海外研报

筛选

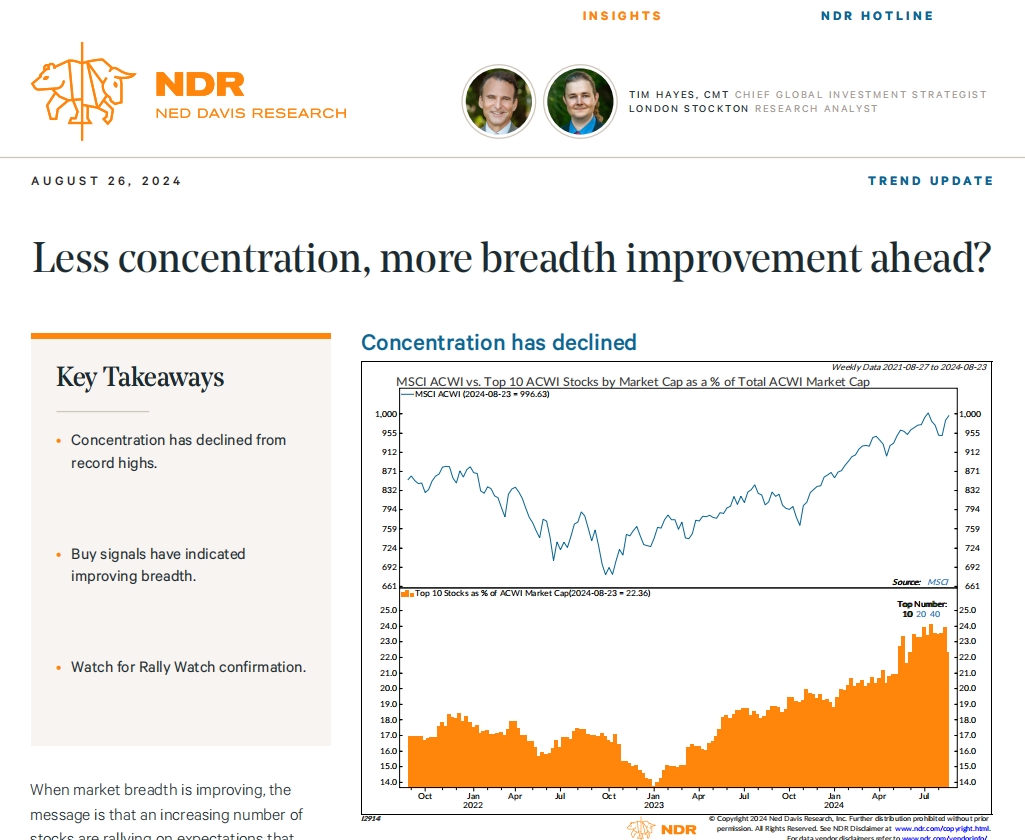

Less concentration, more breadth improvement ahead?

When market breadth is improving, the message is that an increasing number of

海外研报

2024年09月05日

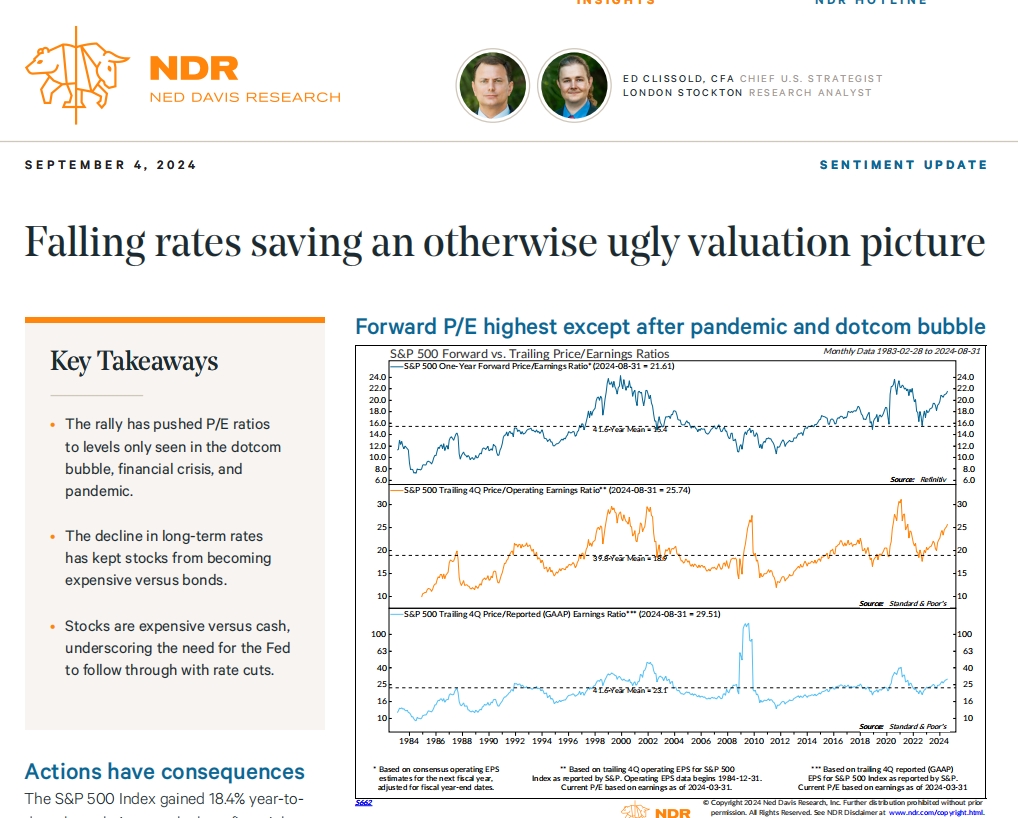

Falling rates saving an otherwise ugly valuation picture

Actions have consequencesThe S&P 500 Index gained 18.4% year-todate through August, the best first eight months of the year since 2021, the secondbest this century, and the 12th best since

