海外研报

筛选

US_Inflation_Monthly_August_CPI_preview

We expect core Consumer Price Index (CPI) inflation to have risen 0.21% m/m and headline CPI inflation to rise by 0.13% in August. In year-on-year terms,

海外研报

2024年09月10日

CR--Market comments

Friday’s US payrolls report was supposed to settle the question of whether the Fed would be cutting by 25bps next week, or 50. On Thursday of last week the OIS futures had 33.8bps of cuts

海外研报

2024年09月10日

US Week Ahead_ September 9 – September 15

The key economic data releases this week are the CPI report on Wednesday and theUniversity of Michigan report on Friday. Fed officials are not expected to comment

海外研报

2024年09月10日

BNPP_GLOBAL OUTLOOK Q4 2024 CUTTING IT FINE

Central bank easing in the US and across most developed markets will helpstabilise growth in what we would continue to characterise as a soft landing.

海外研报

2024年09月10日

US Autos & Industrial Tech_ 2024 Communacopia + Technology conference preview

We will host fireside chats and/or small group meetings with 12 companies (RIVN, F,TSLA, APTV, MBLY, AUR, SYM, CHPT, ST, KEYS, FLEX and VRT) at the Goldman

海外研报

2024年09月10日

Barclays_Barclays Equity Factor Insights_ September

We maintain Positive view on Growth and Negative view onValue across both regions, despite the recent weakness in US

海外研报

2024年09月10日

UBS - Rebecca Cheong - I am turning tactically bearish next 2 months (at least -10%) – IWM,

Over the last two weeks, market internal has deteriorated to be the worst YTD. Current condition is also the most vulnerable in 6 years – which means any small

海外研报

2024年09月10日

Barclays - Global Rates Weekly_ Decision time

In the US, strength in income and underlying activity suggeststhat neutral is higher than currently priced in. We recommend

海外研报

2024年09月10日

Curvature Securities, LLC September 3, 2024

The SEC dropped a bomb on the market back in 2022. They proposed mandating central clearing in the U.S. Treasury market. The goal was to make the market more secure during times of stress. All

海外研报

2024年09月10日

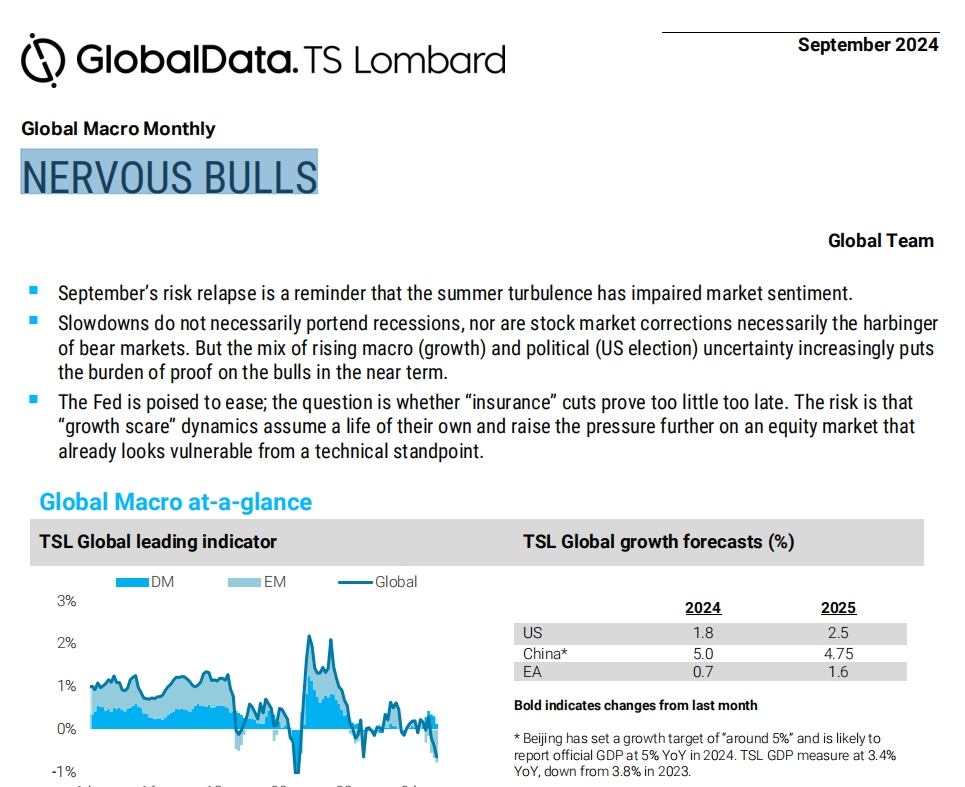

GD--NERVOUS BULLS

September’s risk relapse is a reminder that the summer turbulence has impaired market sentiment. ▪ Slowdowns do not necessarily portend recessions, nor are stock market corrections necessarily the harbinger

海外研报

2024年09月10日