海外研报

筛选

What’s Top of Mind in Macro Research

US: benign inflation, continued focus on growthUS core CPI rose 0.17% in July, roughly in line with expectations, which led us to

海外研报

2024年08月16日

3 themes from 2Q 2024 conference calls: The labor market, the consumer, and AI

Our quarterly S&P 500 Beige Book reviews conference call transcripts to gain aqualitative perspective on key issues facing company managements. This

海外研报

2024年08月16日

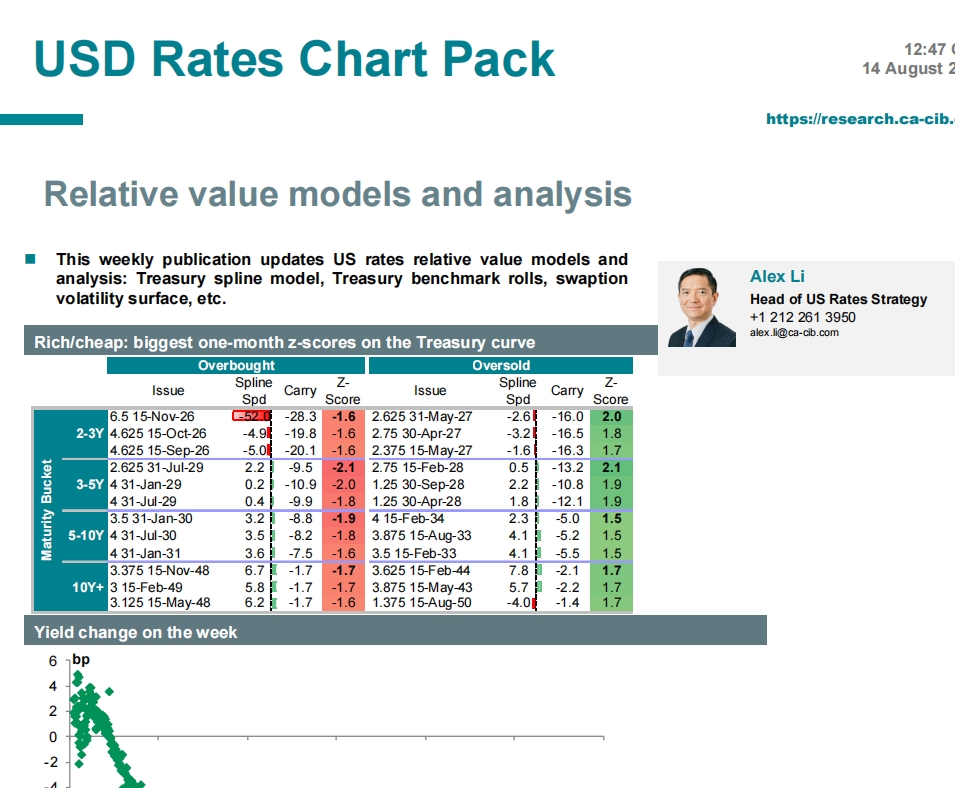

Relative value models and analysis

This weekly publication updates US rates relative value models and analysis: Treasury spline model, Treasury benchmark rolls, swaption

海外研报

2024年08月16日

Yen vs the World: Don’t get carried away

Nearly all Governor Ueda’s monetary policy press conferences has been on the dovish side. However, this

海外研报

2024年08月16日

Macro at a Glance: Latest views and forecasts

Globally, we expect real GDP growth of 2.7% yoy in 2024, reflecting tailwindsfrom real household income growth, a gradual recovery in manufacturing activity,

海外研报

2024年08月16日

Lamenting party policy prescriptions for inflation

• The Biden/Harris administration has blamed greedy corporations

海外研报

2024年08月16日

Hardware Sector Update; DELL Add to Focus List; ALAB

My colleague Jack Atherton, who covers Comm, Internet, Media and Software, is on New Parent Leave until Labor Day. I’ll be backing him up - including sending this combined TMT morning daily, and providing his

海外研报

2024年08月16日

BOJ watch: How will Kishida's successor get along with the central bank?

Prime Minister Fumio Kishida indicated in a 14 August press conference that he intendsto step aside at the end of his current term rather than seek re-election by his party

海外研报

2024年08月16日

RWE: Uncertain Capital allocation a continued overhang // E.ON

Goldman Sachs does and seeks to do business with companies covered in its research reports. As a result,investors should be aware that the firm may have a conflict of interest that could affect the objectivity of this

海外研报

2024年08月16日

GS EUROPEAN EXPRESS: Encore: Buy ISS, EON, Neste (all on CL); Sell Elekta

SS – upsized buyback supportive of our thesis – ISS 1H results were characterisedby headline numbers that were largely in-line with expectations, FY24 organic

海外研报

2024年08月16日