海外研报

筛选

Back to Congress

Brazil's 2025 budget heading to Congress; the 2Q24 GDP report also in the spotlight. Banxico stresses growth concerns (Chart of

海外研报

2024年09月02日

Happy "Labor" Day

The sharp correction in stocks in July/early August was due to several factors, with the most important one being softer-than-expected economic growth data that

海外研报

2024年09月02日

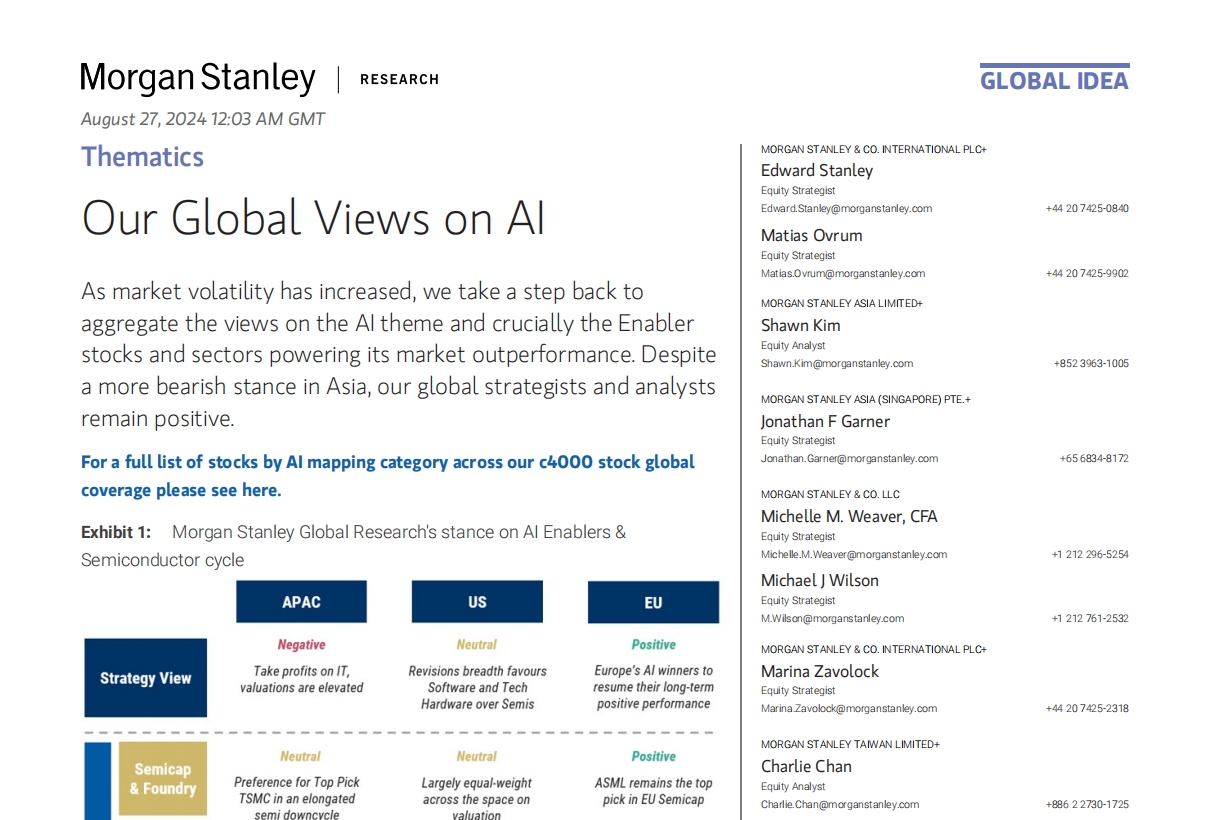

Our Global Views on AI

As market volatility has increased, we take a step back to aggregate the views on the AI theme and crucially the Enabler

海外研报

2024年09月02日

Cycle Playbook – Preparing for a Peak

Amid the excitement around AI, we must not lose sight of the cyclical nature of semiconductors and tech hardware. As we approach a cycle peak, we share our insights on navigating the transition.

海外研报

2024年09月02日

It’s About Labor Markets Now

The Fed is shifting focus toward the labor market. Because we expect slowing but no slump, we think the Fed resets policy

海外研报

2024年09月02日

J.PMorgan US Weekly Prospects

3Q GDP growth tracking stronger on signs of solidconsumer spendingBusiness spending has been more cautious and busi-ness sentiment is downbeat

海外研报

2024年09月02日

Latest monthly NISA data still showing strong growth

Summary of the weekTOPIX: 2,712.63 (1.0%) / NK225: 38,647.75 (0.7%)

海外研报

2024年09月02日

Global Rates Trader Policy Priorities Diverge

Ahead of key US data next week, signals out of the US have furthered the post-JulyNFP theme. Incremental inflation news has reinforced the shift in Fed focus towards

海外研报

2024年09月02日

Global FX Trader Waiting for Labor Da(y)ta

Our thoughts on USD, CNY, EUR, CAD, & TRYUSD: Rates in the driving seat for now. Despite recent market turbulence, the nUS economy looks close to achieving a soft landing, with the Fed likely to deliver

海外研报

2024年09月02日

A Little Less Resilient

One of the outstanding features of Europe’s long stretch of sub-par growth has been the surprising resilience of the continent’s labor market. For six

海外研报

2024年09月02日