海外研报

筛选

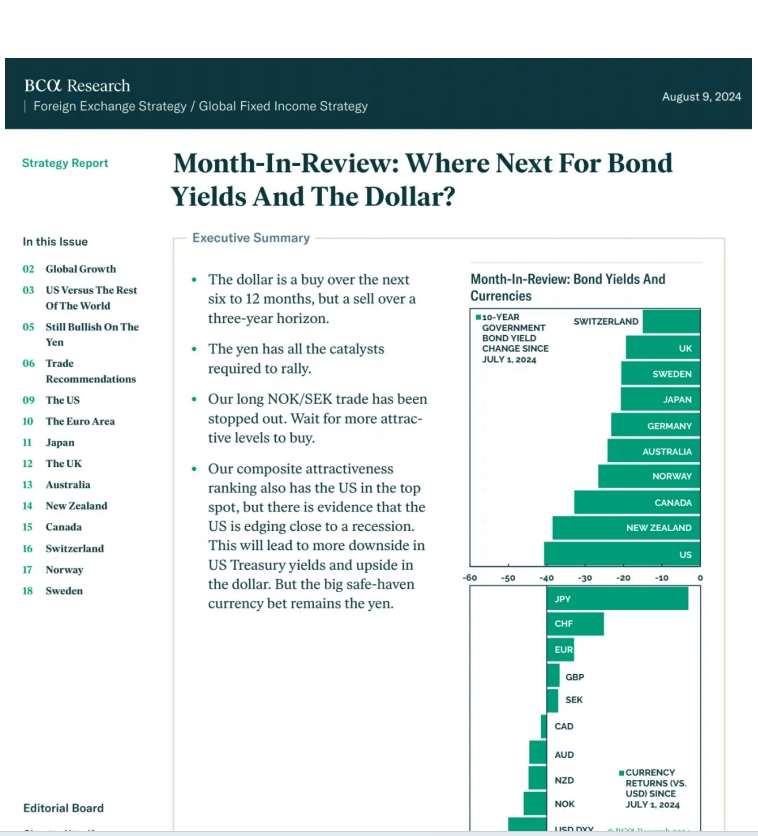

Month-In-Review: Where Next For BondYields And The Dollar?

The dollar is a buy over the nextsix to 12 months, but a sell over athree-year horizon.The yen has all the catalystsrequired to rally.

海外研报

2024年08月12日

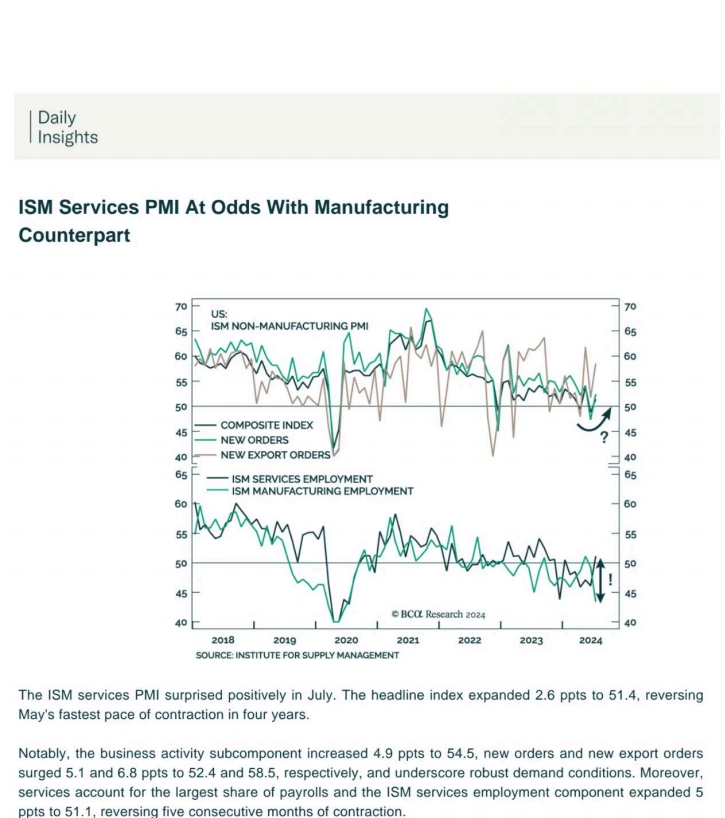

ISM Services PMl At Odds With ManufacturingCounterpart

The lSM services PMl surprised positively in july. The headline index expanded 2.6 ppts to 51.4, reversingMay's fastest pace of contraction in four years.

