海外研报

筛选

US SAAR moderates with Europe also soft, STLA US sales continue to decline

US SAAR moderates as incentives remain up - US SAAR was 15.1mn units inAugust, stepping down by -4.4% vs. July and broadly flat YoY at +0.6%. The print

海外研报

2024年09月06日

Credit CallsTuesday, September 03, 2024

Strategy & Sector CommentaryAsia Cross Regional Credit Weekly: Jobs reportand newissue supplyin foeus(Yoshie Fujimoto /Nathaniel Rosenbaum, CFA/Eric Beinstein /Soo Chong Lim)The US HG market tightened last week with the JULIportfolio s.

海外研报

2024年09月06日

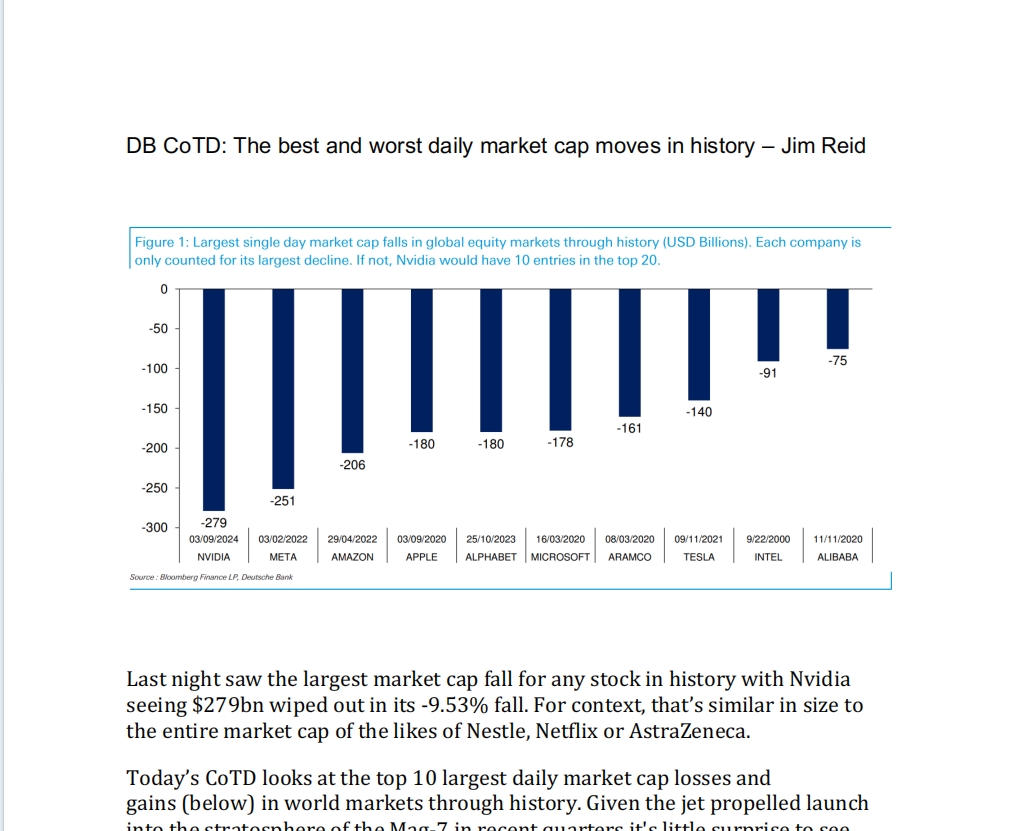

DB CoTD: The best and worst daily market cap moves in history – Jim Reid

Last night saw the largest market cap fall for any stock in history with Nvidia seeing $279bn wiped out in its -9.53% fall. For context, that’s similar in size to

海外研报

2024年09月06日

Potentially Negative Effects of AI on Oil Production Costs and Oil Prices

Energy firms now mention AI more frequently on earnings calls and use AI more nthan the median firm in the economy. The debate on the impact of AI on energy

