海外研报

筛选

Dollar Tree Stores Inc. (DLTR): First Take: 2Q miss; FY guidance lowered

DLTR reported 2Q adj EPS of $0.67, below the GS estimate of $1.07 and consensus(Refinitiv) of $1.04. Consolidated SSS of +0.7% was below GS/consensus at

海外研报

2024年09月05日

The Global Point Wednesday, 04 September 2024

Global Multi-Asset - Industrial Technology & Mobility: How disruptive forces are driving the M&A landscape in Industrials; Focus on Germany

海外研报

2024年09月05日

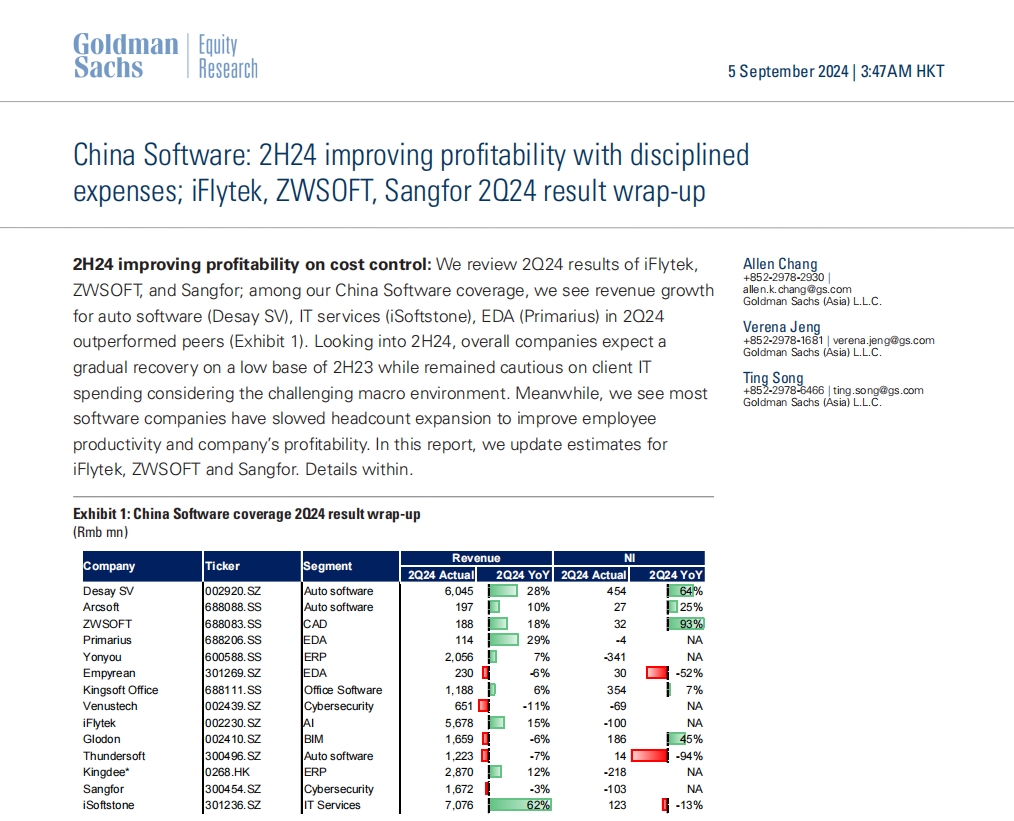

China Software: 2H24 improving profitability with disciplined expenses; iFlytek, ZWSOFT,

2H24 improving profitability on cost control: We review 2Q24 results of iFlytek,ZWSOFT, and Sangfor; among our China Software coverage, we see revenue growth

海外研报

2024年09月05日

BofA Securities Equity Client Flow Trends Near-record week of equity outflows

Biggest net sales since Nov. 2020• Biggest net sales since Nov. 2020: In the final week of August (ahead of a

海外研报

2024年09月05日

Global Equity Volatility Insights Return of Fed put adds to risk of fragility

The time has come… to dust off the fragility playbookAt Jackson Hole, Powell spoke of contained inflation, lower rates ahead, and a revived

海外研报

2024年09月05日

Capital at risk: nature through an investment lens

As natural resources come under growing strain, we see new risks and opportunities emerging for investors. An

海外研报

2024年09月05日

How do Asian equities trade the start of a Fed cutting cycle?

Post-Fed cut performance hinges on the growth backdrop: While performancefollowing the first Fed cut has varied widely, the MXAPJ median performance has

海外研报

2024年09月05日

nterest Rate Cuts; Analysis Shows Transports Fare Well

Bottom Line: As the probability that a rate cut comes more into view at theSeptember Fed meeting, we wanted to refresh our analysis on share price

海外研报

2024年09月05日

Investment Banking Monitor: Some improvement in M&A and DCM, but weaker ECM

Announced August investment banking activity levelsrose 9% YoY and were only 2% below average August

海外研报

2024年09月05日

TOP 5 CLIENT QUESTIONS

Is the US in recession or will it be in the next 12 months? Recession probably hasn’t started yet. The economy is entering a soft patch but the Fed will now begin cutting every

海外研报

2024年09月05日