海外研报

筛选

GS Healthcare: Back-to-School Kickstart

Performance, Valuations, Revisions. On the year, HC is still middle-of-the-pack n(+15% vs SPX +19%) albeit with improved performance in the first two months

海外研报

2024年09月06日

GS UK Today: AI | Encore: Buy AstraZeneca, Wise

AI – to buy, or not to buy – The technology sector has generated 32% of the Global

海外研报

2024年09月06日

HFs Sellers of N. Am Equities Despite Market Breadth Improving

Volumes remained lower ahead of the holiday weekend, however the market posted notable signs of improving breadth as the equal

海外研报

2024年09月06日

Telecom KPIs: Mobile ARPU bottoming out, but competition for subscribers intensifying

Mobile service revenue at the three major MNOs (NTT DoCoMo, KDDI, and nSoftbank) in April-June 2024 totaled ¥1,383.9 bn (-0.4% yoy/-¥4.9 bn yoy).

海外研报

2024年09月06日

AI: To buy, or not to buy, that is the question

The technology sector has generated 32% of the Global equity return and40% of the US equity market return since 2010. This has reflected

海外研报

2024年09月06日

Global Retail Conference 2024 — Day 1 Takeaways

Day 1 of our 31st Annual Global Retailing Conference revealed a better-than-fearedand cautiously optimistic tone on the outlook for the consumer into 2H. This slightly

海外研报

2024年09月06日

US SAAR moderates with Europe also soft, STLA US sales continue to decline

US SAAR moderates as incentives remain up - US SAAR was 15.1mn units inAugust, stepping down by -4.4% vs. July and broadly flat YoY at +0.6%. The print

海外研报

2024年09月06日

Credit CallsTuesday, September 03, 2024

Strategy & Sector CommentaryAsia Cross Regional Credit Weekly: Jobs reportand newissue supplyin foeus(Yoshie Fujimoto /Nathaniel Rosenbaum, CFA/Eric Beinstein /Soo Chong Lim)The US HG market tightened last week with the JULIportfolio s.

海外研报

2024年09月06日

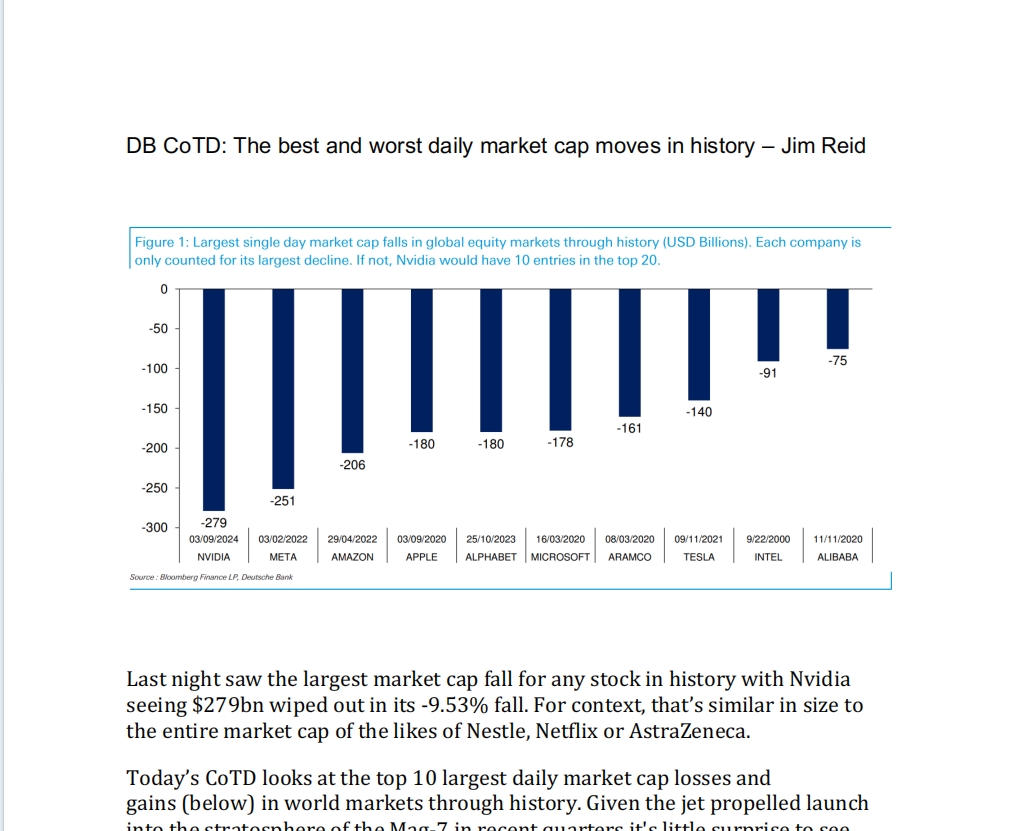

DB CoTD: The best and worst daily market cap moves in history – Jim Reid

Last night saw the largest market cap fall for any stock in history with Nvidia seeing $279bn wiped out in its -9.53% fall. For context, that’s similar in size to

海外研报

2024年09月06日

Potentially Negative Effects of AI on Oil Production Costs and Oil Prices

Energy firms now mention AI more frequently on earnings calls and use AI more nthan the median firm in the economy. The debate on the impact of AI on energy

海外研报

2024年09月06日