海外研报

筛选

TECHNICAL ANALYSIS

2y UST down move stalled after defending the May 2023 trough near 3.65% but signals of significant upside are not yet visible. 2y

海外研报

2024年08月27日

"Wolf! Wolf! The wolf is chasing the sheep!"

Market pricing of end-2024 Fed Funds fell from 4.66% (67bp below the current level) before the July labour market data were released, to 3.85% just before the (stronger) ISM services data

海外研报

2024年08月27日

Fixed Income Special European futures rollover outlook Sep-24/Dec-24

The last trading date for Eurex June futures is 6 September and delivery is on 10 September. The first delivery date for Gilt June futures is 2 September. The rollover will gradually start on 27

海外研报

2024年08月27日

CHINA ECONOMIC UPDATE

July activity growth weakened further as the manufacturing sectors ‘beloved’ by policymakers cooled off, and ‘unloved’ domestic demand

海外研报

2024年08月27日

Cross-Asset Weekly

Investors are eagerly waiting for Jay Powell’s speech at Jackson Hole where he is expectedto give his nod to a first Fed rate cut in September. While he will probably confirm that the

海外研报

2024年08月27日

Precious Metals Trading Desk View

This publication was prepared by Bank J Safra Sarasin (BJSS) Trading department. The views or ideas expressed herein are those of the desk and/or the author only. The publication cannot be considered as investment research or a

