海外研报

筛选

Oil Tracker: Upside Risks to Non-OPEC Supply From Company Data

The Brent crude price hit a new year-to-date low on Tuesday as Libya oil productionmay recover sooner given a reportedly nearing potential truce and as commodity,

海外研报

2024年09月05日

Nonfarm payroll in focus

Markets will focus on the August employment report this Friday as a key data point

海外研报

2024年09月05日

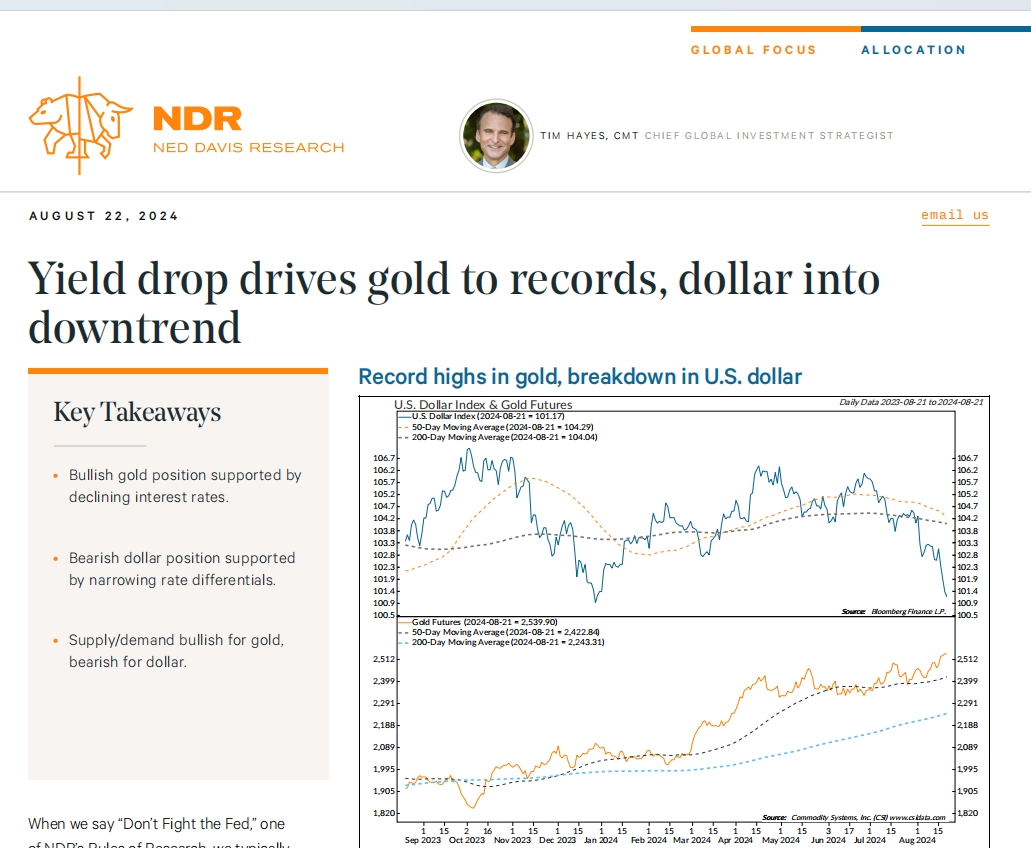

Yield drop drives gold to records, dollar into downtrend

When we say “Don’t Fight the Fed,” one of NDR’s Rules of Research, we typically

海外研报

