海外研报

筛选

Latam Equity Quant Ibov awaits triggers to keep rallying

Key takeaways• Domestic industries in Brazil are trading at 9% discount vs historical (vs 19% disc. two

海外研报

2024年08月31日

Global FX weekly What’s next for the USD?

The viewBearish USD but balanced risks near term due to valuation, crowded front-end longs,

海外研报

2024年08月31日

Follow The Flow Non stop inflows despite summer lull

Demand for IG over gov’t debt persistsThe need for yield remains a key driver in fixed income space. For another week flows

海外研报

2024年08月31日

Automotive Industry Weekly automotive pit stop

Valuation update – Pages 9-13We believe the accompanying valuation framework is one of the most important

海外研报

2024年08月31日

Active managers’ holdings update What are your neighbors doing?

2Q trades: LOs bought Comm. Svcs., sold cyclicalsOver the last quarter, long-only funds (LOs) increased their relative weight in

海外研报

2024年08月31日

The Flow Show The last private hire

Scores on the Doors: gold 22.4%, stocks 15.4%, crypto 14.3%, HY bonds 6.8%, oil 5.9%, commodities 4.0%, IG bonds 3.8%, cash 3.5%, govt bonds 0.7%, US$ 0.0% YTD.

海外研报

2024年08月31日

Equity Strategy Market Review

Barclays Capital Inc. and/or one of its affiliates does and seeks to do business with companies covered in its research reports. As a result, investors should be

海外研报

2024年08月31日

Australian Macro Weekly

Nothing to concern the RBA in the monthly CPI We saw nothing in the July CPI indicator that will affect the RBA’s thinking for

海外研报

2024年08月31日

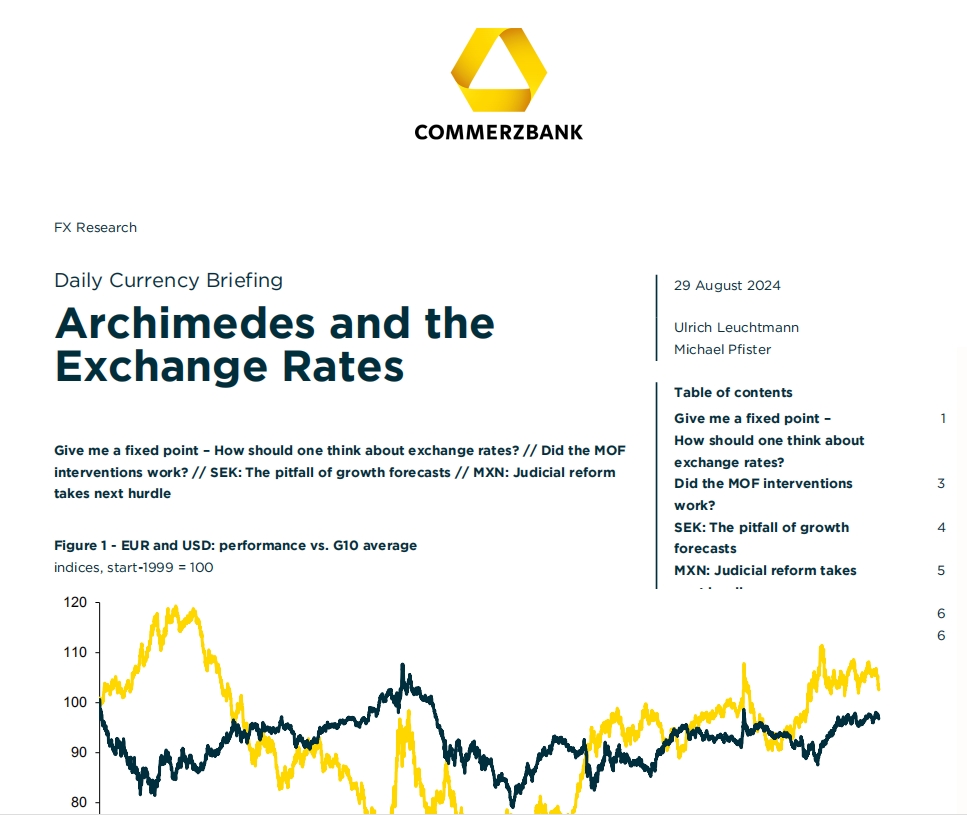

Archimedes and the Exchange Rates

to see. All that we have are exchange rates. And you can't tell from them whether theyfluctuate because the value of one currency changes or that of the other.

海外研报

2024年08月31日

Euro Area: Core Inflation Close to Expectations

BOTTOM LINE: In the flash release for August, core HICP inflation fell marginally to2.84%yoy, while headline HICP decreased 40bp to 2.18%yoy, both in line with

海外研报

2024年08月31日