海外研报

筛选

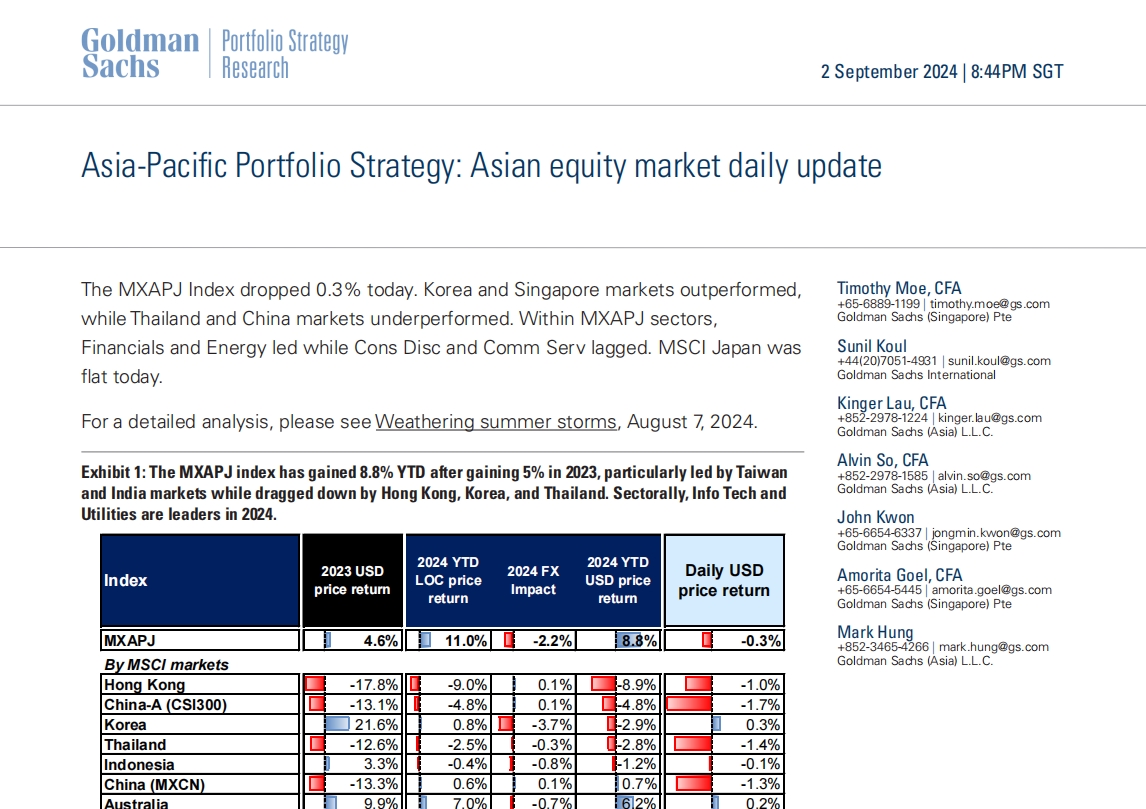

Asia-Pacific Portfolio Strategy: Asian equity market daily update

The MXAPJ Index dropped 0.3% today. Korea and Singapore markets outperformed,while Thailand and China markets underperformed. Within MXAPJ sectors,

