海外研报

筛选

August 2024 Performance Review

August was an incredibly tumultuous month in financial markets, with the VIX index of volatility briefly spiking to levels last seen in March 2020 during the Covid-

海外研报

2024年09月03日

The Point for Asia Pacific Monday, 02 September 2024

China Banks - Worse-than-expected existing mortgage rate cut incoming; banks w/ high mortgage exposure more vulnerable

海外研报

2024年09月03日

Banks & foreign investors buy while CTA demand peaking

Buying aboundsRecent weeks have seen buying flow from CTAs, investment funds, asset managers, banks, and even foreign investors. The bid for duration appears to be quite strong. While

海外研报

2024年09月03日

US Week Ahead: September 2 - September 8

The key economic data releases this week are the ISM manufacturing index onTuesday, the JOLTS job openings report on Wednesday, and the employment report

海外研报

2024年09月02日

Precious Metals Trading Desk View

This publication was prepared by Bank J Safra Sarasin (BJSS) Trading department. The views or ideas expressed herein are those of the desk and/or the author only. The publication cannot be considered as investment research or a

海外研报

2024年09月02日

Back to Congress

Brazil's 2025 budget heading to Congress; the 2Q24 GDP report also in the spotlight. Banxico stresses growth concerns (Chart of

海外研报

2024年09月02日

Happy "Labor" Day

The sharp correction in stocks in July/early August was due to several factors, with the most important one being softer-than-expected economic growth data that

海外研报

2024年09月02日

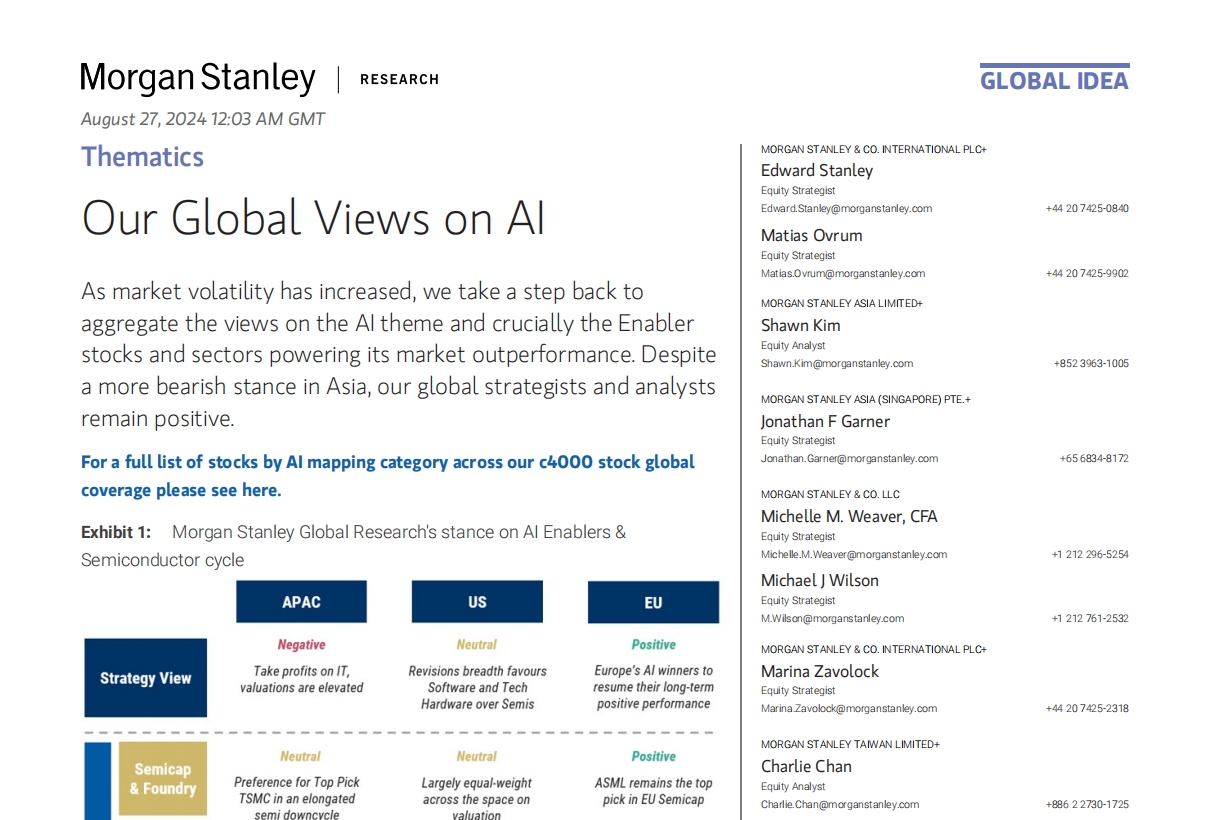

Our Global Views on AI

As market volatility has increased, we take a step back to aggregate the views on the AI theme and crucially the Enabler

海外研报

2024年09月02日

Cycle Playbook – Preparing for a Peak

Amid the excitement around AI, we must not lose sight of the cyclical nature of semiconductors and tech hardware. As we approach a cycle peak, we share our insights on navigating the transition.

海外研报

2024年09月02日

It’s About Labor Markets Now

The Fed is shifting focus toward the labor market. Because we expect slowing but no slump, we think the Fed resets policy

海外研报

2024年09月02日