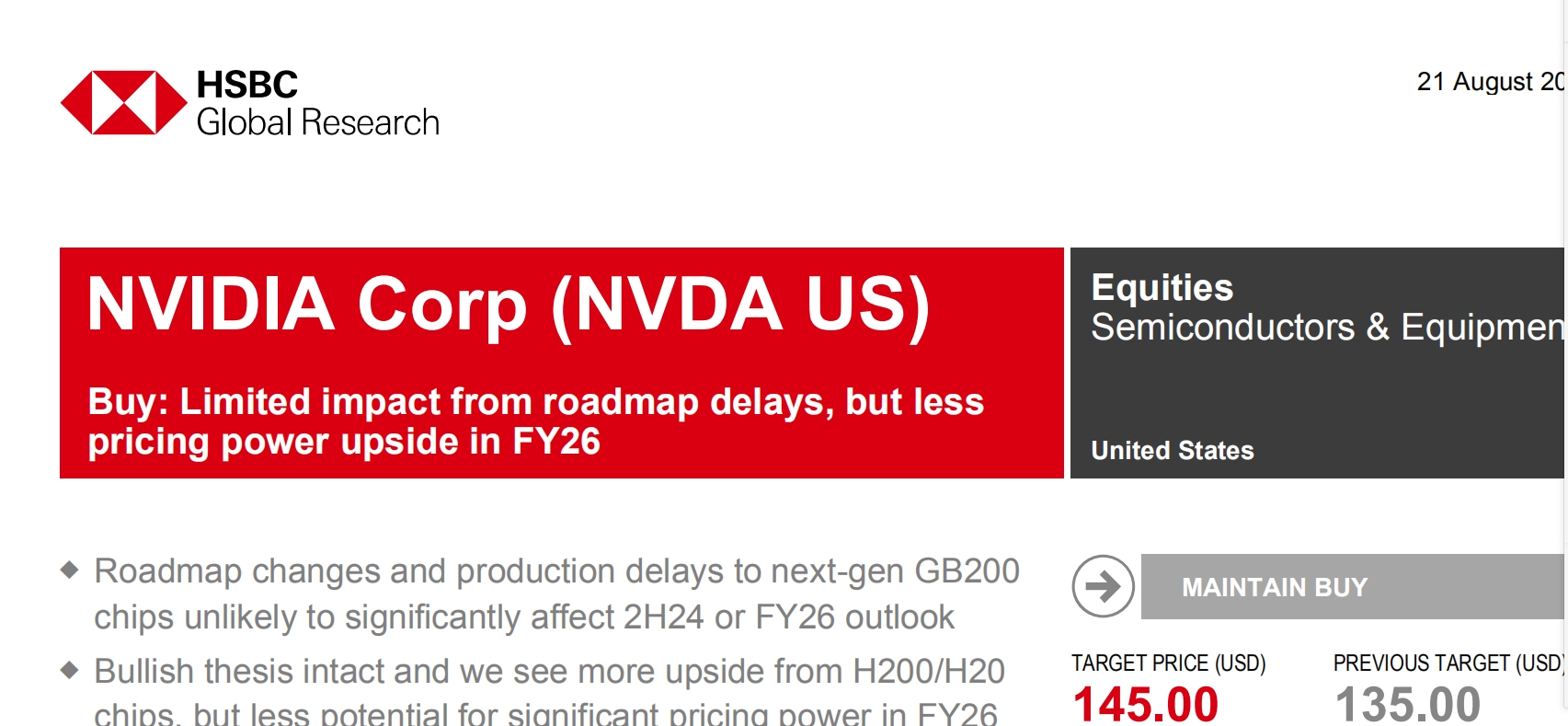

Limited impact from roadmap delays, but less pricing power upside in FY26

Roadmap changes and production delays to next-gen GB200 chips unlikely to significantly affect 2H24 or FY26 outlook

