海外研报

筛选

The Flow Show The last private hire

Scores on the Doors: gold 22.4%, stocks 15.4%, crypto 14.3%, HY bonds 6.8%, oil 5.9%, commodities 4.0%, IG bonds 3.8%, cash 3.5%, govt bonds 0.7%, US$ 0.0% YTD.

海外研报

2024年08月31日

Equity Strategy Market Review

Barclays Capital Inc. and/or one of its affiliates does and seeks to do business with companies covered in its research reports. As a result, investors should be

海外研报

2024年08月31日

Australian Macro Weekly

Nothing to concern the RBA in the monthly CPI We saw nothing in the July CPI indicator that will affect the RBA’s thinking for

海外研报

2024年08月31日

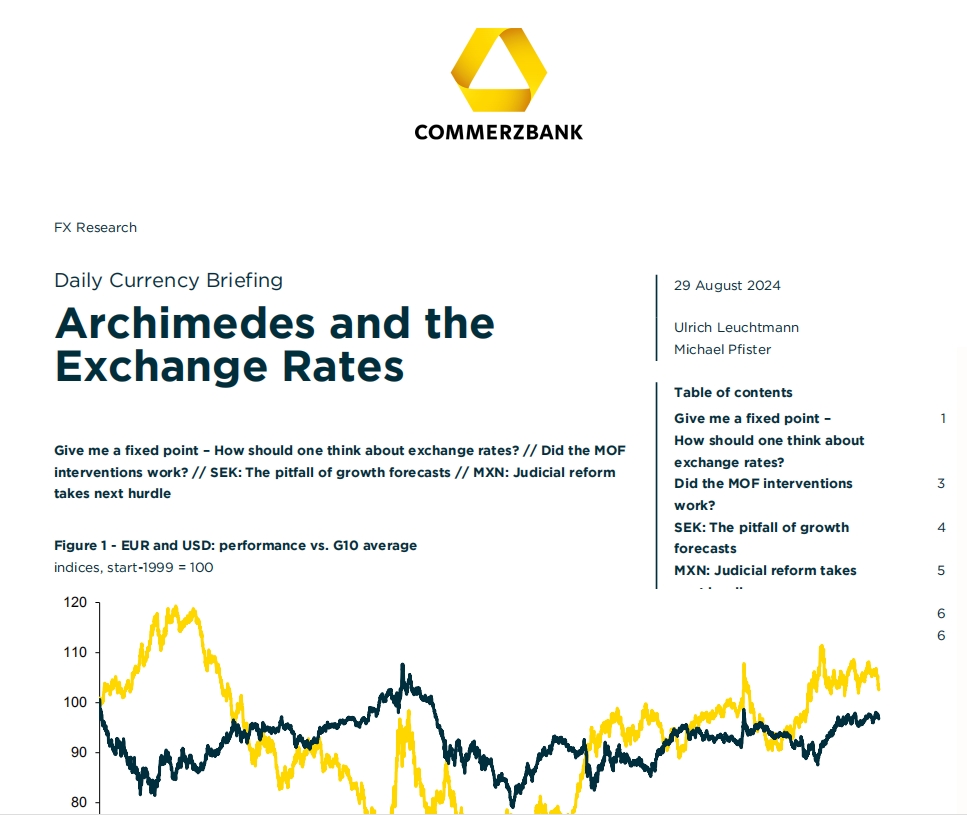

Archimedes and the Exchange Rates

to see. All that we have are exchange rates. And you can't tell from them whether theyfluctuate because the value of one currency changes or that of the other.

海外研报

2024年08月31日

Euro Area: Core Inflation Close to Expectations

BOTTOM LINE: In the flash release for August, core HICP inflation fell marginally to2.84%yoy, while headline HICP decreased 40bp to 2.18%yoy, both in line with

海外研报

2024年08月31日

StoneX Strategy U.S. Landing Gear Engaged, Labor Data in Focus

StoneX Strategy U.S. Landing Gear Engaged, Labor Data in FocusA spate of recent data indicate that while the U.s. labor market has slowed, the economy has avoidedspiraling into recession

