海外研报

筛选

Confidence Game-Global Daily

As we approach the Jackson Hole Symposium later this week the message from Fed speakers, broadly, has been that they are gaining confidence that the economy is reaching the point where

海外研报

2024年08月20日

Data pushes back against 50bp September cut

A fed-focused week lies ahead with the annual Jackson Hole Economic Symposium in the spotlight, along with the minutes from the July FOMC

海外研报

2024年08月20日

Tail wags dog as rate hike expectations fade despite hawkish rate increase

The BoJ increased its policy rate to 0.25% at the July 30-31 Monetary Policy Meeting when the market was not expecting it and also emphasized its intention to

海外研报

2024年08月20日

Trading Catalysts Eyes on Jackson Hole, minds on NVDA

Economics: Slow and steadyThe message from last week’s data was clear: inflation is soft enough for the Fed to

海外研报

2024年08月20日

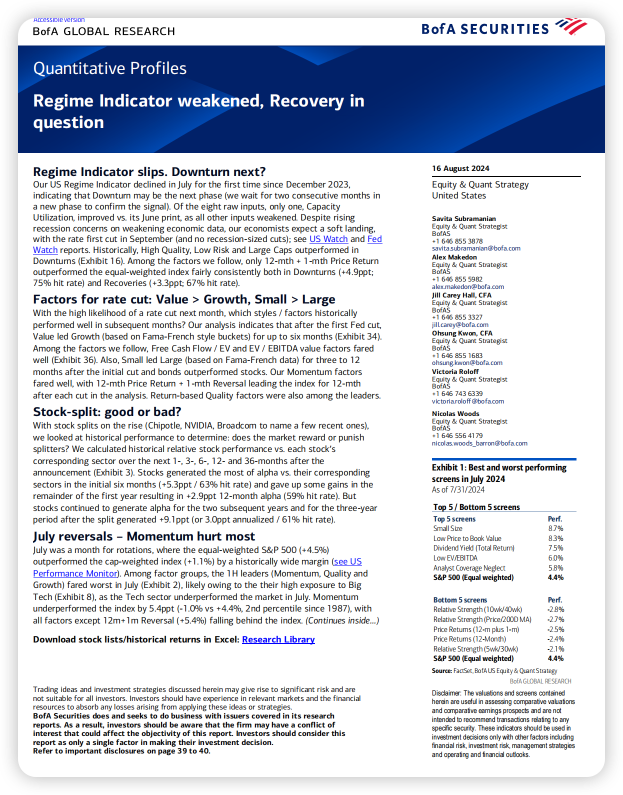

Regime Indicator weakened, Recovery in question

Regime Indicator slips. Downturn next?Our US Regime Indicator declined in July for the first time since December 2023,

海外研报

2024年08月20日

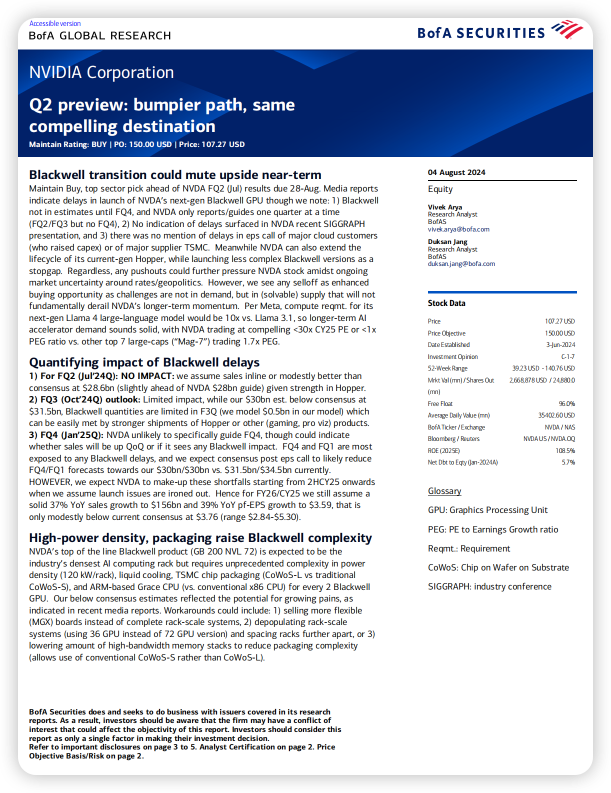

Q2 preview: bumpier path, same compelling destination

Blackwell transition could mute upside near-termMaintain Buy, top sector pick ahead of NVDA FQ2 (Jul) results due 28-Aug. Media reports