2024年09月05日

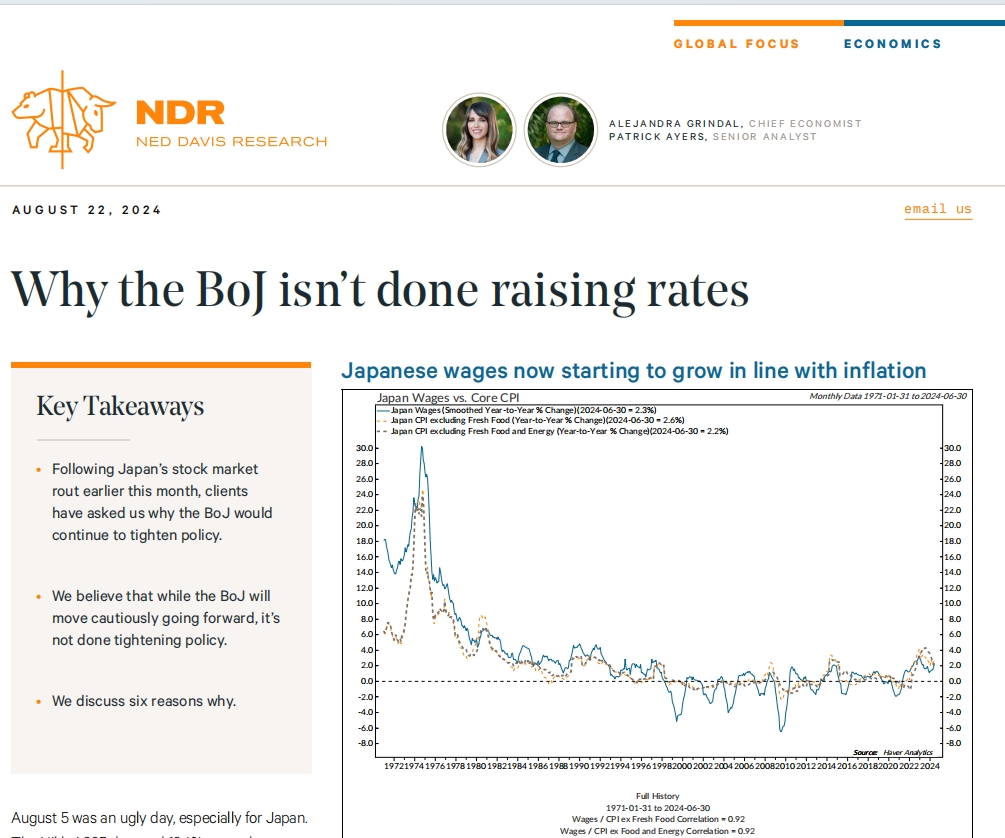

Why the BoJ isn’t done raising rates

August 5 was an ugly day, especially for Japan. The Nikkei 225 dropped 12.4%, more than any

海外研报

2024年09月05日

When do equity investors need to worry about a recession?

Chicken and eggRecession fears have been at the forefront of investors’ minds for nearly three years.

海外研报

2024年09月05日

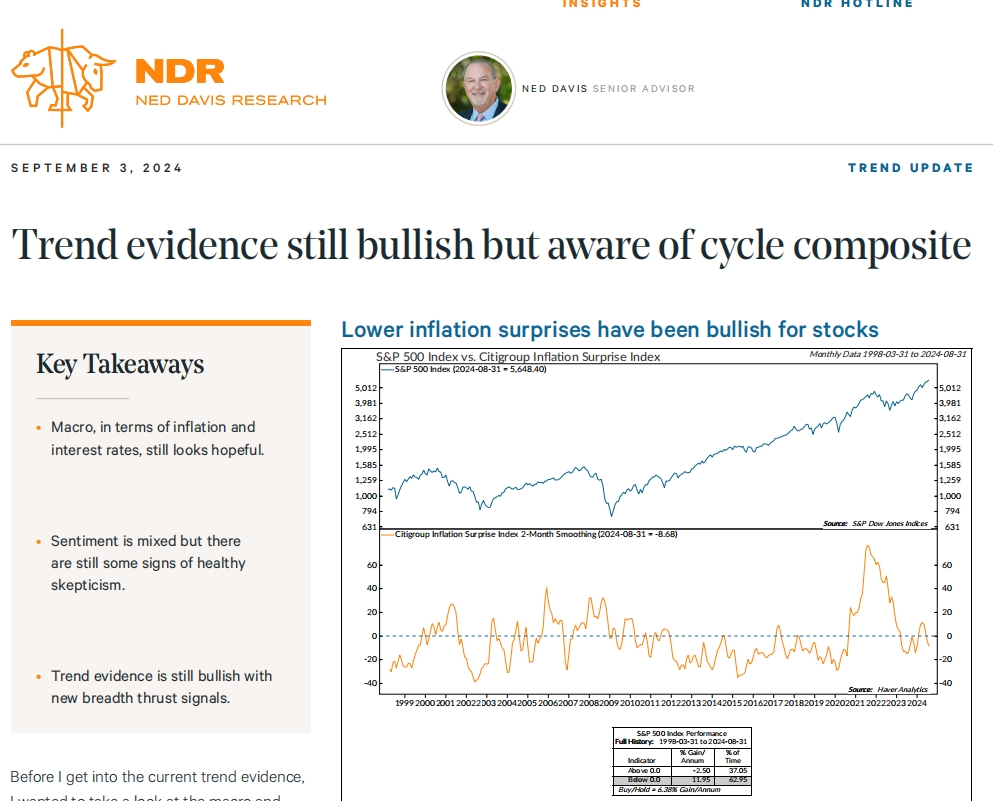

Trend evidence still bullish but aware of cycle composite

Before I get into the current trend evidence, I wanted to take a look at the macro and

