海外研报

筛选

A severe case of COVIDIA: prognosis for an AI-driven US equity market

NVIDIA and its GPU customers are now a large driver of equity market returns, earnings growth, earnings revisions, industrial production and capital spending. NVIDIA’s financial results are extraordinary (it beat on

海外研报

2024年09月05日

Europe Technology: Hardware: Key investor questions for European Digital Enablers at the

Ahead of the GS Communacopia + Technology Conference in San Francisco(September 9-11), we summarise key investor questions for our coverage, spanning

海外研报

2024年09月05日

Obesity/Diabetes thoughts into EASD and through the end of 2024

For Roche, we see negative risk/ reward into the EASD presentations with nthe stock already reflecting a largely best case scenario given the stage of

海外研报

2024年09月05日

Q1 2024 ETP flows round up

At the global level, equity ETPs led the way in Q1 ($255B), alongside inflows into fixed income ($80B) and continued selling of commodities (-$6.7B). This compares with the $274B added to equities, $95.6B into

海外研报

2024年09月05日

Dollar Tree Stores Inc. (DLTR): First Take: 2Q miss; FY guidance lowered

DLTR reported 2Q adj EPS of $0.67, below the GS estimate of $1.07 and consensus(Refinitiv) of $1.04. Consolidated SSS of +0.7% was below GS/consensus at

海外研报

2024年09月05日

The Global Point Wednesday, 04 September 2024

Global Multi-Asset - Industrial Technology & Mobility: How disruptive forces are driving the M&A landscape in Industrials; Focus on Germany

海外研报

2024年09月05日

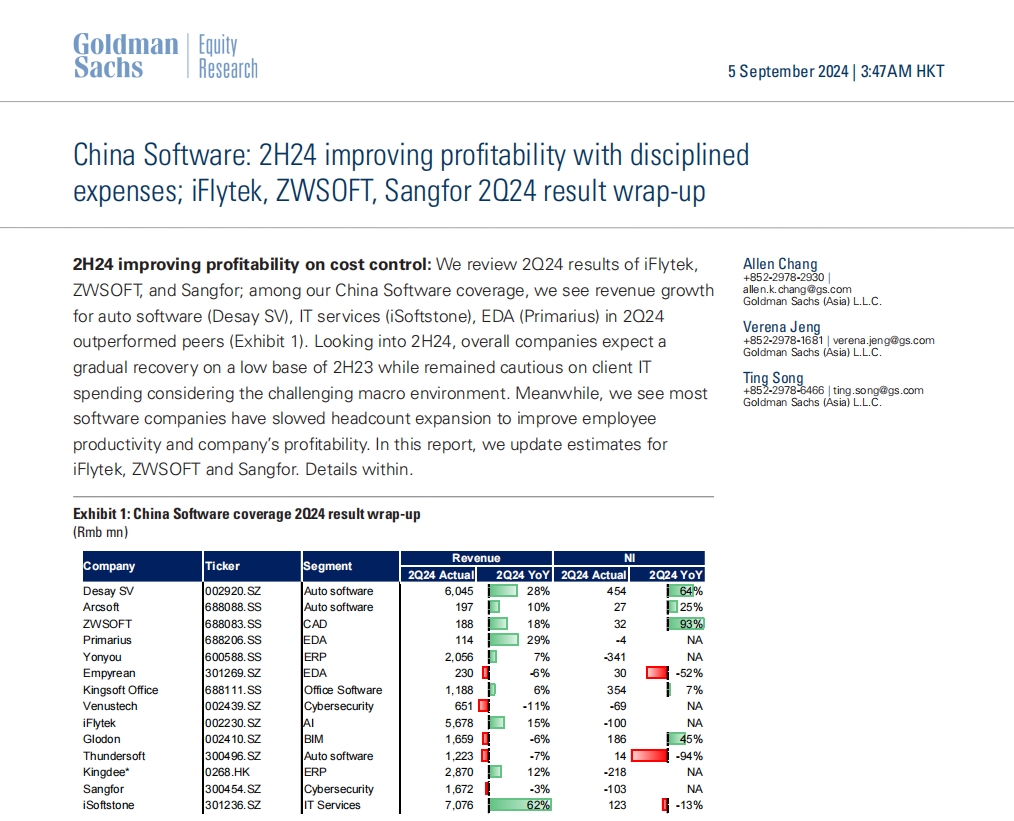

China Software: 2H24 improving profitability with disciplined expenses; iFlytek, ZWSOFT,

2H24 improving profitability on cost control: We review 2Q24 results of iFlytek,ZWSOFT, and Sangfor; among our China Software coverage, we see revenue growth