海外研报

2024年08月24日

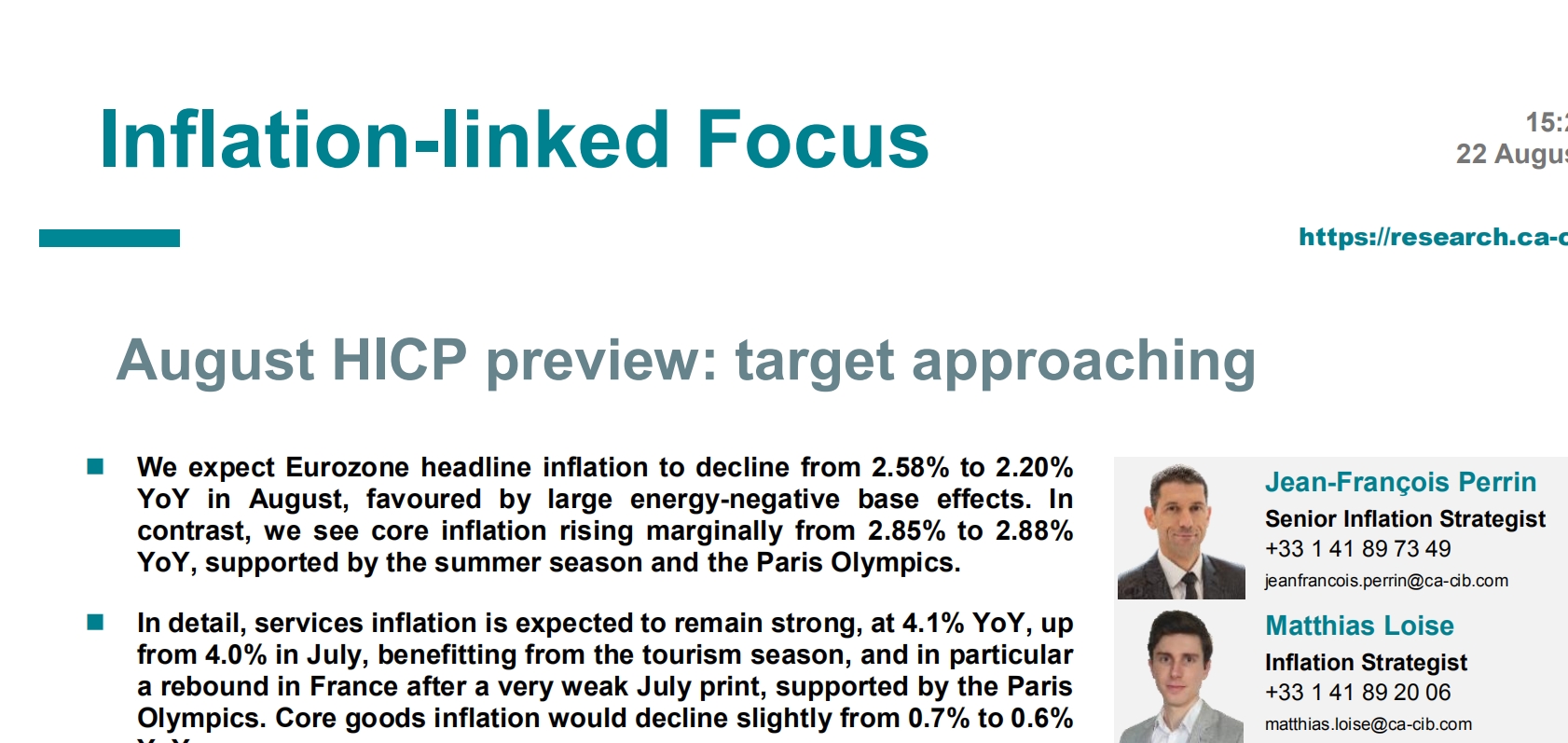

August HICP preview: target approaching

We expect Eurozone headline inflation to decline from 2.58% to 2.20% YoY in August, favoured by large energy-negative base effects. In