海外研报

2024年09月05日

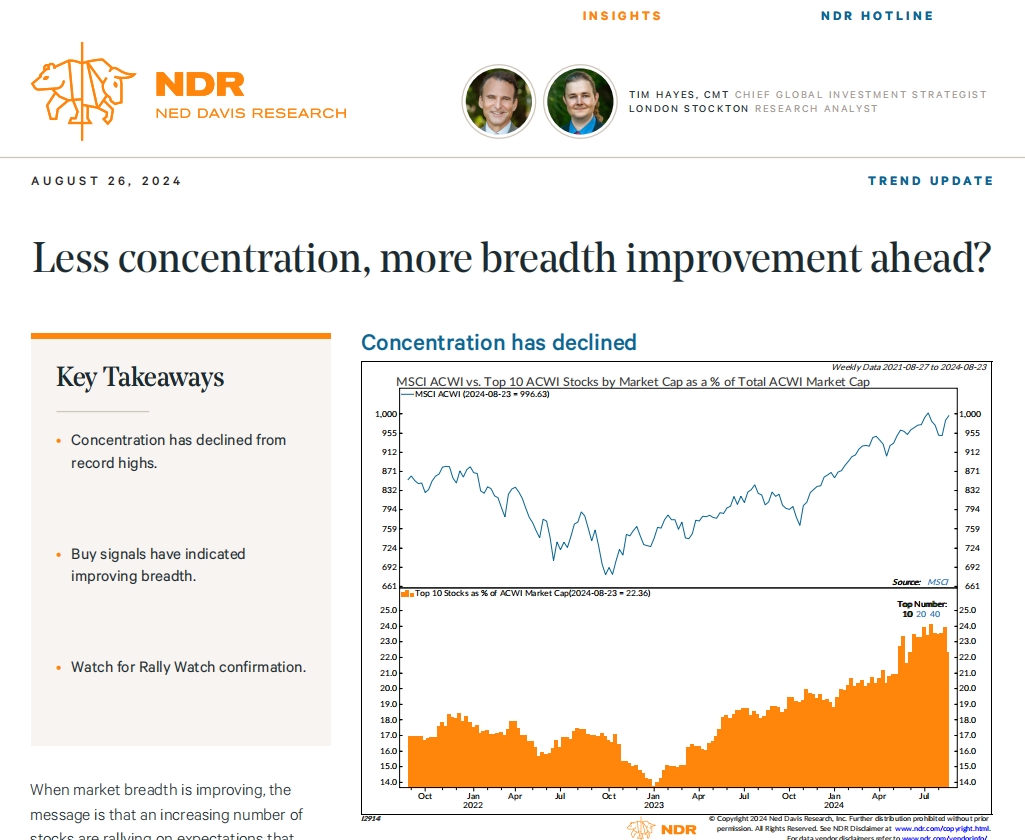

Less concentration, more breadth improvement ahead?