海外研报

2024年08月27日

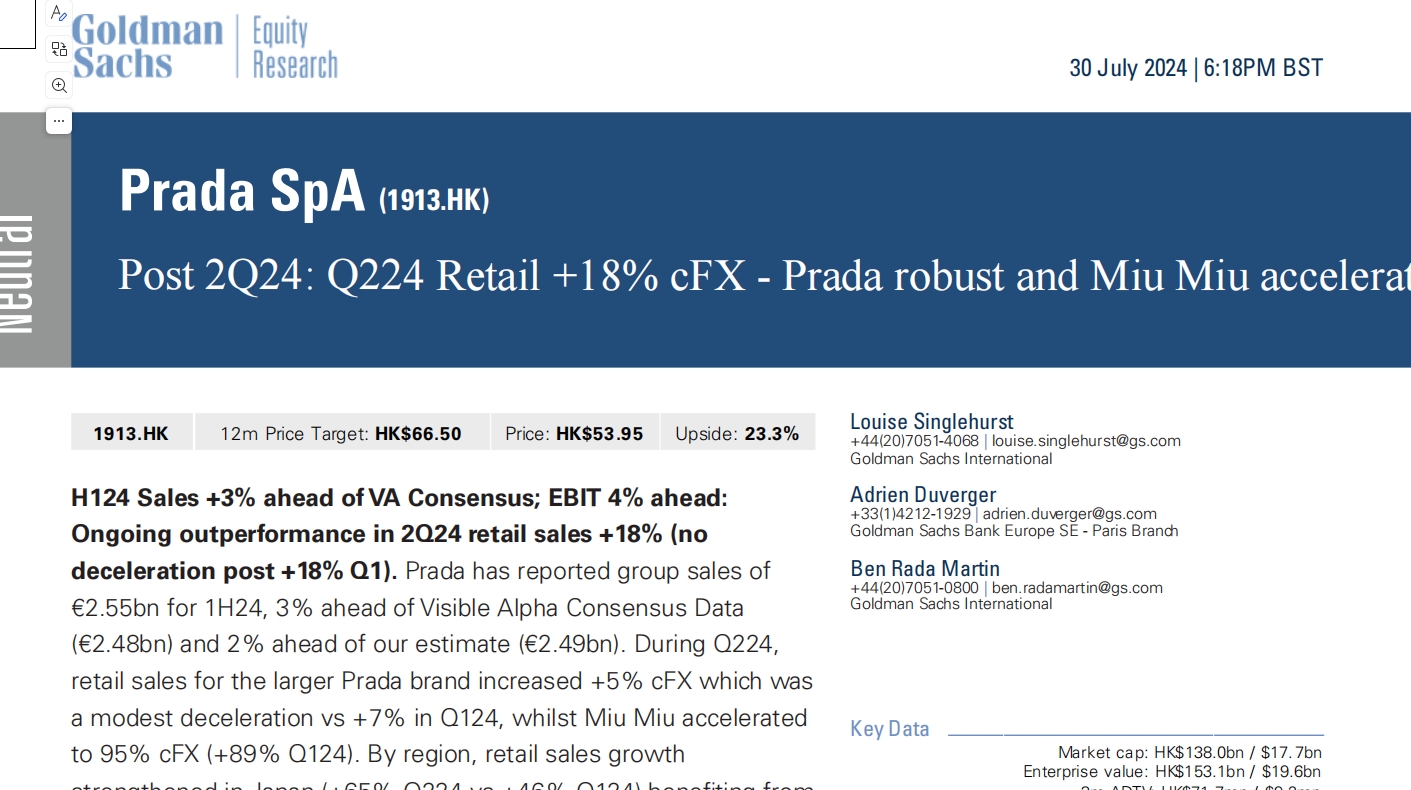

Post 2Q24: Q224 Retail +18% cFX - Prada robust and Miu Miu acceleratio

H124 Sales +3% ahead of VA Consensus; EBIT 4% ahead:Ongoing outperformance in 2Q24 retail sales +18% (no