海外研报

2024年08月24日

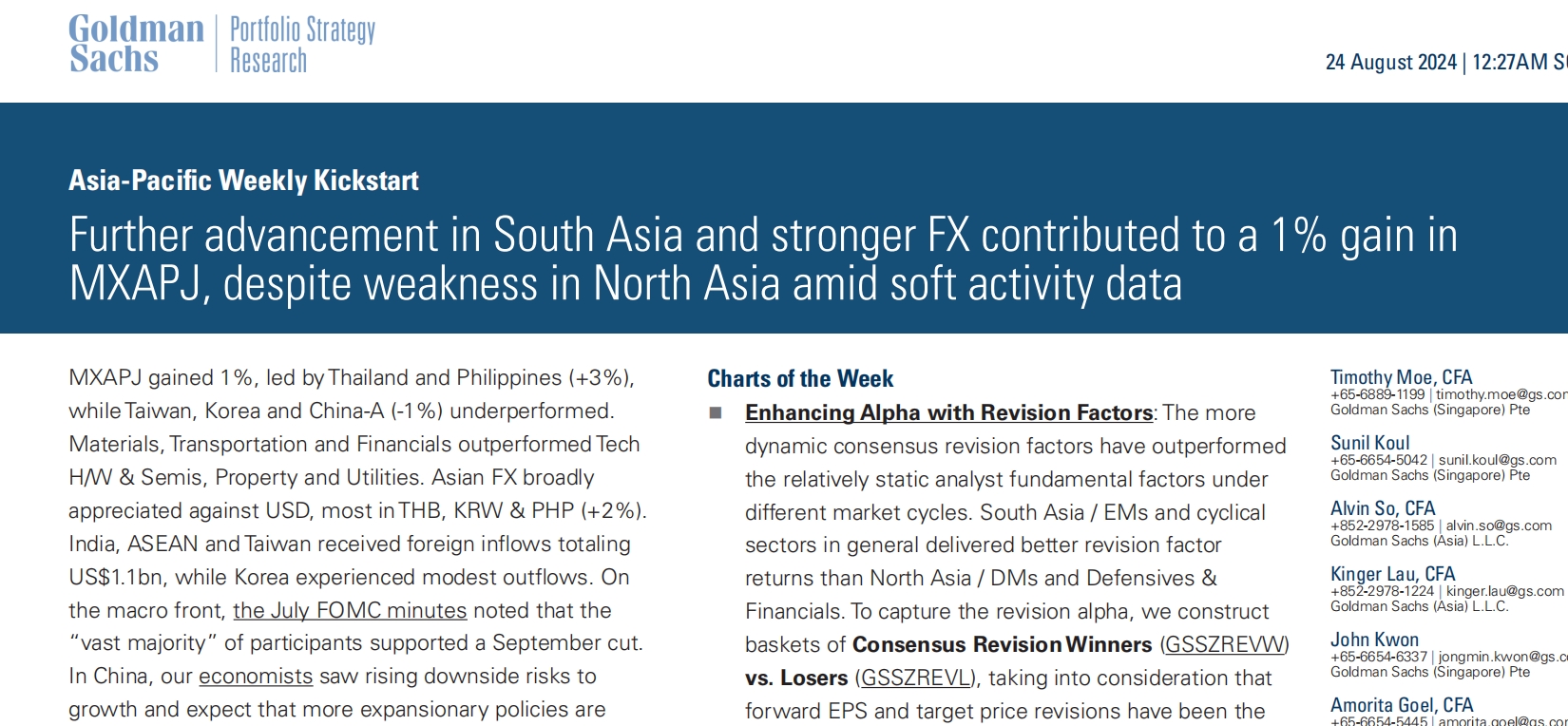

Further advancement in South Asia and stronger FX contributed to a 1% gain in MXAPJ

MXAPJ gained 1%, led by Thailand and Philippines (+3%),while Taiwan, Korea and China-A (-1%) underperformed.

海外研报

2024年08月24日

GS TWIG Notes: This Week in Global Research - August 23, 2024

Jan Hatzius lowers the probability that the US will enter a recession in the next12 months to 20% from 25% in last weekend’s note, “Renewed Progress on

海外研报

2024年08月24日

Asia Macro Weekly

Malaysia’s investment approvals maintained a robust pace in Q1 2024 after rising to an all-time high in 2023. Investments accelerated in the

海外研报

2024年08月24日

We need it like a Jackson Hole in the headGlobal Daily

Unlike the key BLS revisions to April 2023-March 2024 payrolls estimates, at -818K the largest drop since the Global Financial Crisis, today’s Global Daily was released at the same time to all -

海外研报

2024年08月23日

The Structured Credit Trader No end to amend and extend

n Despite the rally across spread products, Freddie Ksenior tranches have lagged and now appear cheap vs.

海外研报

2024年08月23日

Foldable, AI server and satellite early-stage product cycles – initiate SZS, Chenbro, WNC at Buy

We further expand our coverage into 3 areas where we are positive and see the product cycle at an early stage: SZS(foldable), Chenbro (AI server), and WNC (satellite) are well positioned with leading technologies and customer bases. In

海外研报

2024年08月23日

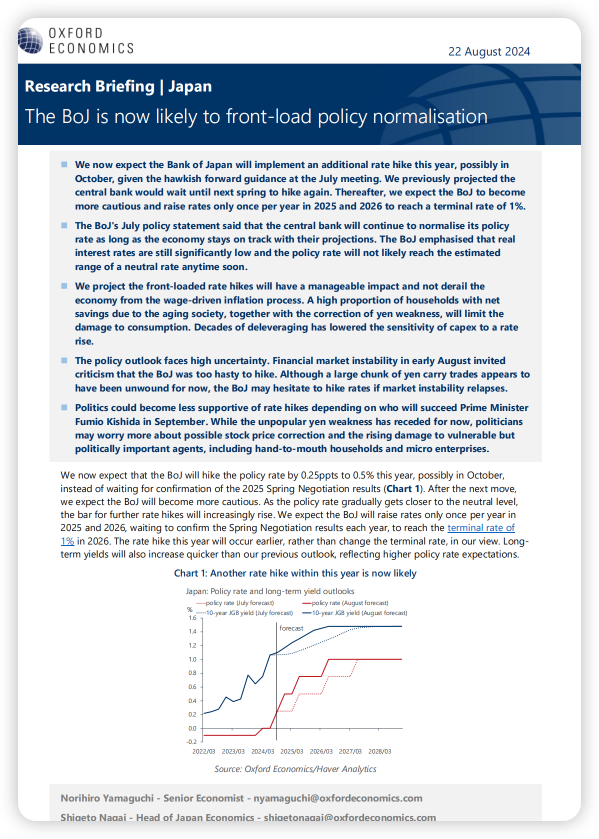

The BoJ is now likely to front-load policy normalisation

◼ We now expect the Bank of Japan will implement an additional rate hike this year, possibly in October, given the hawkish forward guidance at the July meeting. We previously projected the

海外研报

2024年08月23日