海外研报

2024年08月30日

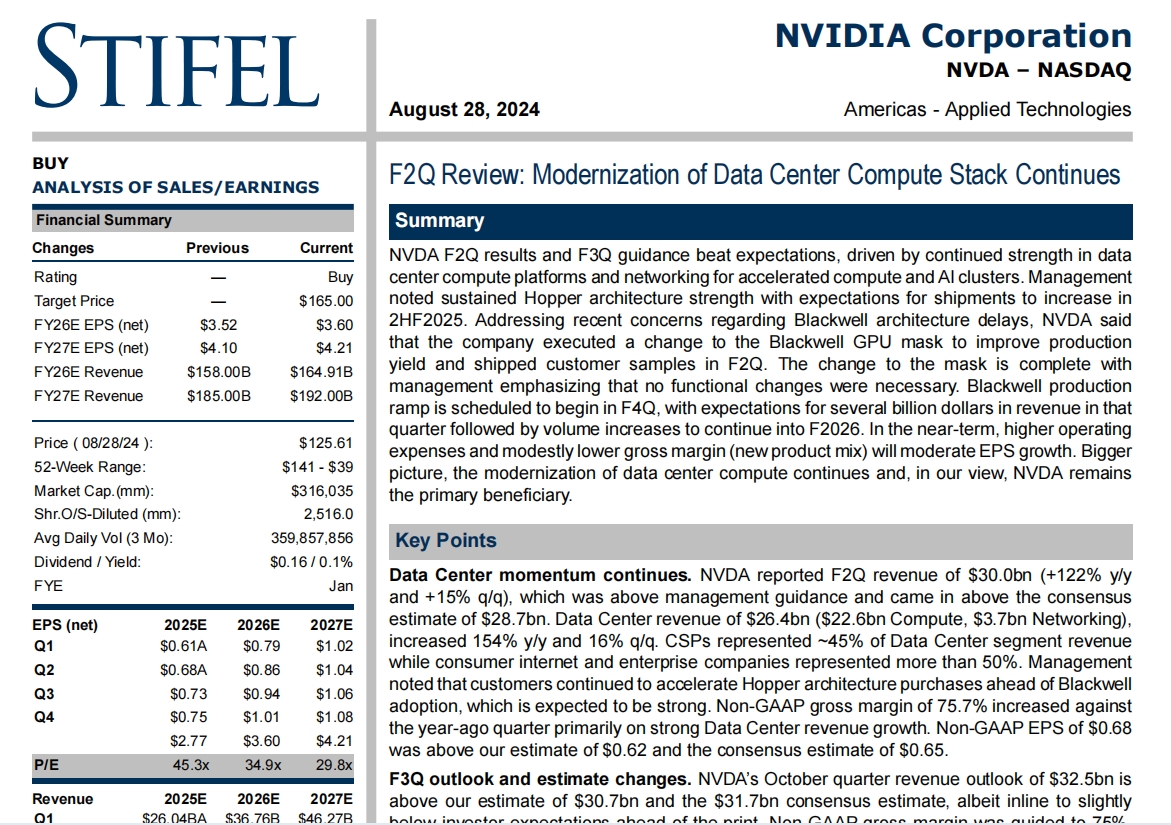

F2Q Review: Modernization of Data Center Compute Stack Continues

NVDA F2Q results and F3Q guidance beat expectations, driven by continued strength in datacenter compute platforms and networking for accelerated compute and AI clusters. Management

海外研报

2024年08月30日

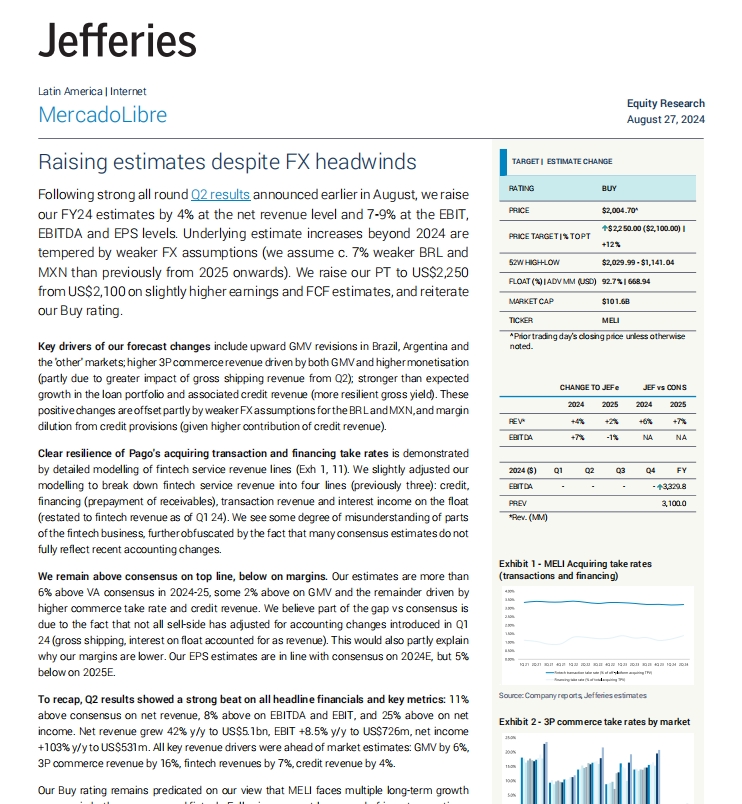

Raising estimates despite FX headwinds

Following strong all round Q2 results announced earlier in August, we raiseour FY24 estimates by 4% at the net revenue level and 7-9% at the EBIT,

海外研报

2024年08月30日

Invidious-Global Daily

Headlines today are of disappointing earnings at NVIDIA. Yet somehow world markets --and the world economy aside from one firm, in one sector, in one country-- managed to survive, and we

海外研报

2024年08月30日

Power demand is inflecting: 1-1.5% up since the start of the year

Earlier this year (here), we noted that Europe could soon experience an inflection inpower demand (datacenters, electrification). We now point out something that the

海外研报

2024年08月30日