海外研报

2024年09月03日

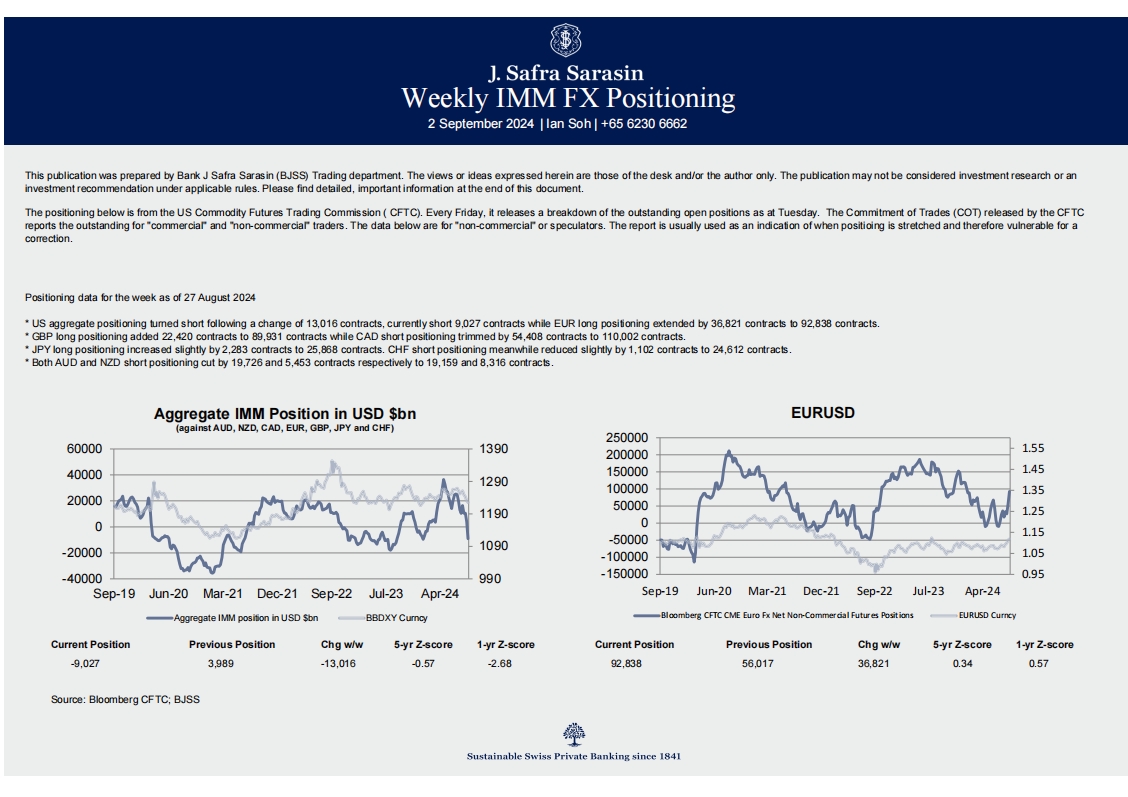

Weekly IMM FX Positioning

This publication was prepared by Bank J Safra Sarasin (BJSS) Trading department. The views or ideas expressed herein are

海外研报

2024年09月03日

China’s demographic challenges

Unless otherwise noted, information included herein is presented as of the dates indicated. Apollo GlobalManagement, Inc. (together with its subsidiaries, “Apollo”) makes no representation or warranty, expressed or

