海外研报

筛选

Barclays_Global Economics Weekly Easing time has come

Easing time has comeWhile the US jobs report did not bring final clarity on the size

海外研报

2024年09月09日

GS--Asia Credit Trader Still Lacking In Firm Direction After Payrolls

Risk appetite was fairly muted last week across the Asiacredit market, as investors awaited the US August nonfarm

海外研报

2024年09月09日

GD--EARNINGS TRENDS IMPROVING DESPITE SOFTER MACRO DATA

Macro Drivers: The Sahm rule has been triggered, the Perkins rule has not◼ Multi Asset: Investors have added to Nasdaq, UST 30y and Gold longs

海外研报

2024年09月09日

GD-August Employment Data Will Keep Fed At 25 But It Should Not

August employment data continue the portrayal of an economy running out the string, nearing an inflection point.Yes, August was an uptick from June and July, but given the combined 86,000 downward revision to those months,

海外研报

2024年09月09日

FOREIGN INVESTORS SKIP A HIGH GROWTH STORY

Despite India’s relatively fast-paced GDP growth and stable macroeconomic parameters, foreign investment has been lacking in terms of both long-term FDI as well as short-term FII

海外研报

2024年09月06日

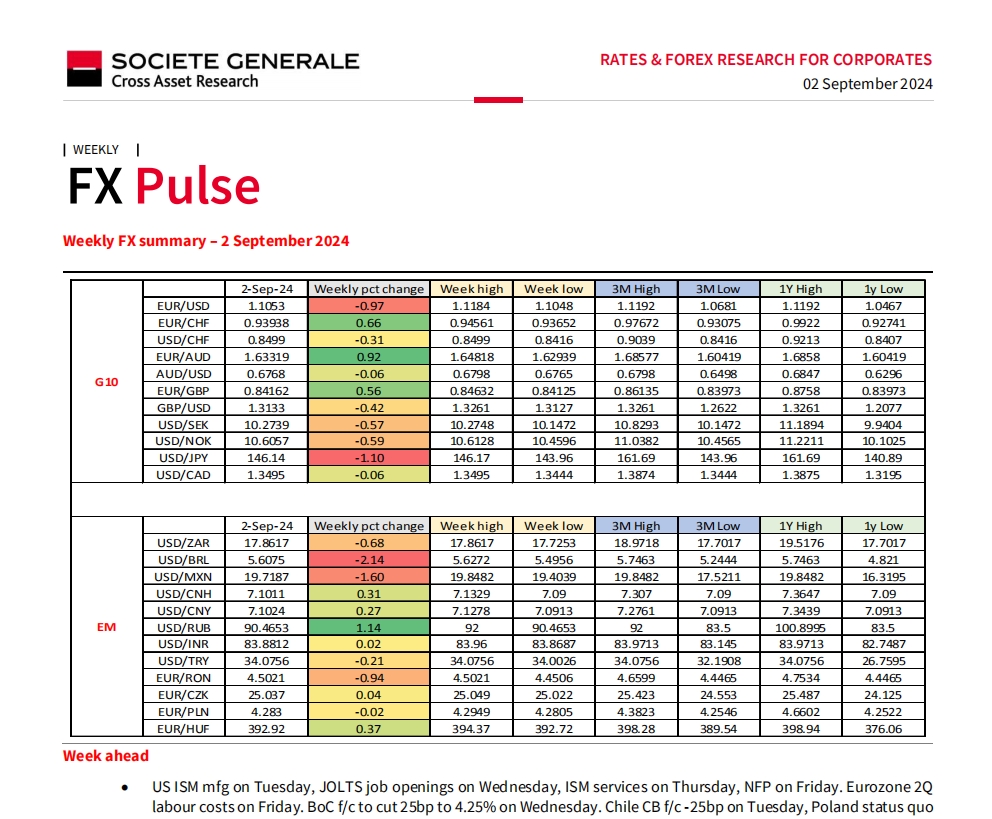

The Harris Bounce 011

With Kamala Harris on top of the Democratic ticket, the odds for the Democrats have dramatically improved. After weeks of media hype and her nomination at the Democratic

海外研报

2024年09月06日

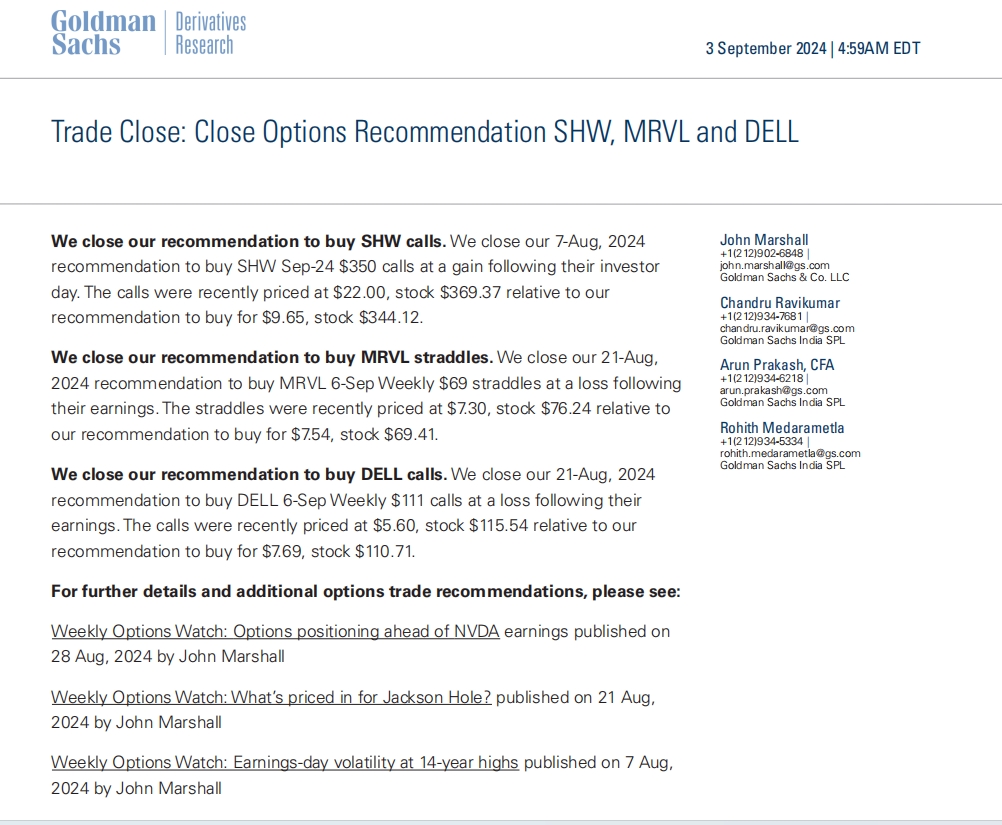

Trade Close: Close Options Recommendation SHW, MRVL and DELL

We close our recommendation to buy SHW calls. We close our 7-Aug, 2024

海外研报

2024年09月06日

BULL MARKET CRACKING?

Markets have rebounded sharply after the vol spike in early August and the equal weight S&P 500 had marked a new all-time high. Our pro risk trades have paid off, with the longs on the equal

海外研报

2024年09月06日

he Election and the Economy

We discuss likely changes to trade, immigration, and fiscal policy under each npossible election outcome and estimate the effects on inflation, labor force

海外研报

2024年09月06日