海外研报

筛选

FAST FX Fair Value Model--USD looking undervalued

The FAST FX model continues to sit out the FX markets and remains up 2.50% over the past year with a hit rate of 50%. Heading into the Jackson

海外研报

2024年08月20日

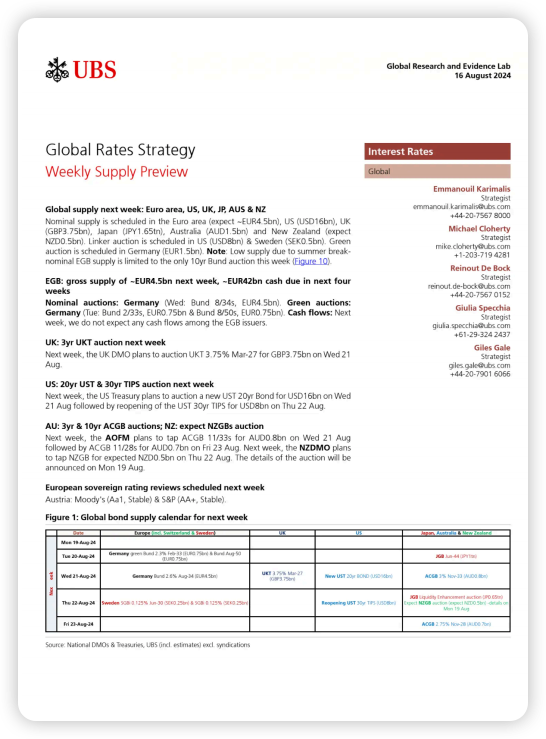

Global Rates StrategyWeekly supply Preview

Global supply next week: Euro area, Us, UK, JP, AUS & NZNominal supply is scheduled in the Euro area (expect ~EUR4.5bn), US (USD16bn), UK(GBP3.75bn), Japan (JPY1.65tn),Australia (AUD1.5bn) and New Zealand

海外研报

2024年08月20日

Global Rates StrategySep/Dec Futures roll

Repo risk is meaningful for DecGiven the uncertain path of the Fed over the next few months, valuation of the Deccontracts will be sensitive to

海外研报

2024年08月20日

Is the VlX spike a signal of wider credit spreadsahead?

A key debate last week was whether equities were sending a signal for creditThe massive spikes in cross-asset volatility in early August (e.g., 2, 4, 5 sigma moves in1Oyr USTs, IPYUSD, and VlX) have left investors actively

海外研报

2024年08月20日

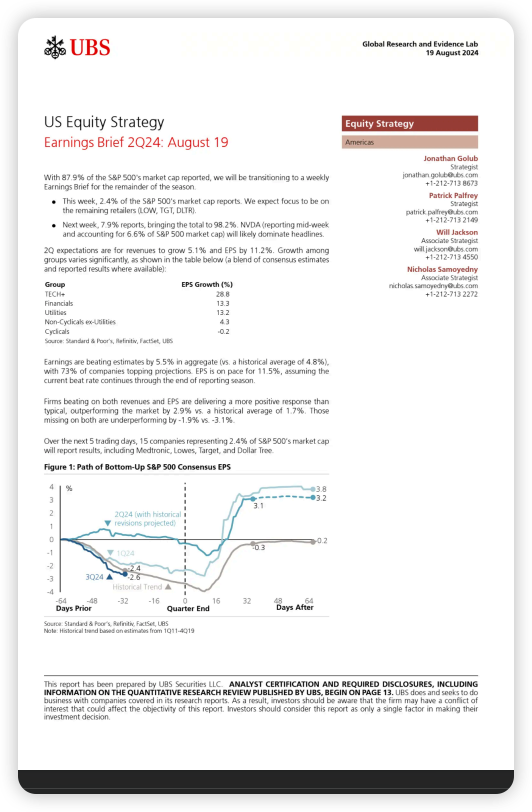

Us Equity StrategyEarnings Brief 2Q24: August 19

With 87.9% of the S&P 500's market cap reported, we will be transitioning to a weeklyEarnings Brief for the remainder of the season..

海外研报

2024年08月20日

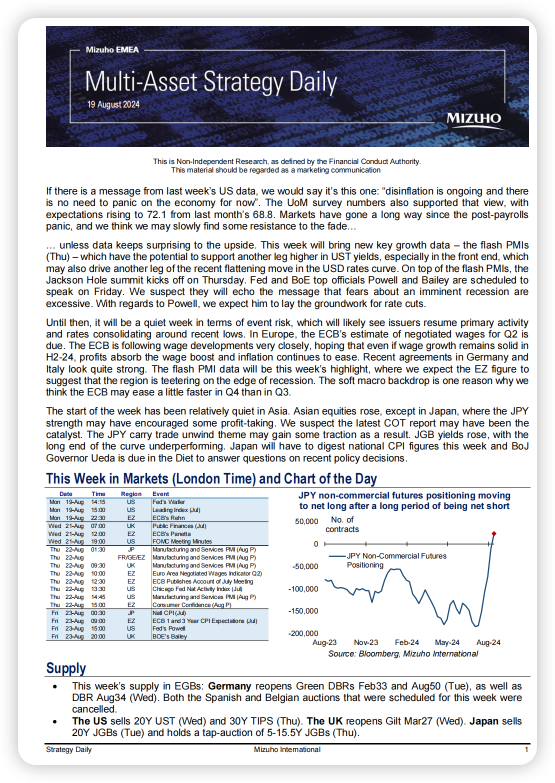

Multi-Asset Strategy Daily

If there is a message from last week’s US data, we would say it’s this one: “disinflation is ongoing and there is no need to panic on the economy for now”. The UoM survey numbers also supported that view, with