海外研报

2024年09月03日

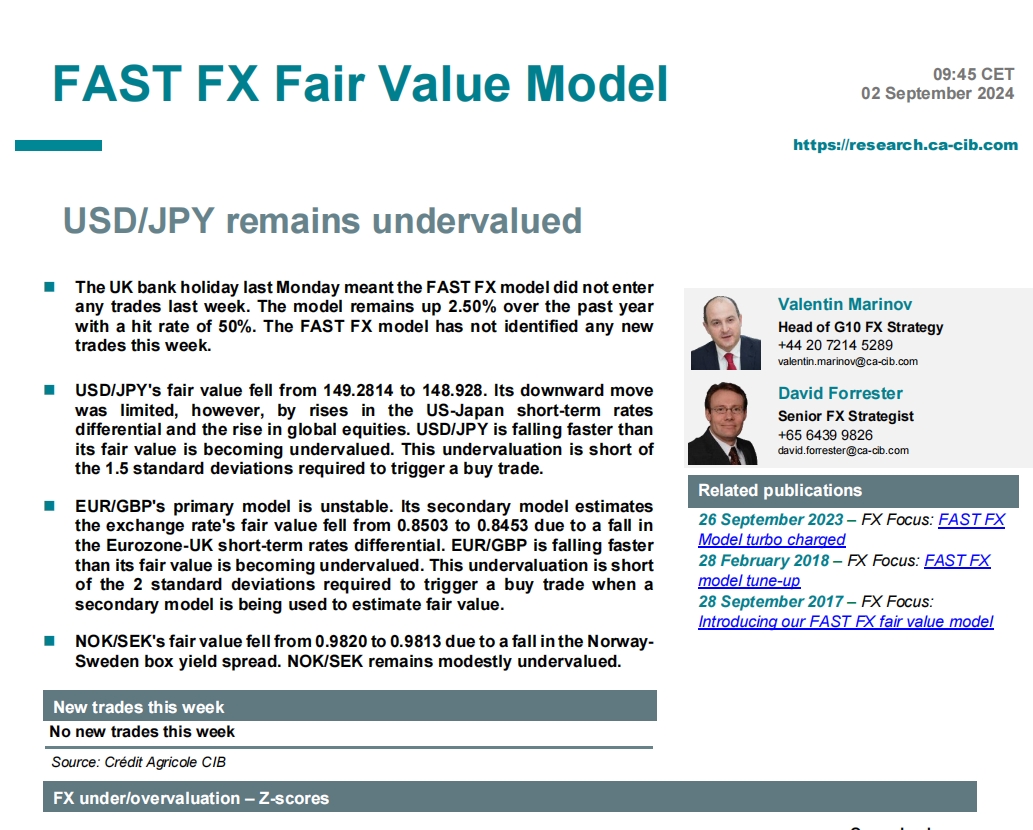

FAST FX Fair Value Model

The UK bank holiday last Monday meant the FAST FX model did not enter any trades last week. The model remains up 2.50% over the past year

海外研报

2024年09月03日

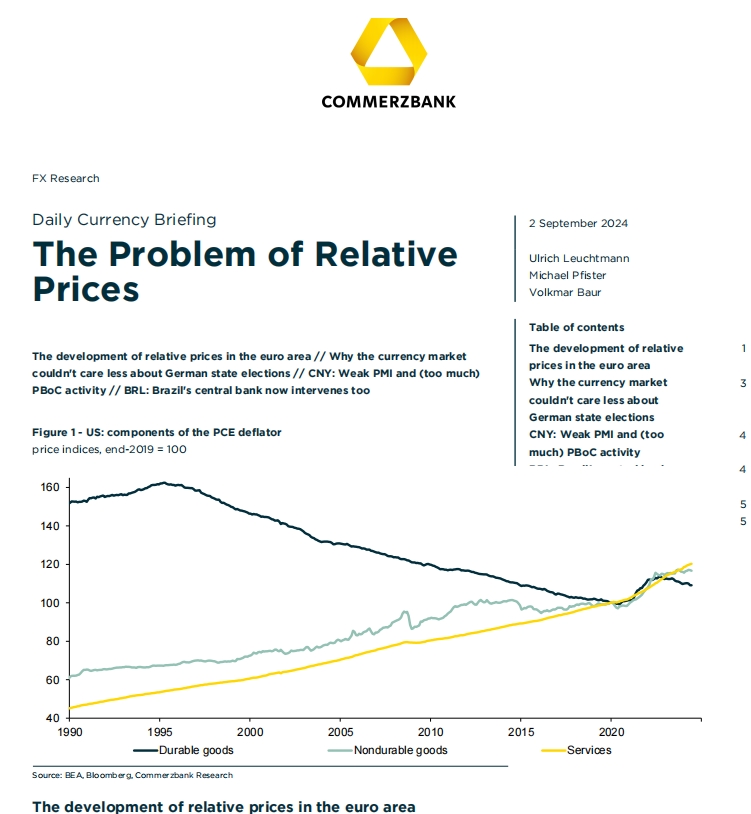

The Problem of Relative Prices

One of the points I don't understand was brought home to me again when I read what ECBExecutive Board member Isabel Schnabel said on Friday: that the ECB's monetary policy

海外研报

2024年09月03日

Asia Cross Asset Focus – Monthly

Focus of the month – APAC’s monetary policy outlook and market implicationsNow that the Fed is dovish and the dollar is weaker, there are no more external hurdles stopping

海外研报

2024年09月03日

Week Ahead in Economics

US non-farm payrolls will take centre stage next week. Following the soft July figure, we expect a rebound to 175k, which is a moderation from the pace seen earlier in the year. This

海外研报

2024年09月03日

FX View Humpty Dumpty dollar?

