海外研报

筛选

SocGen - On Our Minds - BoE preview – on hold and a further £100bn QT envelope

August’s narrow vote in favour of a cut, with some members who voted for the cut describing the decision as “finely balanced”, implies that the MPC will proceed

海外研报

2024年09月16日

GS-- Communacopia + Technology Conference 2024 — Key Takeaways05

Presenter(s): We hosted Twilio’s CEO Khozema Shipchandler as part of ourCommunacopia + Technology conference.

海外研报

2024年09月16日

GS--European Conviction List - Directors’ Cut September 13, 2024 Update

We remove DSV from the Conviction List. DSV was on the list for 195 days,delivering a total return of 25.0% and a relative return to the SXXP of +19.3% (as of

海外研报

2024年09月15日

GS--Foreign selling led by Korea and Taiwan; India domestic funds saw strong

Foreign (FII) flows / positioningn EM Asian ex-China region saw selling (-US$1.9bn) this

海外研报

2024年09月15日

BofA--Stock Flash Bullish AVGO, LOW, PLTR and ROST. Bearish FERG and SCHW_20240912

Broadcom (AVGO): Bullish triangle breakout watchAVGO is a semiconductor devices stock that is on bullish triangle breakout watch. A

海外研报

2024年09月15日

BofA--Global FX Weekly Powell s victory lap- Draghi s frustration_20240913

G10. US soft landing and Fed still main market drivers. Draghi shows the way in Europe. EM. More conservative Fed pricing to weight on EM FX.

海外研报

2024年09月15日

BofA - Hartnett - The Flow Show 3B Bulls_20240912

Scores on the Doors: gold 21.6%, stocks 13.6%, crypto 9.1%, HY bonds 6.9%, IG bonds 4.8%, cash 3.7%, govt bonds 2.2%, US dollar 0.3%, commodities -2.0%, oil -6.1% YTD.

海外研报

2024年09月15日

GS--What’s Powering Your Services Recap - 9/13/24

This week in Business & Information Services, we had a number of companiespresent at our 2024 Communacopia + Technology Conference in San Francisco,

海外研报

2024年09月15日

GS--AEJ Week Ahead: China August activity data; CBC and BI meetings

growth to decline to 4.3% yoy in August from 5.1% yoy in July, in line withsofter NBS manufacturing PMI and wider year-on-year contraction in steel

海外研报

2024年09月15日

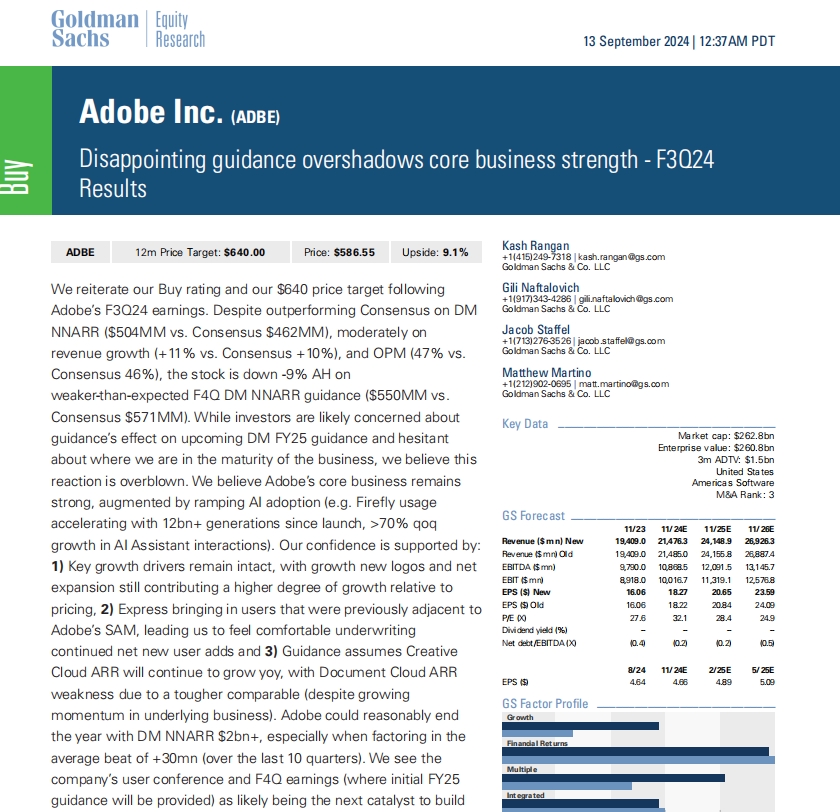

GS--Disappointing guidance overshadows core business strength - F3Q24 Results

We reiterate our Buy rating and our $640 price target followingAdobe’s F3Q24 earnings. Despite outperforming Consensus on DM

海外研报

2024年09月15日