海外研报

2024年09月06日

DB CoTD: Flat! – Jim Reid

Regular readers will know that I’m a big fan of the predictive power of the yield curve in terms of forecasting the US cycle. However, it’s fair to say that its

海外研报

2024年09月06日

THE CHINA+ ECONOMIC MONITOR

The Caixin manufacturing index continues to outperform the official gauge, but both are at low

海外研报

2024年09月06日

Morning Market Tidbits From one mandate to the other

An end to the sole focus on the inflation mandateFor this inflation forecaster, next week’s CPI report will be bittersweet. After a

海外研报

2024年09月06日

August employment preview: improved from July

We expect nonfarm payrolls to rise by +165k in August, bouncing back somewhat from the soft print of just +114k in July. If our forecast is on

海外研报

2024年09月06日

PositioningInteligence-Monthly chartbook

This material (“Material”) is not a product of J.P. Morgan’s Research Departments and should not be viewed as a research report. The Material is provided by J.P. Morgan’s Prime Finance business for informational purposes

海外研报

2024年09月06日

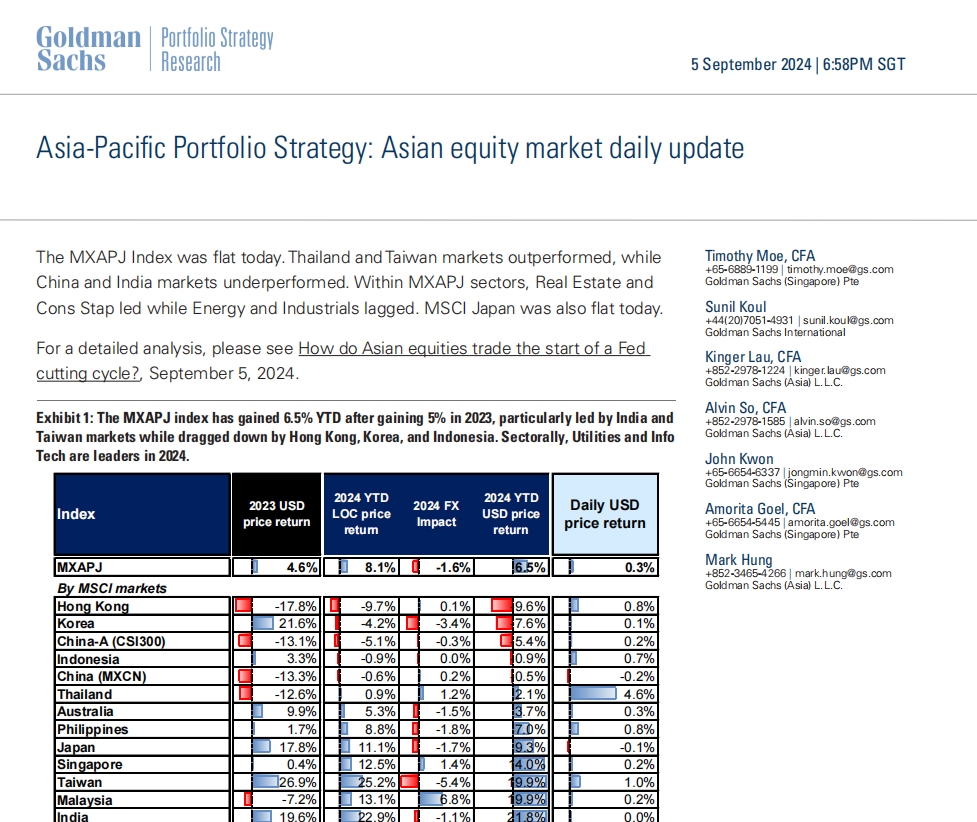

Asia-Pacific Portfolio Strategy: Asian equity market daily update

The MXAPJ Index was flat today. Thailand and Taiwan markets outperformed, while

海外研报

2024年09月06日