海外研报

筛选

Europe Non Research Other

Not that much to add to yesterday's piece really, enough to make things murky for markets going forward (recession riskiniddleEastUkraine incursion'US politics) that after the huge deleveraging episode post payrols daspite the swift

海外研报

2024年08月14日

Total recall 2Q:24 – Core strength drives OEMs; Supplier outlooks disappointing

Pricing remains solid but production outlook down YoY2Q:24 showed a change of pace for the automotive industry. Global production is now

海外研报

2024年08月14日

Risk-reward for equities to stay mixed through summer, but Japan not to underperform further

We remain concerned about the backdrop for stocks, there could be further bouts of weakness as we progress through summer. Activity is weakening,

海外研报

2024年08月14日

European Morning Research Summary

This summary is compiled from research reports previously published by Barclays Equity Research. A full list of all publications is available on

海外研报

2024年08月14日

Europe Non Research Other

Prely good session for EM tx wih ZAR emy decent demand for the curency mainly fromSyslamalic accounts but also HFs. As regular readers wll know, l have been trading USDZAR from the short side lately which hasworked well am l am further

海外研报

2024年08月14日

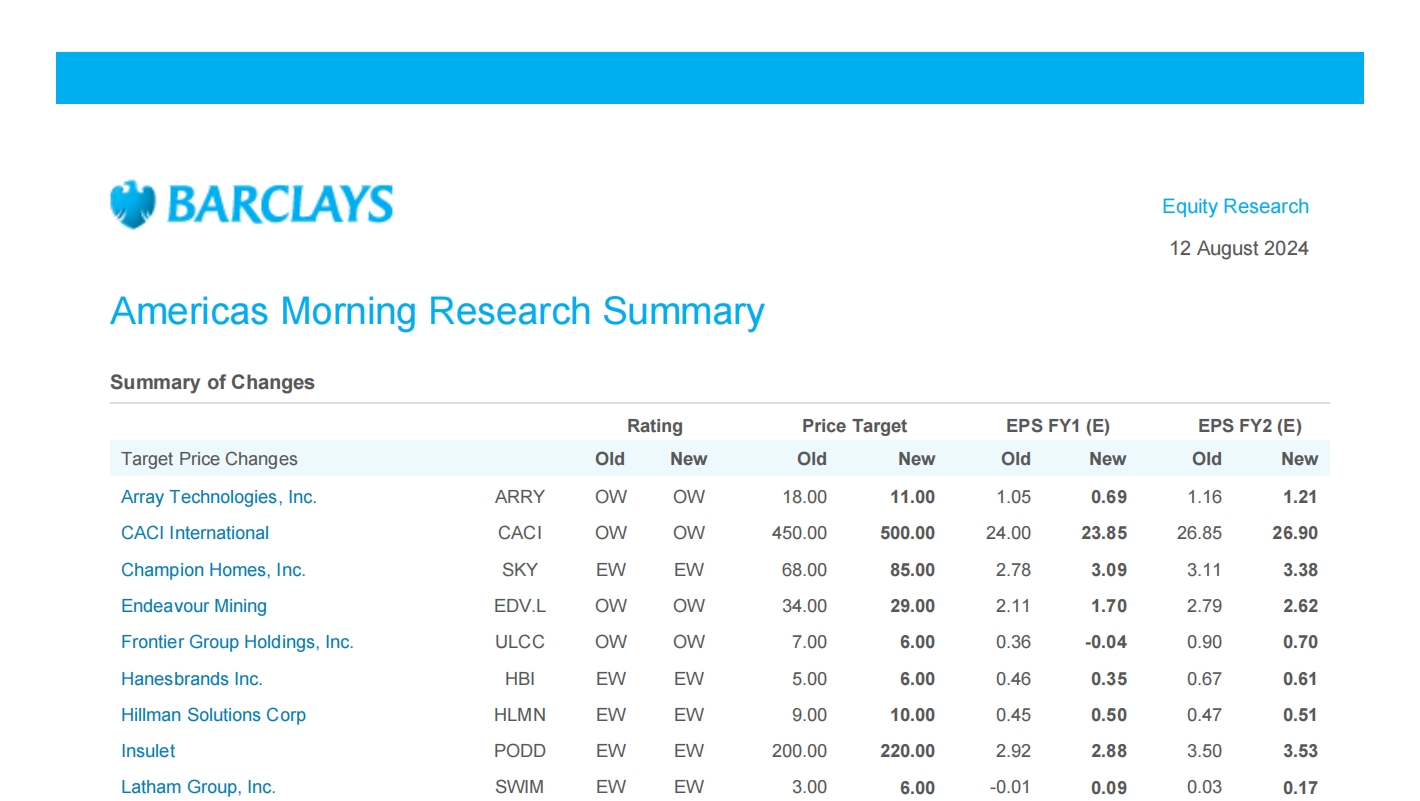

Americas Morning Research Summary

This summary is compiled from research reports previously published by Barclays Equity Research. A full list of all publications is available on