海外研报

2024年08月20日

FX Trade Idea-Sell EUR/USD

towards the bottom of its recent trading range in the coming months due to:1. Paring back of some of the market’s dovish Fed expectations for this

海外研报

2024年08月20日

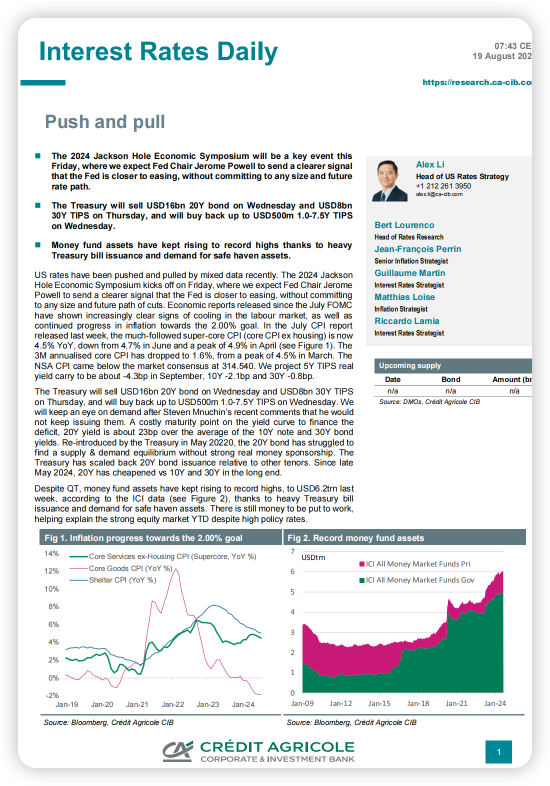

Interest Rates Daily-Push and pull

US rates have been pushed and pulled by mixed data recently. The 2024 Jackson Hole Economic Symposium kicks off on Friday, where we expect Fed Chair Jerome

海外研报

2024年08月20日

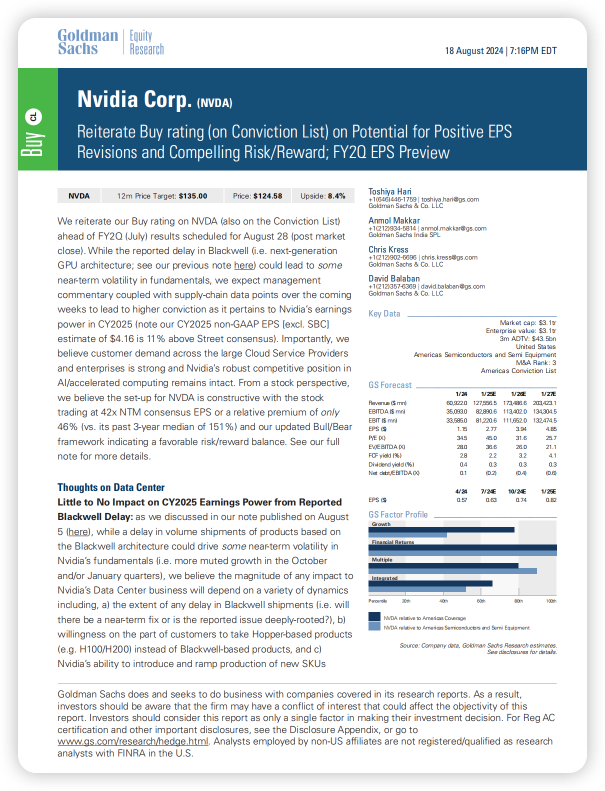

Reiterate Buy rating (on Conviction List) on Potential for Positive EPS Revisions and Compelling

We reiterate our Buy rating on NVDA (also on the Conviction List)ahead of FY2Q (July) results scheduled for August 28 (post market

海外研报

2024年08月20日

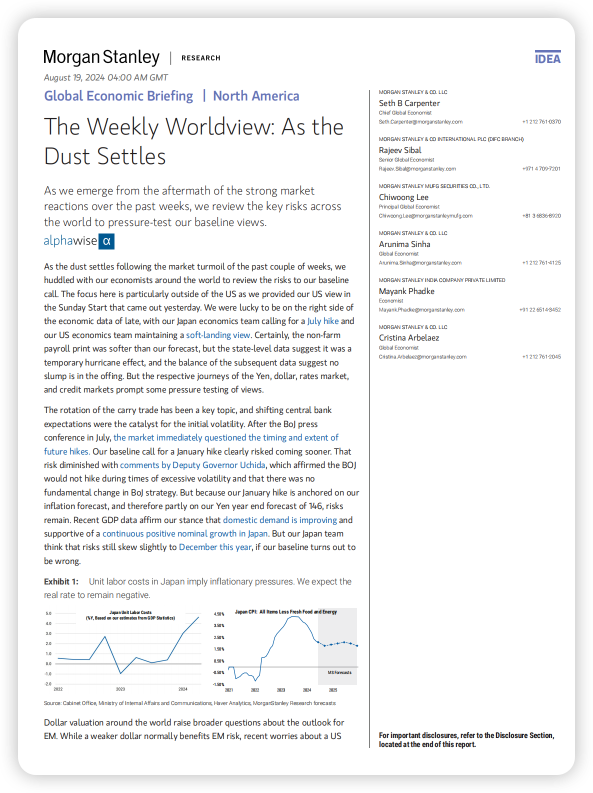

The Weekly Worldview: As the Dust Settles

As the dust settles following the market turmoil of the past couple of weeks, we huddled with our economists around the world to review the risks to our baseline

海外研报

2024年08月20日