海外研报

2024年08月20日

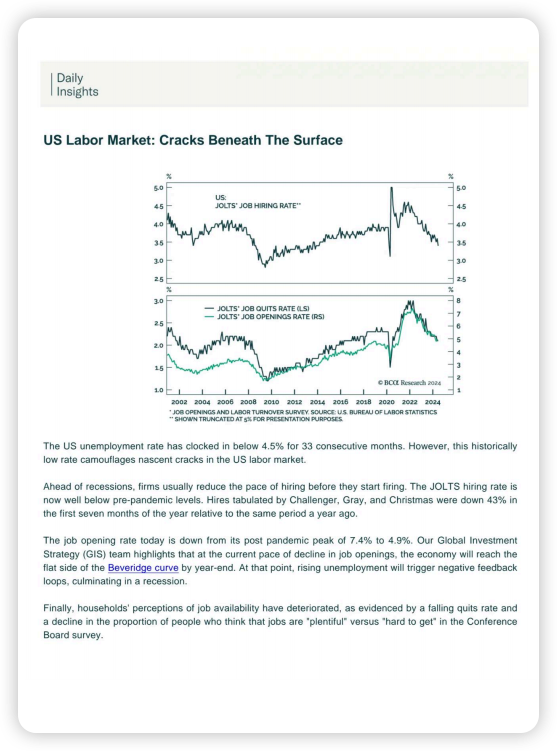

US Labor Market: Cracks Beneath The Surface

The US unemployment rate has clocked in below 4.5% for 33 consecutive months. However, this historicallylow rate camouflages nascent cracks in the US labor market.

海外研报

2024年08月20日

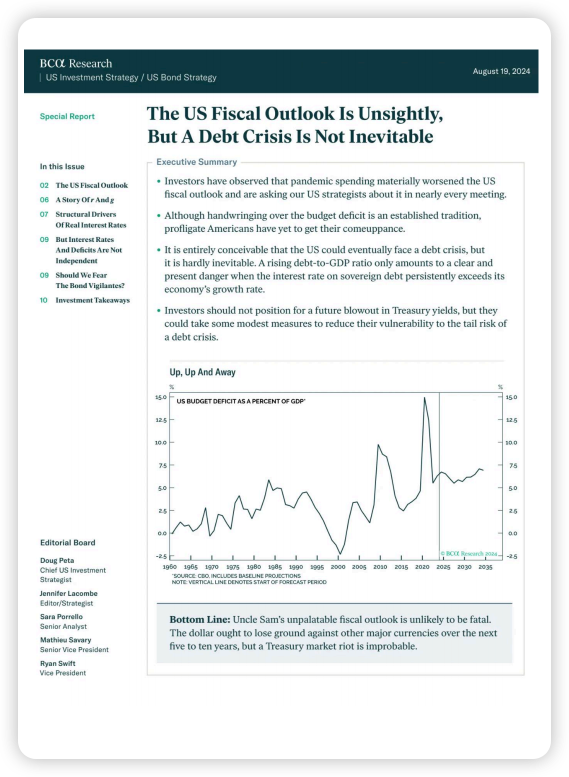

The US Fiscal OutlookIs Unsightly,But A Debt Crisis Is Not Inevitable

Executive SummaryInvestors have observed that pandemic spending materially worsened the USfiscal outlook and are asking our US strategists about it in nearly every meeting

海外研报

2024年08月20日

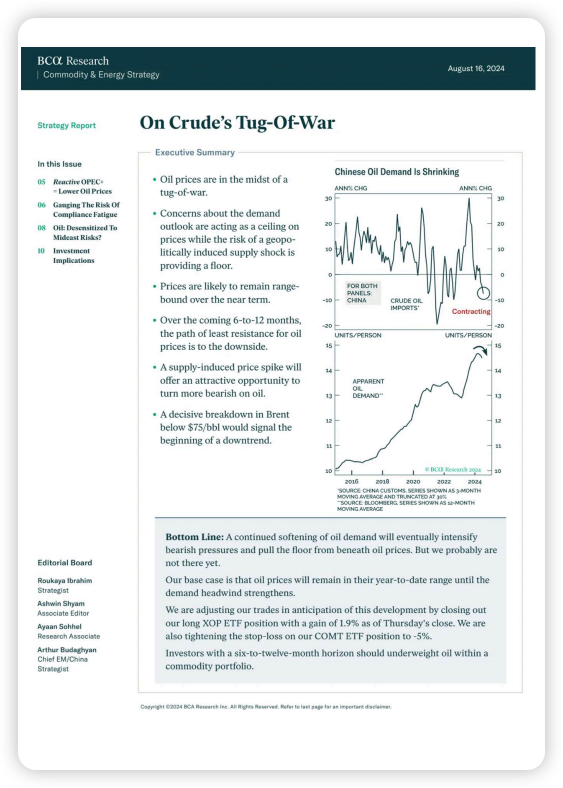

On Crude's Tug-Of-War

Bottom Line: A continued softening of oil demand will eventually intensifybearish pressures and pull the floor from beneath oil prices. But we probably arenot there yet..

海外研报

2024年08月20日

USD: in the shadow of the Rockies

It was a tentative start to the week for risk sentiment. The rhetoric from the Fed remains mixed. While dovish FOMC voter Mary Daly expressed more confidence

海外研报

2024年08月20日