海外研报

筛选

DB CoTD: Flat! – Jim Reid

Regular readers will know that I’m a big fan of the predictive power of the yield curve in terms of forecasting the US cycle. However, it’s fair to say that its

海外研报

2024年09月06日

THE CHINA+ ECONOMIC MONITOR

The Caixin manufacturing index continues to outperform the official gauge, but both are at low

海外研报

2024年09月06日

Morning Market Tidbits From one mandate to the other

An end to the sole focus on the inflation mandateFor this inflation forecaster, next week’s CPI report will be bittersweet. After a

海外研报

2024年09月06日

August employment preview: improved from July

We expect nonfarm payrolls to rise by +165k in August, bouncing back somewhat from the soft print of just +114k in July. If our forecast is on

海外研报

2024年09月06日

PositioningInteligence-Monthly chartbook

This material (“Material”) is not a product of J.P. Morgan’s Research Departments and should not be viewed as a research report. The Material is provided by J.P. Morgan’s Prime Finance business for informational purposes

海外研报

2024年09月06日

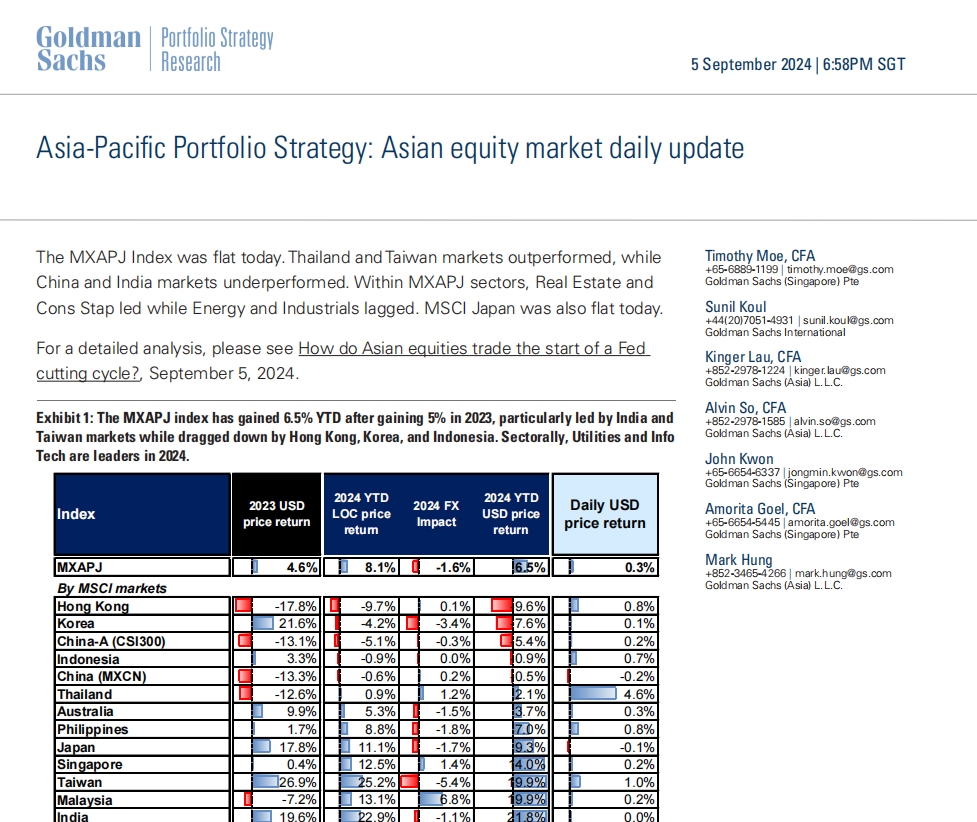

Asia-Pacific Portfolio Strategy: Asian equity market daily update

The MXAPJ Index was flat today. Thailand and Taiwan markets outperformed, while

海外研报

2024年09月06日

Asia-Pacific Growth Monitor: Steady overall, SE Asia outperforming

This publication summarizes regional and country-specific growth data across nthe Asia-Pacific economies we cover. In most cases, the latest data points arefor August 2024.

海外研报

2024年09月06日

Research Unplugged: European Conviction List - Directors’ Cut: September Spotlight

Goldman Sachs does and seeks to do business with companies covered in its research reports. As a result,investors should be aware that the firm may have a conflict of interest that could affect the objectivity of this

海外研报

2024年09月06日

A more dovish ECB on inflation?

Last time, in June, the ECB surprised markets with significant upward revisions onthe inflation path while cutting its rates. This time, we expect the second rate cut

海外研报

2024年09月06日

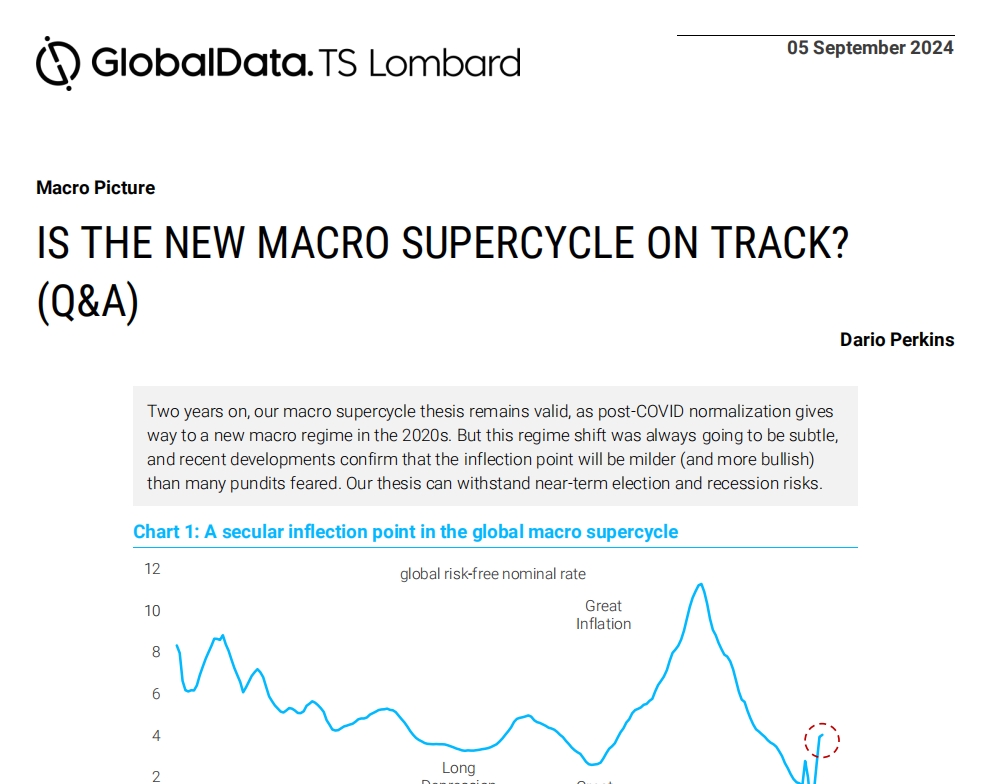

IS THE NEW MACRO SUPERCYCLE ON TRACK?

Two years on, our macro supercycle thesis remains valid, as post-COVID normalization gives way to a new macro regime in the 2020s. But this regime shift was always going to be subtle,

海外研报

2024年09月06日