海外研报

筛选

Japan: April-June Machinery Orders Flat, but Exceed Previously Announced Outlook

BOTTOM LINE: Private sector core machinery orders, a leading indicator for capex,rose +2.1% mom in June, the first increase in three months, and came in above the

海外研报

2024年08月20日

Israel: Large Downside Surprise to Growth in Q2

Bottom Line: Israel’s GDP growth fell from +17.3%qoq annl. to +1.2%qoq annl.(both seasonally adjusted), which was significantly below consensus expectations

海外研报

2024年08月20日

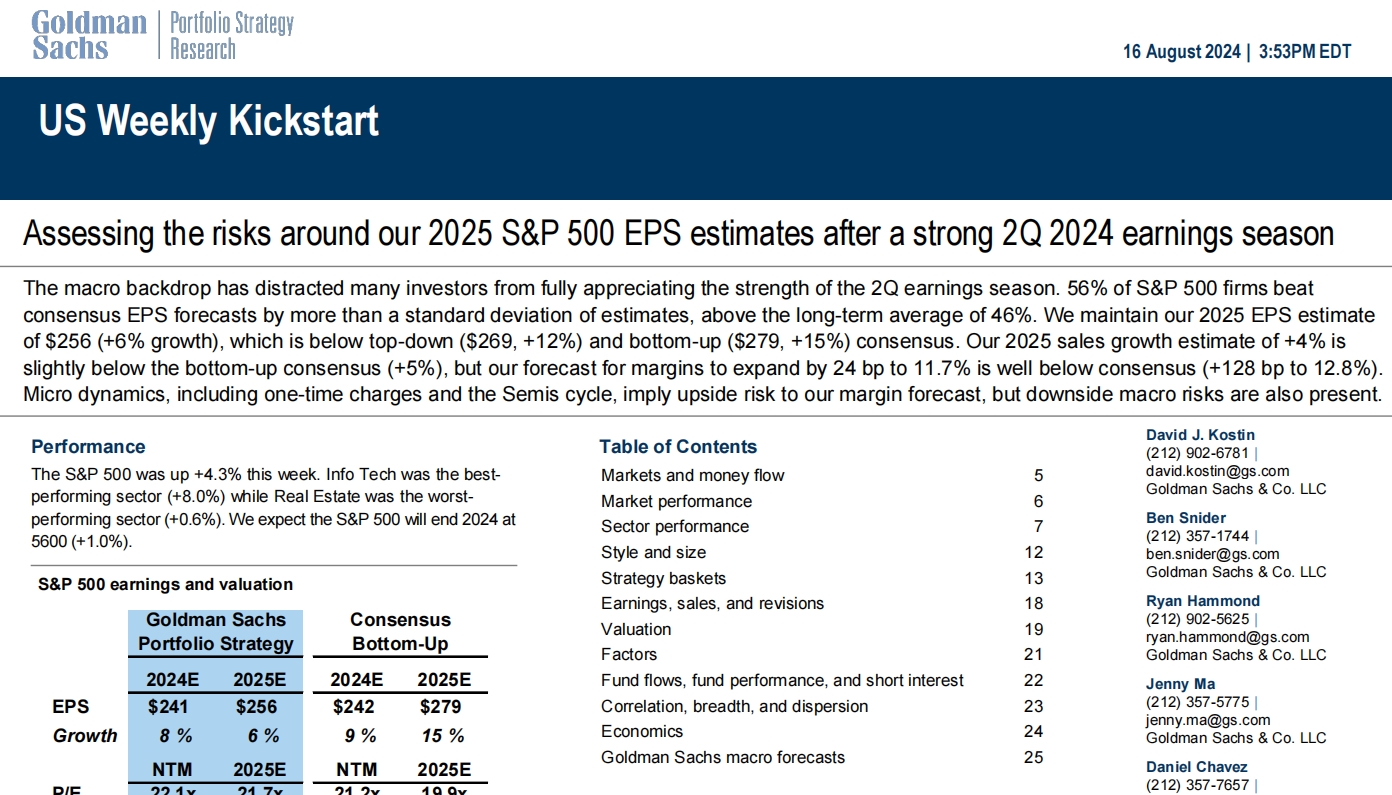

Assessing the risks around our 2025 S&P 500 EPS estimates after a strong 2Q 2024 earnings season

The macro backdrop has distracted many investors from fully appreciating the strength of the 2Q earnings season. 56% of S&P 500 firms beat

海外研报

2024年08月19日

US Week Ahead: August 19 - August 25

The key economic data releases this week are the jobless claims and existing homesales reports on Thursday. The minutes from the July FOMC meeting will be

海外研报

2024年08月19日

US Daily: Renewed Progress on Recession Risk (Hatzius)

After the July jobs report released on August 2 triggered the “Sahm rule,” weraised our 12-month US recession probability from 15% to 25%. Now, we have

海外研报

2024年08月19日

The Viewpoint: How Asian Central Banks Will React

The key debate is still US recession risks. Our US economics team continues to expect a soft landing with the Fed only cutting rates to 3.625% by end-2025.

海外研报

2024年08月19日

Signals from the Credit Market for US Growth Risks

We think signals from the corporate credit market are fully consistent with a soft landing.

海外研报

2024年08月19日

The Consumer in Context

Our view has been that consumer spending would slow but not slump; so far that path has played out. Employment, wealth, and

海外研报

2024年08月19日

Global Macro Commentary | North America August 16 Morgan Stanley & Co.

Strong US data caps UST rally; solid UK retail sales sends gilts higher; RBNZ's Silk says contraction may be needed to lower

海外研报

2024年08月19日

Apr-Jun GDP Quick Comment: Domestic Demand Recovery Reaffirmed

2024 reveal that real GDP growth came in at 3.1% SAAR, exceeding both the Bloomberg consensus of 2.3% and our 2.6% prior forecast (Japan Economics: Apr-Jun

海外研报

2024年08月19日