海外研报

筛选

Higher Than Expected Headline IPCA in July, Firmer Core-Services Momentum

Bottom line: The July IPCA printed at 0.38%, slightly above consensus, mostlydriven by higher-than-expected transportation due to rising gasoline prices and airline

海外研报

2024年08月10日

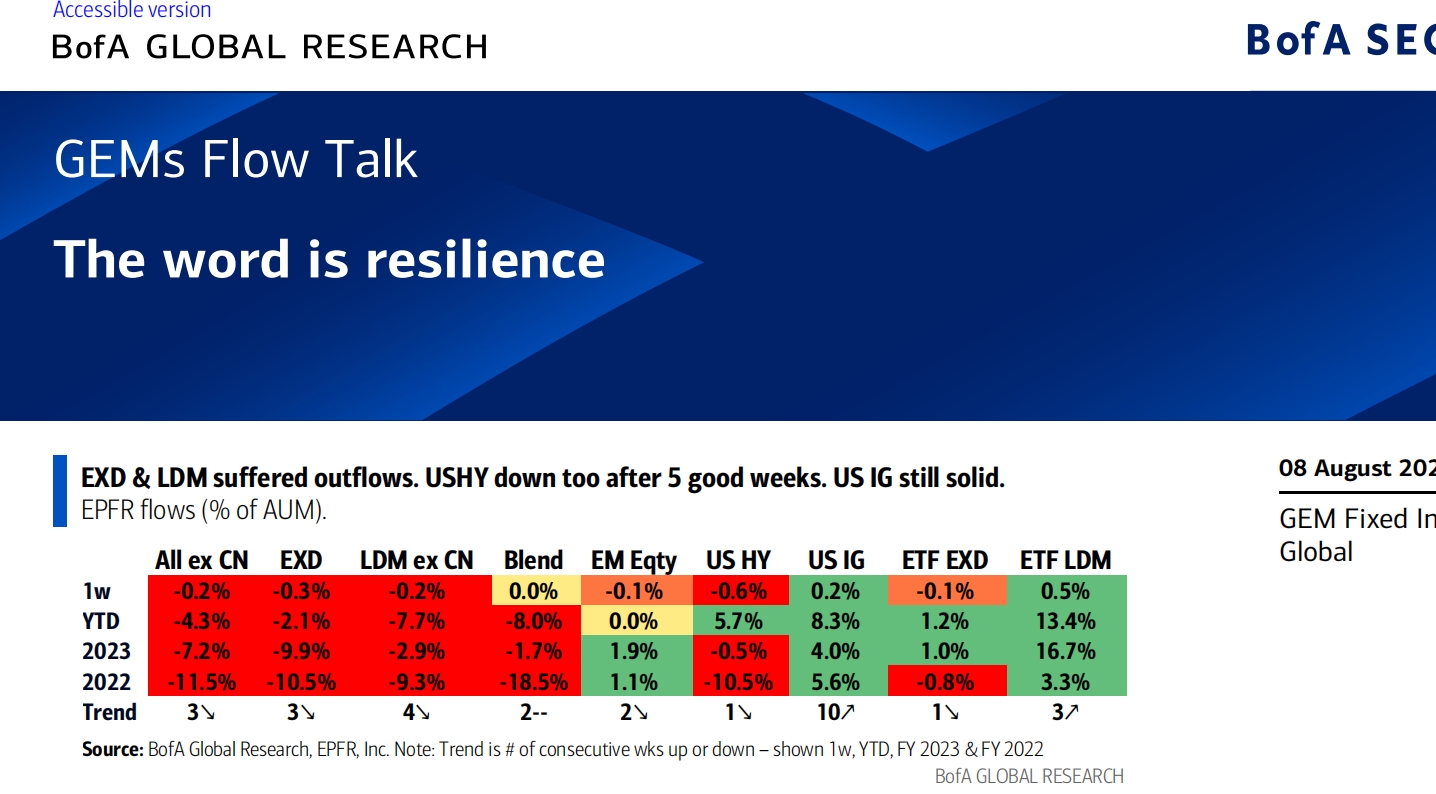

GEMs Flow Talk The word is resilience

Leverage: Credit markets held in well and support our view that there is little if any leverage in public credit markets. EM and DM spreads held in surprisingly well and

海外研报

2024年08月10日

THE UK ECONOMIC MONITOR

July PAYE employment should gain 30K month-tomonth, while the June jobless rate rises to 4.5%.

海外研报

2024年08月10日

Some relief, however the risks still remain

The market began the week with a broad-based risk-off sentiment on Monday, and the continued carry trade unwinding pushed the USD/JPY and USD/CNY

海外研报

2024年08月10日

US July CPI preview: Further easing

We expect US core CPI to extend its recent run of favorable prints with a 0.19% m/m gain in July (report released on 14 August). • We see risks as roughly balanced and pertaining to shelter, with

海外研报

2024年08月10日

Municipals Weekly Muni rates to ride rogue wave lower

A rogue wave event starts the rigorous phase of rallyThe three-day event of equity and bond market moves post FOMC meeting exhibit all

海外研报

2024年08月10日

Market Intelligence: US Morning Update

Stocks in Asia closed higher Friday, ending a relatively volatile week on a calm note.South Korea and Taiwan outperformed, with tech stocks advancing on the back of

海外研报

2024年08月10日

Decompression Creates Opportunities in Asia HY

The path of Asia credit spreads followed the macro marketsover the past week, with spreads under pressure at the start

海外研报

2024年08月10日

Initial claims see more normalization

Initial jobless claims declined last week, driven in part byoutsized drops in Michigan and Texas. Last week's reading of

海外研报

2024年08月10日