海外研报

2024年08月12日

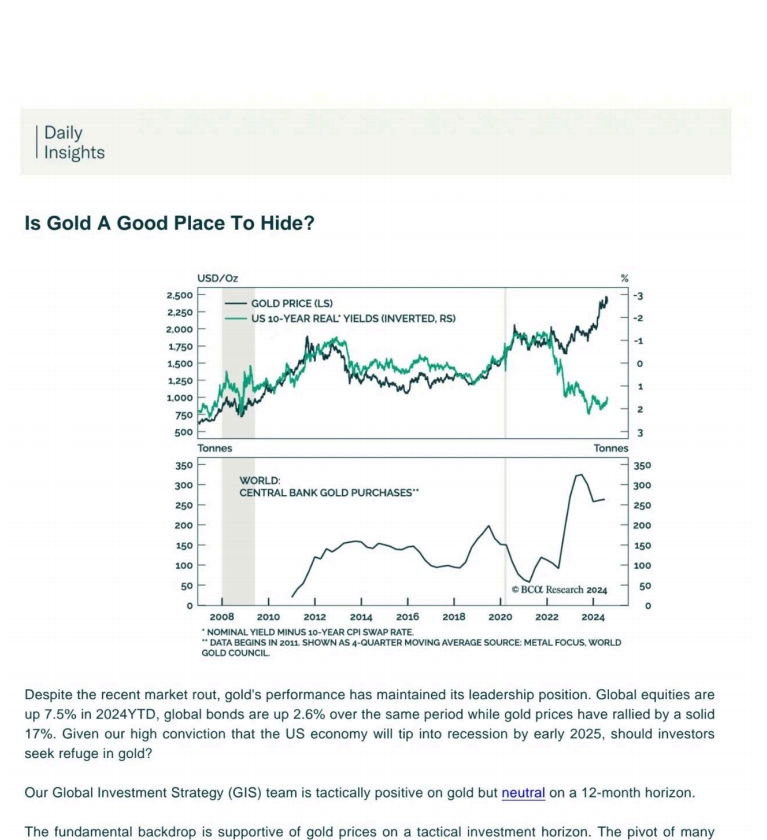

Is Gold A Good Place To Hide?

Despite the recent market rout, gold's performance has maintained its leadership position. Global equities arup 7.5% in 2024YTD, global bonds are up 2.6% over the same period while gold prices have rallied by a soli17%. Given our high conviction

海外研报

2024年08月12日

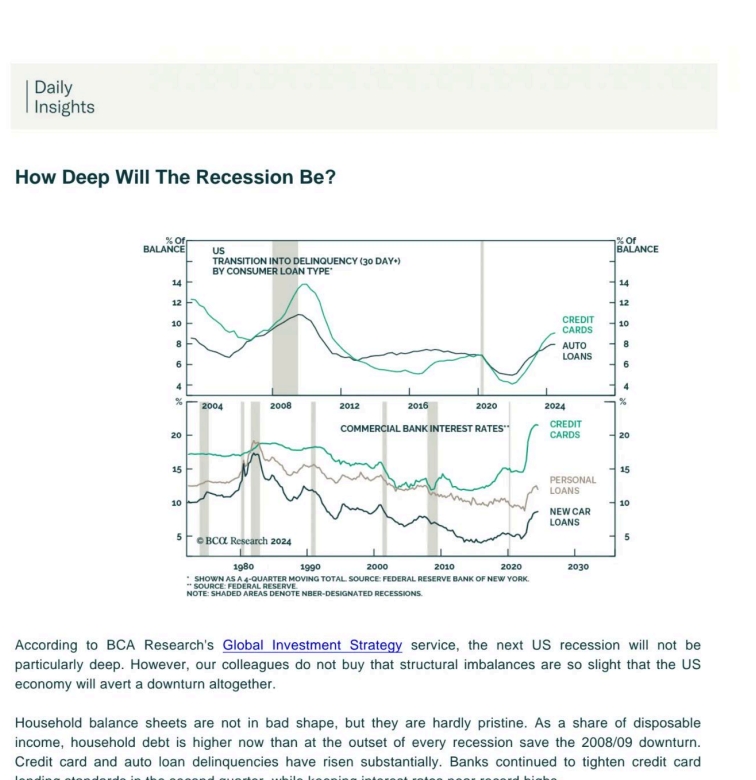

How Deep Will The Recession Be?

According to BCA Research's Global investment Strategy service, the next US recession will not beparticularly deep. However, our colleagues do not buy that structural imbalances are so slight that the USeconomy will avert a downturn

海外研报

2024年08月12日

MONETARY POLICY MATTERS, BUT GROWTH MATTERS MORE

Macro Drivers: Despite the soft payroll numbers, a US recession remains unlikely ◼ Multi Asset: Fed cuts are only good for risk assets when a recession does not follow

海外研报

2024年08月12日

US Weekly Kickstart

The S&P 500 ended flat this week after partially recovering from the steep sell-off that started last Thursday and intensified on Monday. Weak

海外研报

2024年08月12日

UK Weekly Kickstart Summer data-only update

General disclosuresThis research is for our clients only. Other than disclosures relating to Goldman Sachs, this research is based on current public

海外研报

2024年08月12日

European Contextual Diary The Week Ahead

In this note we preview the coming week's corporate events Below we highlight three key events for next week. Please see this excel for a full list of

海外研报

2024年08月12日

Some relief, however the risks still remain

The market began the week with a broad-based risk-off sentiment on Monday, and the continued carry trade unwinding pushed the USD/JPY and USD/CNY

海外研报

2024年08月12日

“When the facts change…”: follow-up on the Fed

In February, we published an Economics Focus entitled “When the facts change…” part 2: the Fed, in which we examined the evolution of the US

海外研报

2024年08月10日