海外研报

2024年09月05日

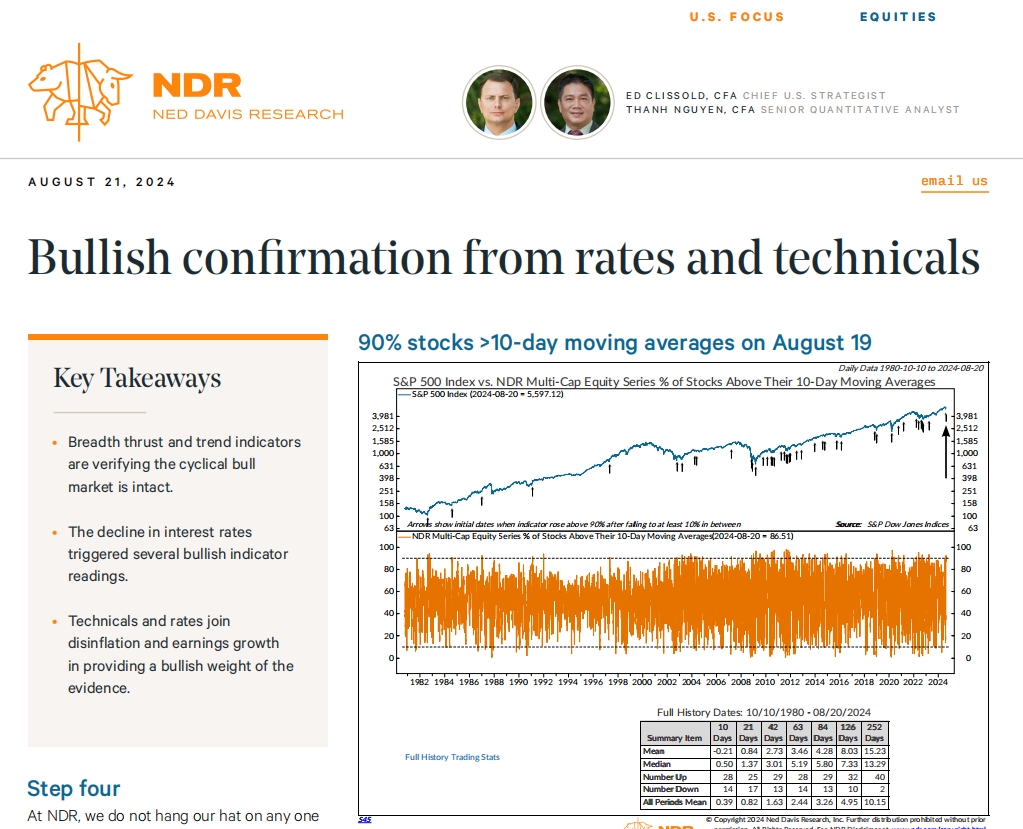

Bullish confirmation from rates and technicals

At NDR, we do not hang our hat on any one indicator. We find a mosaic approach of

海外研报

2024年09月05日

Weekly Warm-up: Happy "Labor" Day

Mixed Signals...The correction in stocks in July/early August was due to several factors, with the most important one being softer-than-expected

海外研报

2024年09月05日

Foreign Exchange Outlook

A BUSY SEPTEMBER WITH POTENTIAL VOLATILITYAfter the turmoil at the start of August risk appetite rebounded sharply and we start

海外研报

2024年09月05日

Mizuho EMEA G4 Forecast Update

August was a bad month for the greenback with both EUR/USD and GBP/USD making yearto-date highs during the month, as investors await the start of the Fed’s easing cycle. USD/JPY

海外研报

2024年09月05日

Thoughts on the Pullback; Positioning intel; GTLB, ZS

Lots of questions yesterday about the Al/Semis pullback/vol shock, Really still no consensus explanation, but a few thingskept coming up in conversations: 1) In the wake of some earings disappointments (particularly memory -- and with that

海外研报

2024年09月05日

Overview – Retail Trading

For the latest data, including intraday updates, visit Investable AI/Data Analytics.

海外研报

2024年09月05日

Payrolls regain their crown as most important data release for stocks

Econ: The economy remains on robust footingThe second print of 2Q US GDP growth surprised to the upside at a robust 3.0% q/q

海外研报

2024年09月03日

Global Portfolio Manager's Digest So Long, Summer

We provide context and perspective on research across regionsand asset classes, this week highlighting our all-encompassing

海外研报

2024年09月03日