海外研报

筛选

Precious Metals Trading Desk View

This publication was prepared by Bank J Safra Sarasin (BJSS) Trading department. The views or ideas expressed herein are those of the desk and/or the author only. The publication cannot be considered as investment research or a

海外研报

2024年08月29日

THE UNITED STATES ECONOMIC MONITOR

We look for a 0.13% rise in the July core PCE deflator, implying downside risk to the 0.2% consensus.Real consumption probably rose by 0.3% in July,

海外研报

2024年08月29日

THE EUROZONE ECONOMIC MONITOR

Destatis confirmed the decline in German GDP in Q2, despite still not publishing services data.

海外研报

2024年08月29日

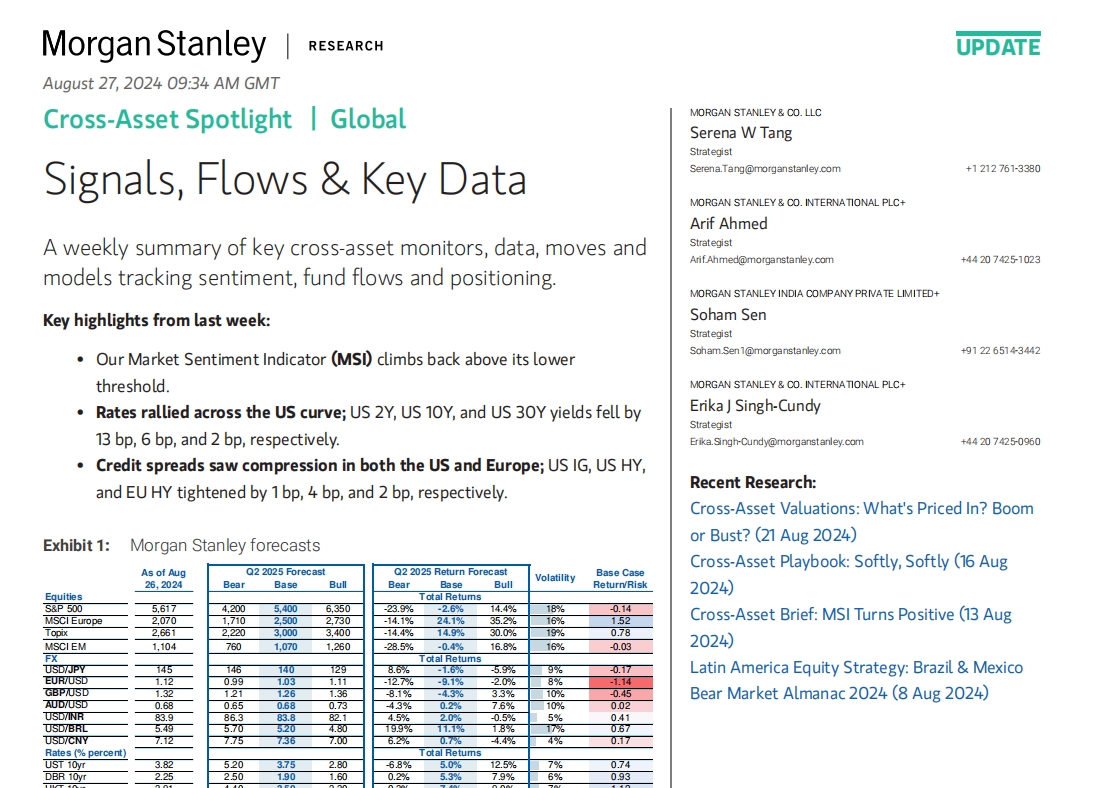

Signals, Flows & Key Data

A weekly summary of key cross-asset monitors, data, moves and models tracking sentiment, fund flows and positioning.