海外研报

2024年08月27日

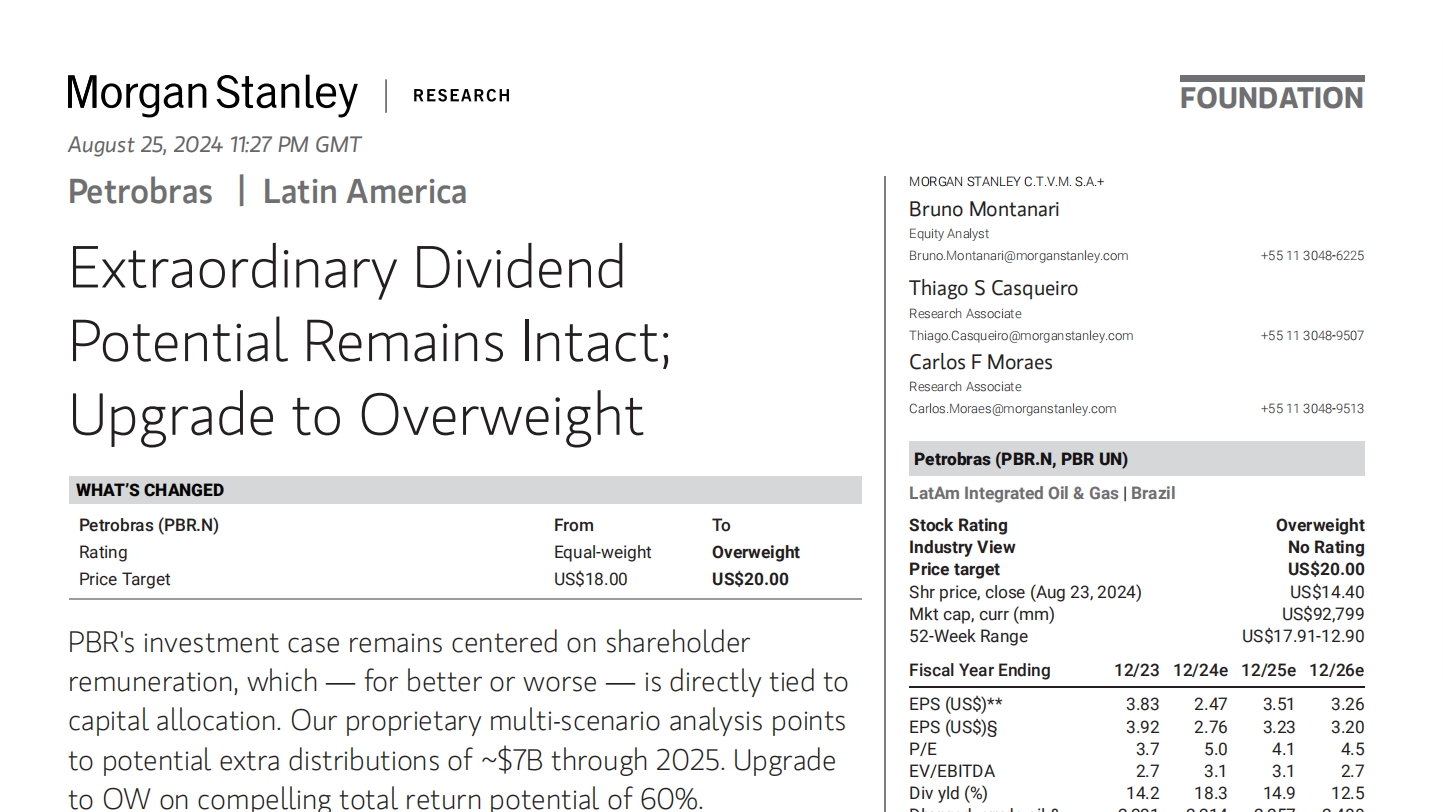

Extraordinary Dividend Potential Remains Intact; Upgrade to Overweight

PBR's investment case remains centered on shareholder remuneration, which — for better or worse — is directly tied to

海外研报

2024年08月27日

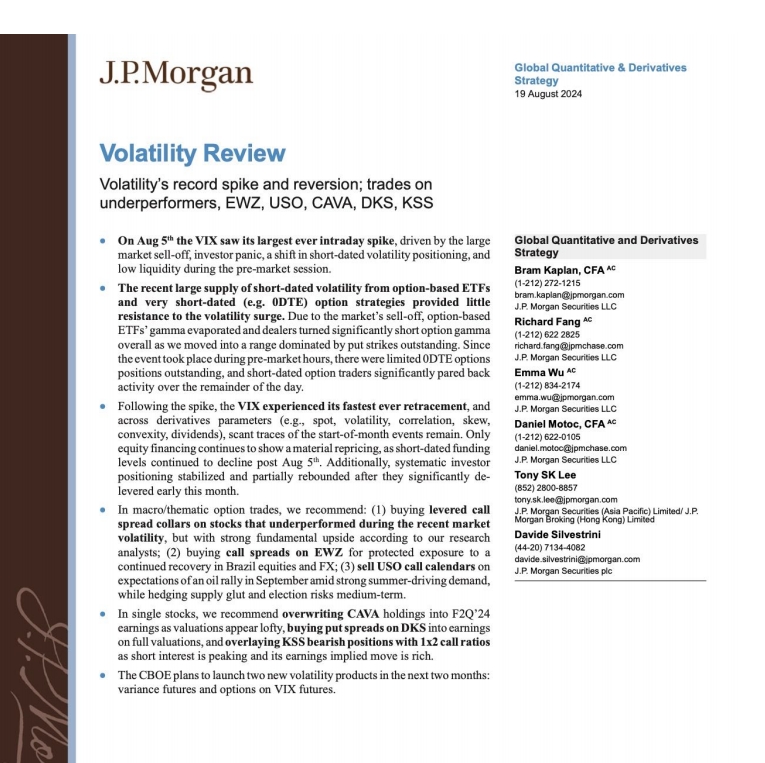

Volatility Review

On Aug $* the VIX saw its largest ever intraday spike, driven by the largemarket sell-off, investor panic, a shift in short-dated volatility positioning, andlow liquidity during the pre-market session.

海外研报

2024年08月27日

US MARKET INTELLGENCE:MORNING BRIEFING

US: Futs are higher to start the week with small-caps outperforming. Pre-mkt, NVDA (+94bps)is leading both Mag7 and Semis higher as bond yields continue to decline as yield curve bullsteepens. USD is flat and commodities are bid with both Energy and

海外研报

2024年08月27日