海外研报

筛选

Trading Catalysts NVDA earnings, an underpriced risk

Economics: The time has comeAt Jackson Hole, Chair Powell sealed the deal for a September rate cut. Although Powell

海外研报

2024年08月29日

Divided shores

Supply risks in Libya have come to the fore but marketparticipants seem sanguine. Notwithstanding elevated

海外研报

2024年08月29日

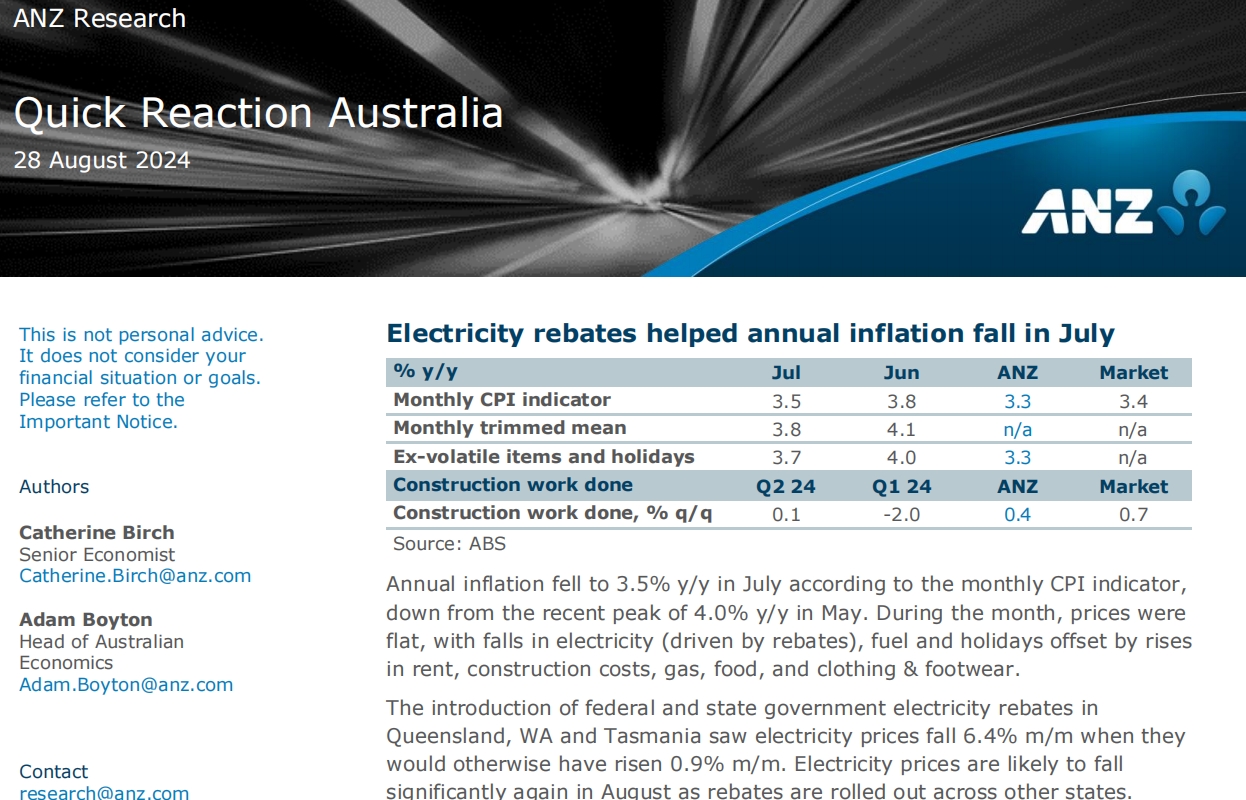

Quick Reaction Australia

Annual inflation fell to 3.5% y/y in July according to the monthly CPI indicator, down from the recent peak of 4.0% y/y in May. During the month, prices were