海外研报

2024年08月29日

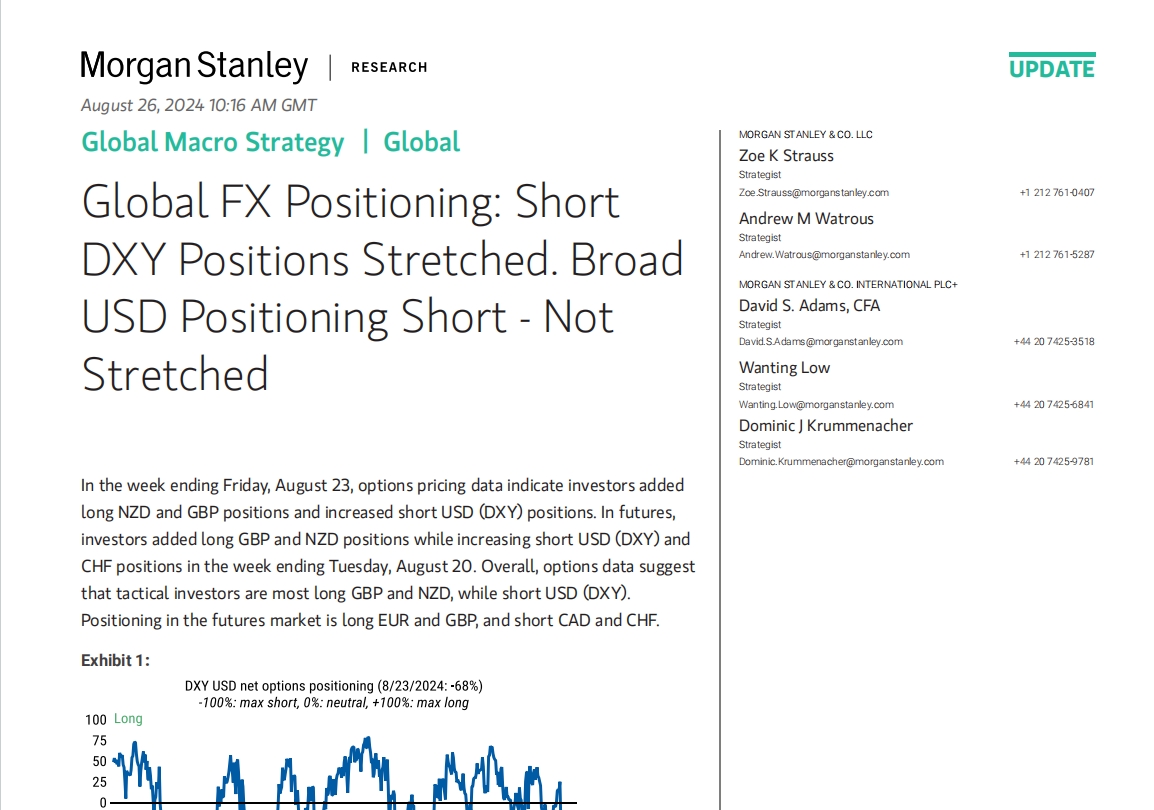

Global FX Positioning: Short DXY Positions Stretched. Broad USD Positioning Short - Not Stretched

In the week ending Friday, August 23, options pricing data indicate investors added long NZD and GBP positions and increased short USD (DXY) positions. In futures,

海外研报

2024年08月29日

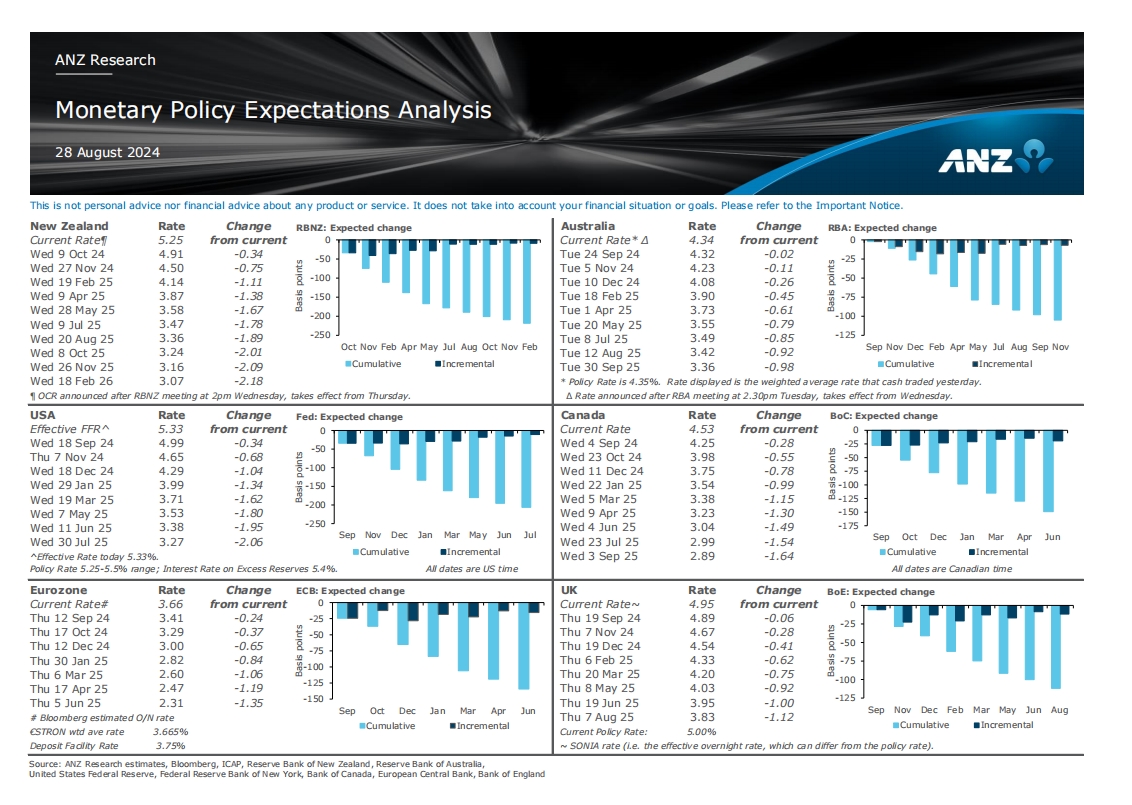

Monetary Policy Expectations Analysis

The opinions and research contained in this document (in the form of text, image, video or audio) are (a) not personal financial advice nor financial advice about any product or service; (b) provided for

