海外研报

筛选

Global Rates Trader Risk Relaxation

Last week’s labor market surprise gave way to broader market tremors as the weekbegan, but relatively benign data out of the US appears to have helped calm rates

海外研报

2024年08月10日

End of Week Market Intelligence: flattish

what’s in a friday?A week after last Friday’s July unemployment report raised concerns about the US

海外研报

2024年08月10日

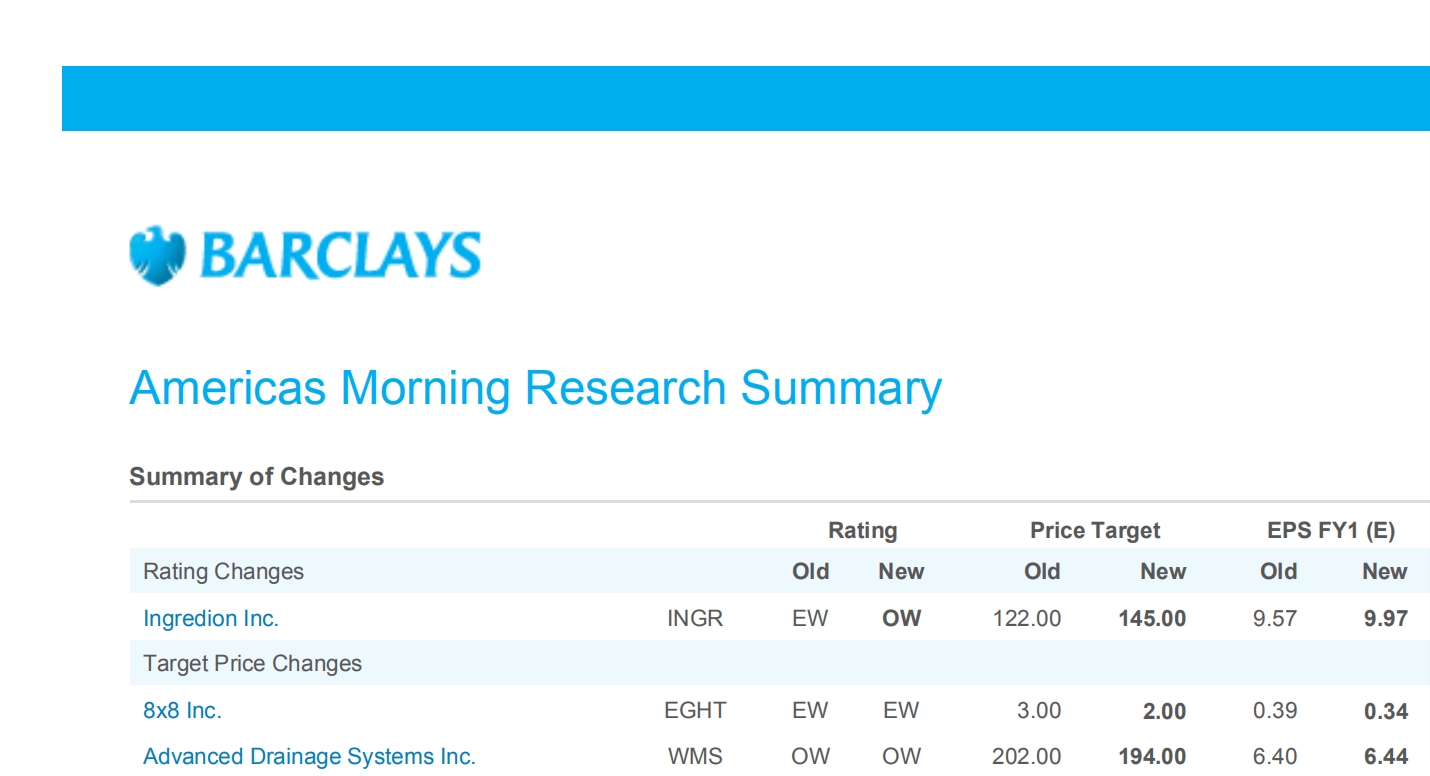

Americas Morning Research Summary

This summary is compiled from research reports previously published by Barclays Equity Research. A full list of all publications is available on

海外研报

2024年08月10日

All EM Asian markets saw foreign selling this week

Foreign (FII) flows / positioningn EM Asian region saw selling (-US$6.5bn) across marketsthis week, led by A-shares (-US$2.1bn) and Taiwan

海外研报

2024年08月10日

Reflecting On 2Q24 Earnings Amid An Uncertain Macro... Investor sentiment; market color

Correlations and volatility spiked during a dizzying week of sentiment whippingaround on recession risks (still low and still-data dependent, as per the latest from

海外研报

2024年08月10日

The Flow Show The Prime of Strife

Scores on the Doors: crypto 17.2%, gold 16.9%, stocks 8.9%, oil 6.3%, HY bonds 4.7%, commodities 3.3%, cash 3.2%, IG bonds 1.9%, US$ 1.9%, govt bonds -0.8% YTD.

海外研报

2024年08月10日

Russia: Inflation rises to 9.1% due to utility increases as expected

Bottom Line: Rosstat published its estimate for July inflation and in line withconsensus and our estimates it was reported at 9.1% yoy. While this was a sharp

海外研报

2024年08月10日

Global Economic Weekly Unwarranted panic

Weaker than expected US payrolls last week unleashed a market headwind that peaked this Monday. At peak, the rates market priced 140bp of Fed cuts by year-end, effectively

海外研报

2024年08月10日

GS TWIG Notes: This Week in Global Research - August 9, 2024

Labor data, recession risk, the Fed, and the path aheadn In the US, David Mericle raised our 12-month recession odds to 25% (from 10%)

海外研报

2024年08月10日

CAD: still labouring away

Asia overnightThe NZD has been the marginal outperformer of otherwise largely steady G10 FX

海外研报

2024年08月10日