海外研报

筛选

BofA_Macro Risk Digest So it begins_20240913

We estimate corporates in Europe and Asia collectively held around $1trn of FX deposits in 1Q 2024. An unwind could amplify USD depreciation, although more likely over the

海外研报

2024年09月15日

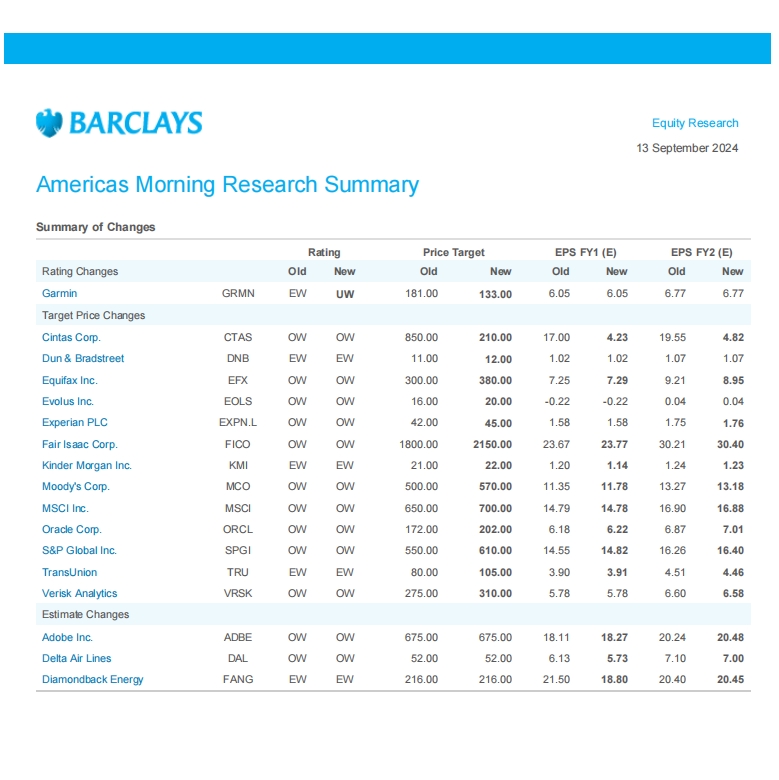

Barclays--Americas Morning Research Summary_20240913

This summary is compiled from research reports previously published by Barclays Equity Research. A full list of all publications is available on

海外研报

2024年09月15日

Asia--Macro_Weekly_Asia_local_markets_resilience_to_be_tested

The Fed is widely expected to begin its monetary easing next week. Amid divided views on the size and pace of US monetary easing, we expect three

海外研报

2024年09月15日

Start Small or Begin Big?

attempted to look past recession fears, while the European Central Bank cut rates by25bps in its September meeting. The ECB in particular left its policy guidance for rate

海外研报

2024年09月15日

GD--EARNINGS TRENDS IMPROVING DESPITE SOFTER MACRO DATA

Macro Drivers: The Sahm rule has been triggered, the Perkins rule has not◼ Multi Asset: Investors have added to Nasdaq, UST 30y and Gold longs

海外研报

2024年09月09日

U.S. Desk Strategy CB Views: Jackson Hole Recap

With the clock ticking, the time has come for Fed cuts Powell said “The time has come for policy to adjust” (towards lower rates)…

海外研报

2024年08月26日

Yen Carry And AI Bubble: One And The Same Trade

The analysis of price complexity strongly suggests that the ‘yen carry trade’ and the AI bubble are one and the same trade, premised on three conditions:

海外研报

2024年08月15日

Abrupt Cut To Underweight

Aggregateequitypositioningplungedthis week, falling from a mid-Julypeakat the top ofthe historical range (z score 1.00, 97th percentile) to belowaverage orunderweight (z score -0,26, 31st percentile). This marked one ofthe steepest declines in recent

海外研报

2024年08月12日

Cross-Asset Weekly

The financial market turbulences this week have highlighted that (1) macro risks are shifting from inflation to growth, (2) carry trades are vulnerable to sharp reversals in late cycle ear.

海外研报

2024年08月12日

MSFT Partner Survey; SMiD Internet; APPF, CFLT, QCOM, TENB, VRNS, XRX

The current market rotation appears to be in its final stages. Today, the market saw outperformance in Growth(.PGPURE) and Quality (.JPOPURE) sectors, indicating that the rotation is nearing its end. This rotation is primarilydriven by crowding

海外研报

2024年07月30日