海外研报

2024年08月29日

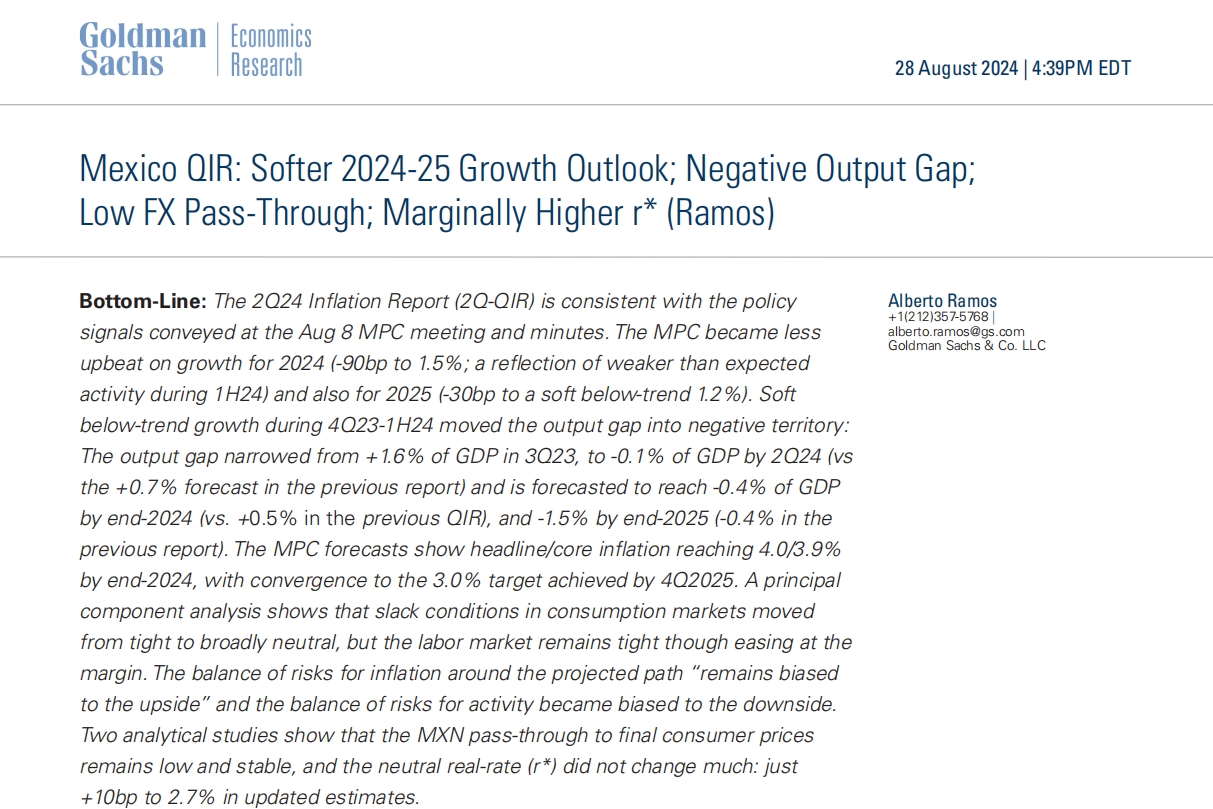

Softer 2024-25 Growth Outlook; Negative Output Gap; Low FX Pass-Through; Marginally Higher r

Bottom-Line: The 2Q24 Inflation Report (2Q-QIR) is consistent with the policysignals conveyed at the Aug 8 MPC meeting and minutes. The MPC became less

海外研报

2024年08月29日

Macro at a Glance: Latest views and forecasts

Globally, we expect real GDP growth of 2.7% yoy in 2024, reflecting tailwinds nfrom real household income growth, a gradual recovery in manufacturing activity,

海外研报

2024年08月29日

US MARKET INTELLIGENCE:MORNING BRIEFING

US: Futs are flat into NVDA earnings this afternoon; NVDA is +31bps pre-mkt with the balanceof Mag7 performing similarly and Semis are also bid. Bond yields are lower in the front-endwith 10Y unchanged. USD is looking to reverse yesterday's gains as

海外研报

2024年08月29日

NVDA Bars, DELL, GTLB, S, SMCI, Hon Hai

Sentiment: Even before last month’s Blackwell panic, investors I speak with were already looking to diversify their AI holdings a bit; but still nobody seemed keen to bet against the name, on a view that the remain extremely

海外研报

2024年08月29日