海外研报

2024年08月14日

IndonesiaPulse: Rupiah has had a reprieve, but downside risks remain

We have lowered our USDIDR forecast to 16150 in Q3 (from 16420 previously) and 16050 in Q4 (from 16360 previously) to reflect recent easing depreciatory

海外研报

2024年08月14日

GSCHARTOFTHEDAY:CPIPREVIEW

We highlight four key component-level trends we expect to see in this month’s report:

海外研报

2024年08月14日

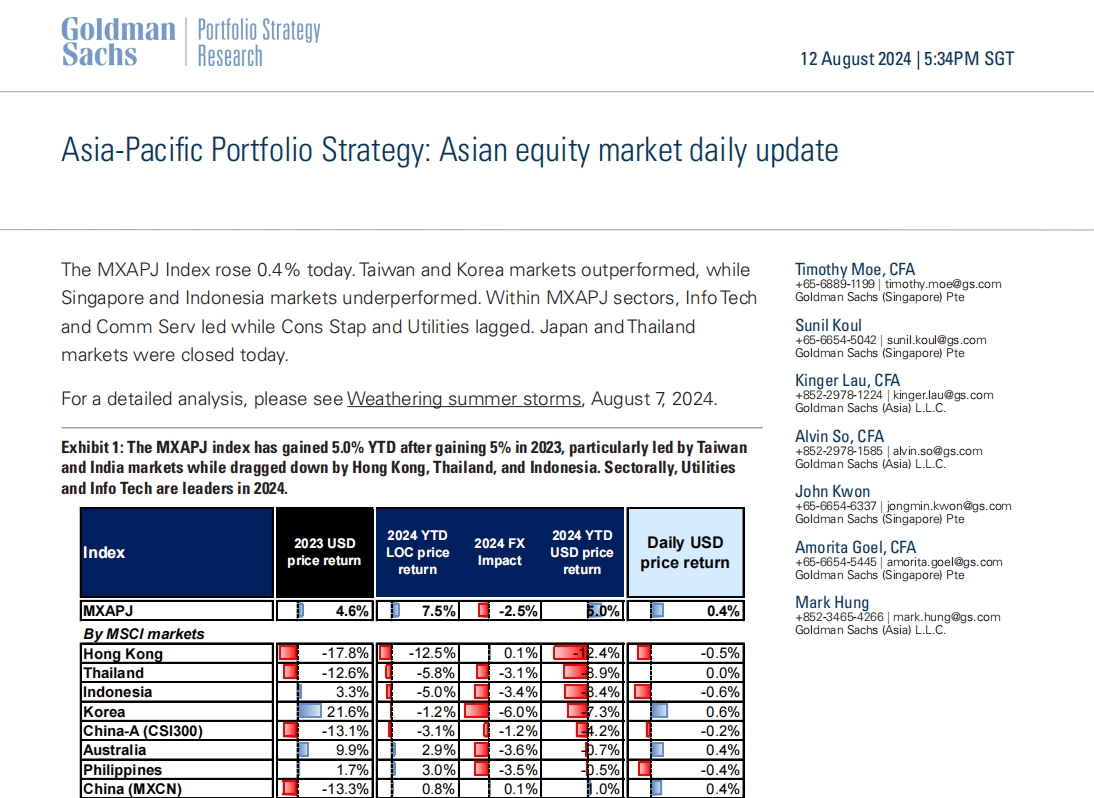

Asia-Pacific Portfolio Strategy: Asian equity market daily update

The MXAPJ Index rose 0.4% today. Taiwan and Korea markets outperformed, whileSingapore and Indonesia markets underperformed. Within MXAPJ sectors, Info Tech

海外研报

2024年08月14日

The Global Point Tuesday, 13 August 2024

We project the 2025E memory market to be better than feared. Despite market concerns on potential memory oversupply in 2025E, and following the memory

海外研报

2024年08月14日