海外研报

2024年08月29日

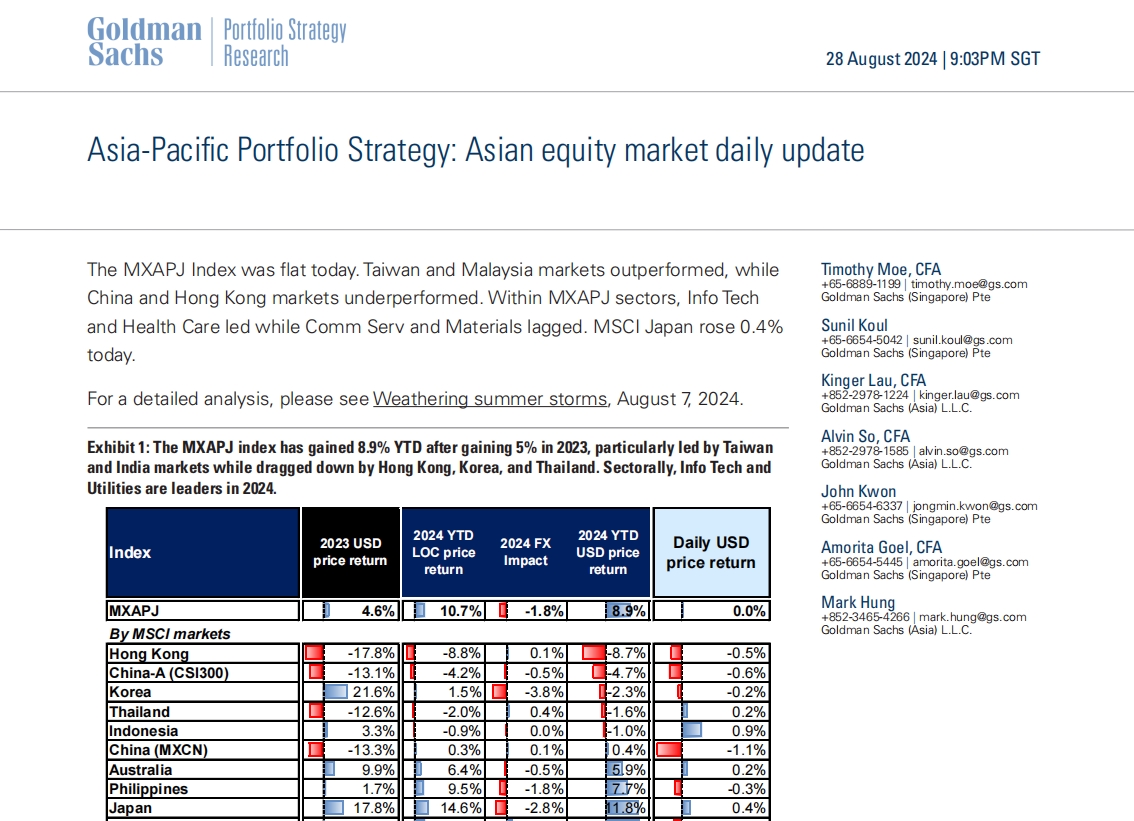

Asia-Pacific Portfolio Strategy: Asian equity market daily update

The MXAPJ Index was flat today. Taiwan and Malaysia markets outperformed, whileChina and Hong Kong markets underperformed. Within MXAPJ sectors, Info Tech

海外研报

2024年08月29日

Can the PBoC achieve its conflicting goals this time?

Credit growth hindered by weak fundamentalsChina’s credit growth for July fell significantly short of expectations, with new loans increasing by merely RMB260b,

海外研报

2024年08月29日

LONG CARRY, SHORT TREND

Powell's Jackson Hole speech gave a strong indication that inflation is no longer the tail risk for the Fed and that it is the health of the labour market that is now paramount. While the dual

海外研报

2024年08月29日

Options positioning ahead of NVDA earnings

The moves in macro assets on NVDA earnings demonstrates the importance ofthe AI theme and NVDA as the most important bellwether in the market. While

海外研报

2024年08月29日

US Strategy: Trading Politics

In November, US voters will decide who controls the White House, Senate and House of Representatives. With the race a

海外研报

2024年08月29日

Tomorrow, back to only thinking "Rate cuts!"

Today, markets are only interested in one economy, one field, and earnings from one company,which may or may not be in a bubble. It makes a change from a focus on “Rate cuts!” I guess. But

海外研报

2024年08月29日

The unlikely champions of Europe

Financial markets are trading sideways ahead of Nvidia’s earnings release later today and the US PCE data release later in the week. Sentiment was weighed

海外研报

2024年08月29日