When market breadth is improving, the message is that an increasing number of

海外研报

2024年09月05日

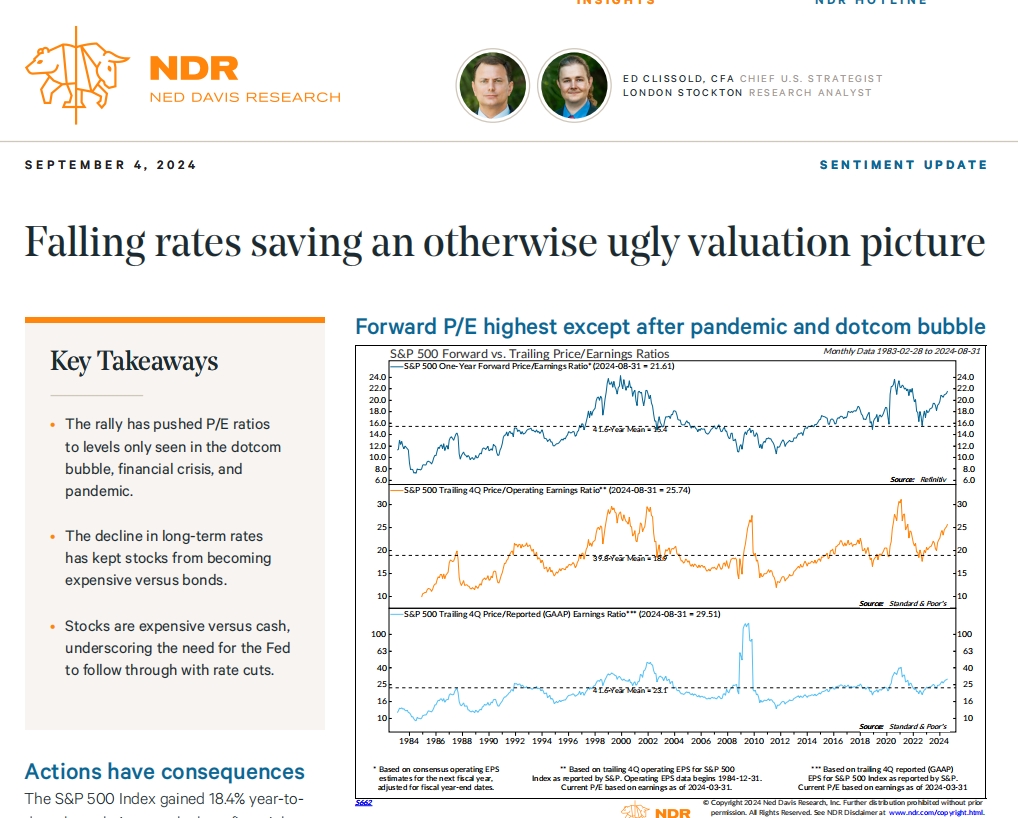

Falling rates saving an otherwise ugly valuation picture

Actions have consequencesThe S&P 500 Index gained 18.4% year-todate through August, the best first eight months of the year since 2021, the secondbest this century, and the 12th best since

海外研报

2024年09月05日

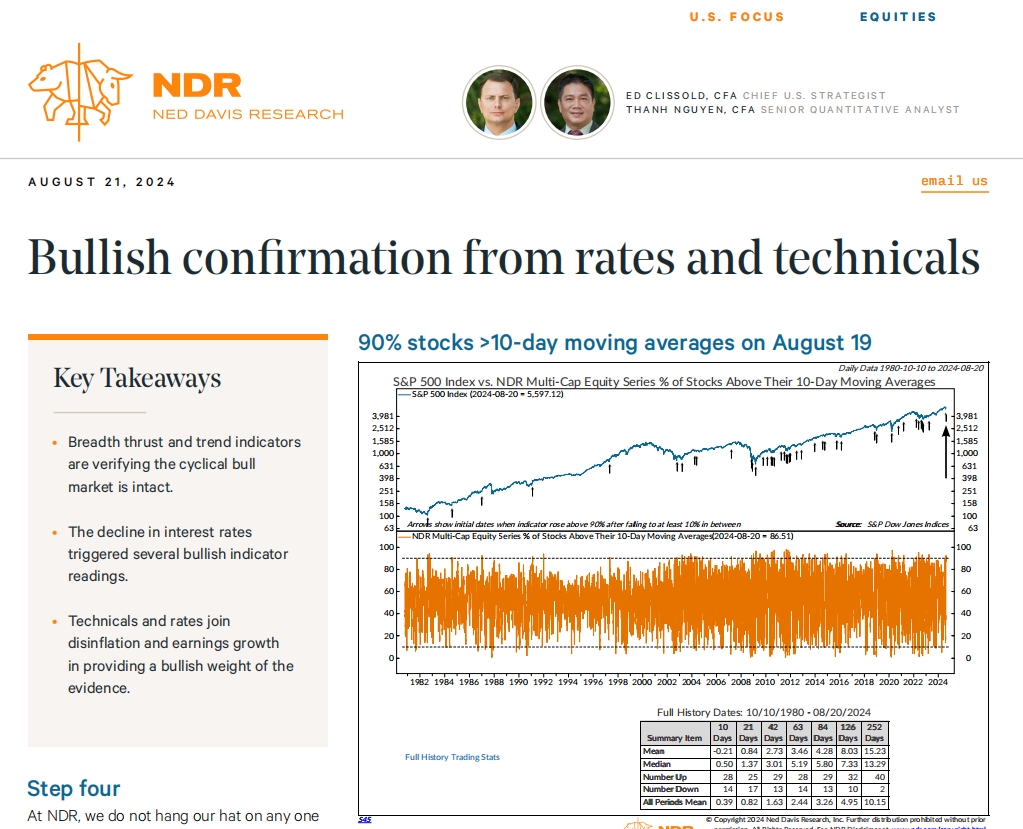

Bullish confirmation from rates and technicals

At NDR, we do not hang our hat on any one indicator. We find a mosaic approach of

海外研报

2024年09月05日

Weekly Warm-up: Happy "Labor" Day

Mixed Signals...The correction in stocks in July/early August was due to several factors, with the most important one being softer-than-expected

海外研报

2024年09月05日