海外研报

筛选

Tariffs and the quest for new markets to drive ODI

China’s latest balance of payments (BOP) data shows that its net direct investmentoutflows (outward minus inward FDI) have picked up very quickly to a historical high.

海外研报

2024年08月24日

The Euro’s powering a balance of payments boom

My colleague Fabien Bossy sent me the chart (below) of the Eurozone current account this morning. Europe’s current account surplus reached EUR 51bn in June, EUR 370bn (2.5% GDP) in

海外研报

2024年08月24日

$hort term stretched, medium term is not

View: $hort term stretched, medium term is notUSD weakness heading into the Jackson Hole conference with US Federal Reserve chair

海外研报

2024年08月24日

US Treasury futures: calendar rolls outlook, September-December 2024

RecommendationsTU – Mildly bearish. Positioning is bearish due to record-high asset manager net positioning in the sector. TU roll will likely be sensitive to risk events and front-end moves, including a

海外研报

2024年08月24日

Weekly automotive pit stop

We believe the accompanying valuation framework is one of the most important fundamental factors that should be considered when making investment decisions on

海外研报

2024年08月24日

Precious Metals Trading Desk View

This publication was prepared by Bank J Safra Sarasin (BJSS) Trading department. The views or ideas expressed

海外研报

2024年08月24日

Global macro: Too far, too fast? (2)

In Global macro: Too far, too fast?, dated 5 August, wenoted that the US Federal Reserve, on average across

海外研报

2024年08月24日

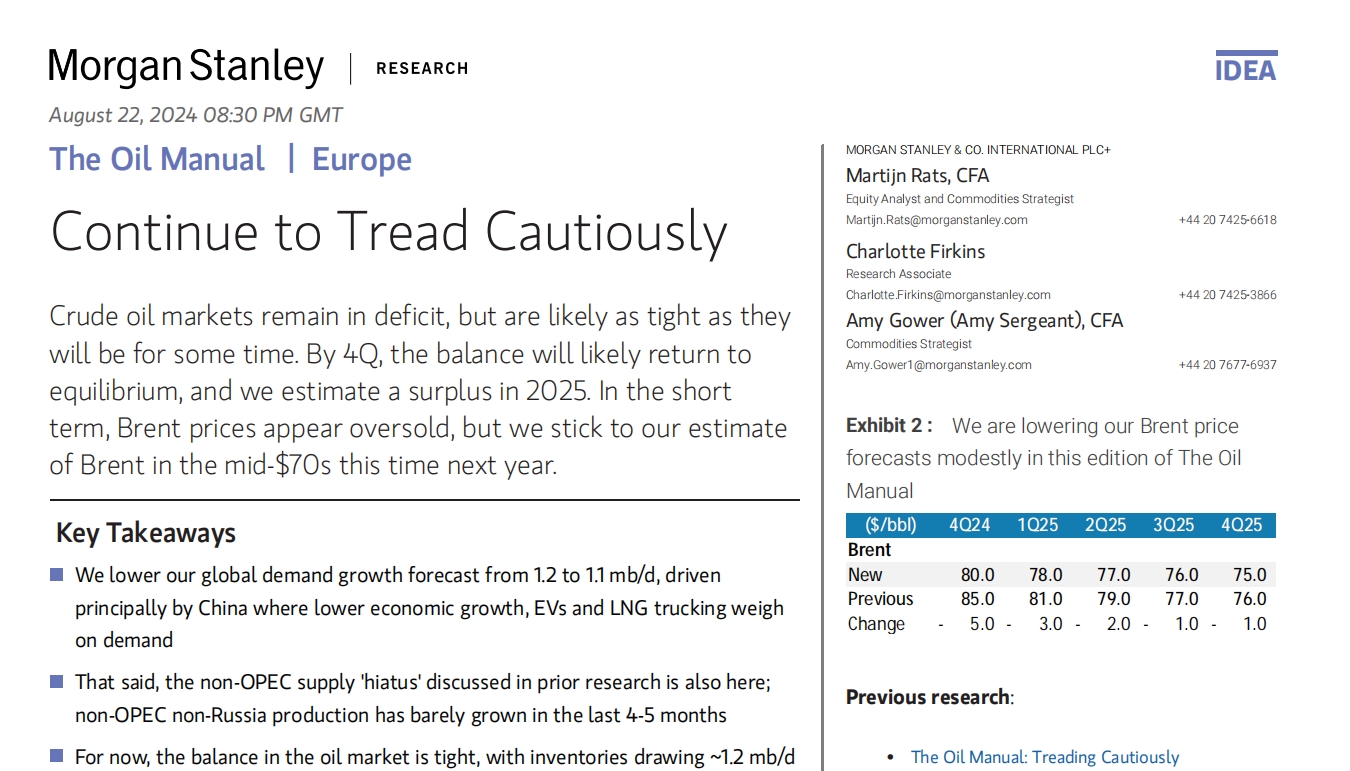

Continue to Tread Cautiously

We lower our global demand growth forecast from 1.2 to 1.1 mb/d, driven principally by China where lower economic growth, EVs and LNG trucking weigh

海外研报

2024年08月24日

Equities: Bad cop, good copper

KEY MESSAGESWe initiate three trade ideas to position for upside incompanies involved in the production of transition metals

海外研报

2024年08月24日

Impression from Gov. Ueda's Remarks at the House of Representatives: Quick Comment

Ueda's remarks at the House of Representatives in the morning: Gov. Ueda said that "financial and capital markets at home and abroad have still been unstable, so

海外研报

2024年08月24日