海外研报

2024年09月05日

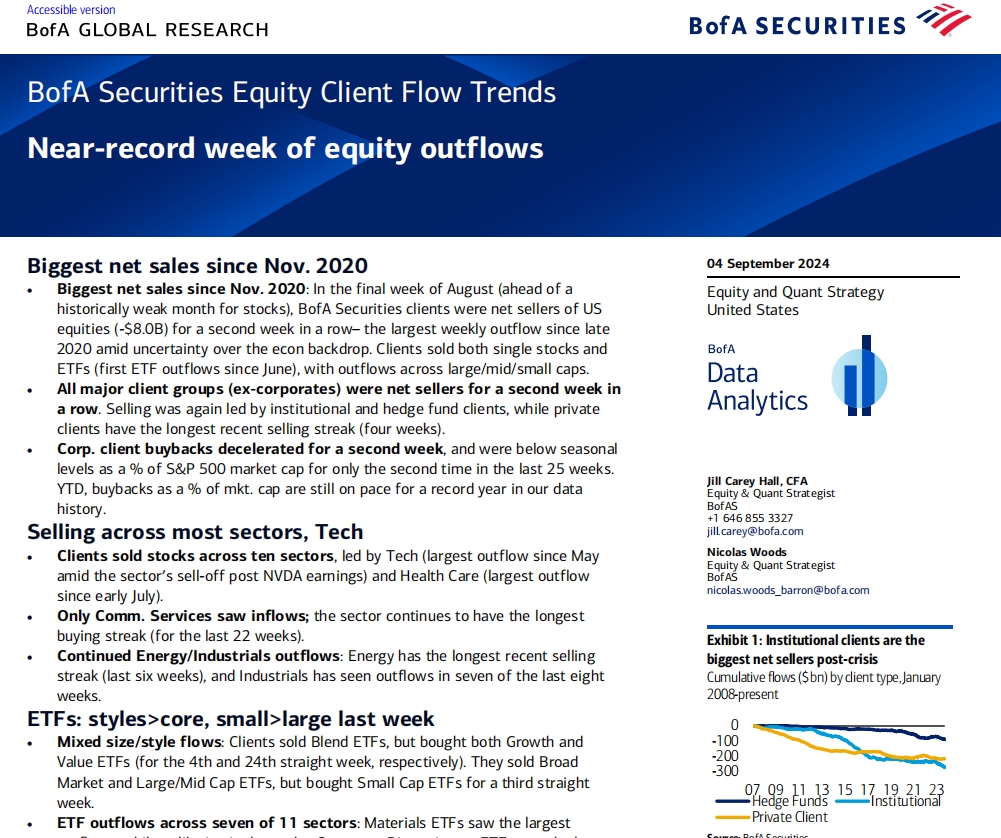

BofA Securities Equity Client Flow Trends Near-record week of equity outflows

Biggest net sales since Nov. 2020• Biggest net sales since Nov. 2020: In the final week of August (ahead of a

海外研报

2024年09月05日

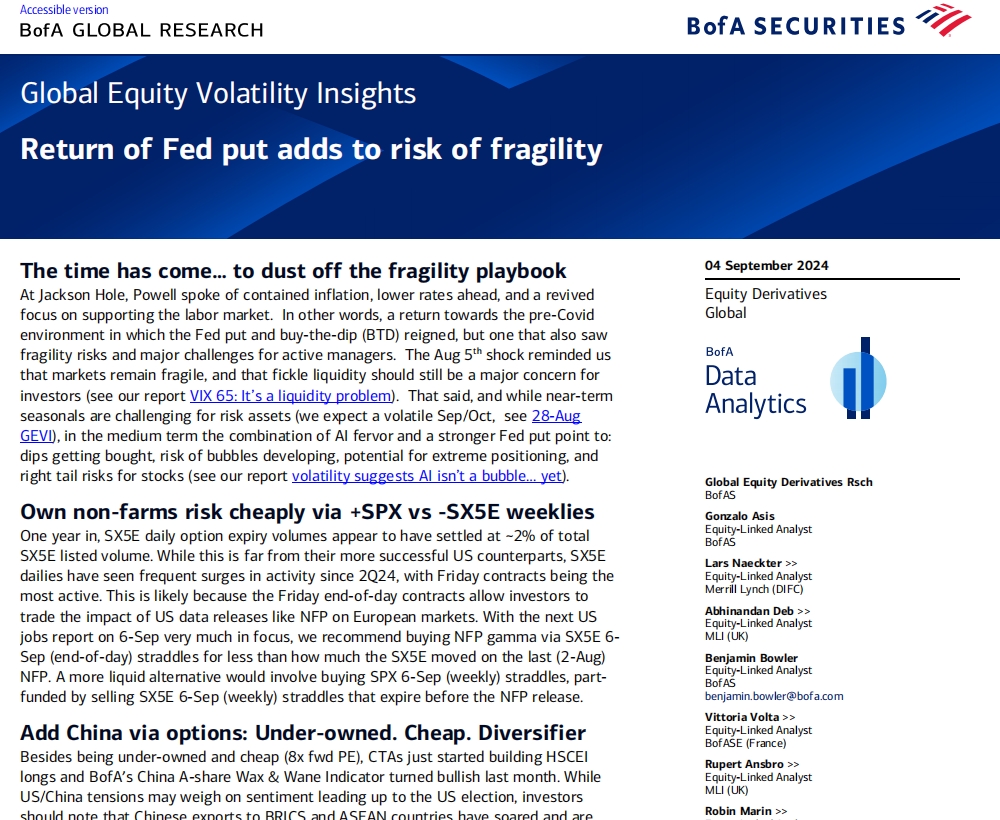

Global Equity Volatility Insights Return of Fed put adds to risk of fragility

The time has come… to dust off the fragility playbookAt Jackson Hole, Powell spoke of contained inflation, lower rates ahead, and a revived

海外研报

2024年09月05日

Capital at risk: nature through an investment lens

As natural resources come under growing strain, we see new risks and opportunities emerging for investors. An

海外研报

2024年09月05日