The first of the two charts below shows the dollar’s real effective value since 1980 during which time we have already seen two major rallies (in the first half of the 1980s and the second

海外研报

2024年09月03日

Fixed Income Weekly Back to reality

September is about to begin with a series of key data that will enable the market to finetune its rate cut pricing. As central banks aim to ease their monetary policy stance preemptively, there is no reason to rush

海外研报

2024年09月03日

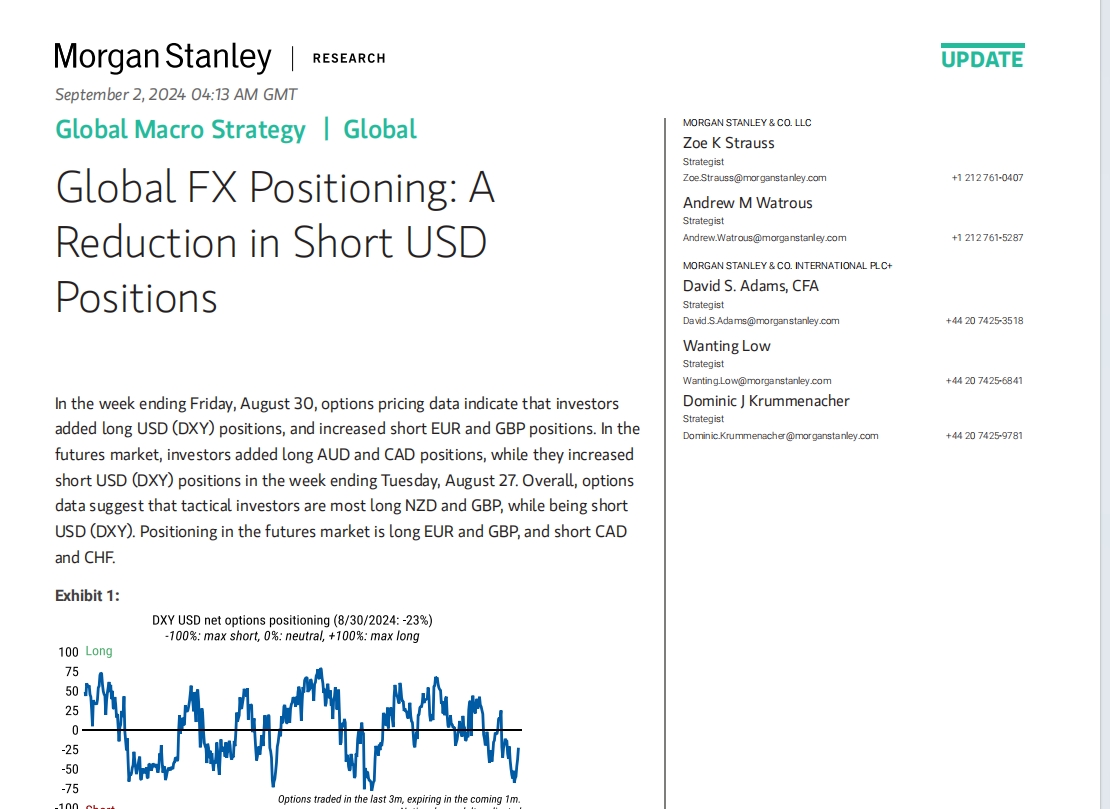

Global FX Positioning: A Reduction in Short USD Positions

In the week ending Friday, August 30, options pricing data indicate that investors added long USD (DXY) positions, and increased short EUR and GBP positions. In the

海外研报

2024年09月03日