海外研报

筛选

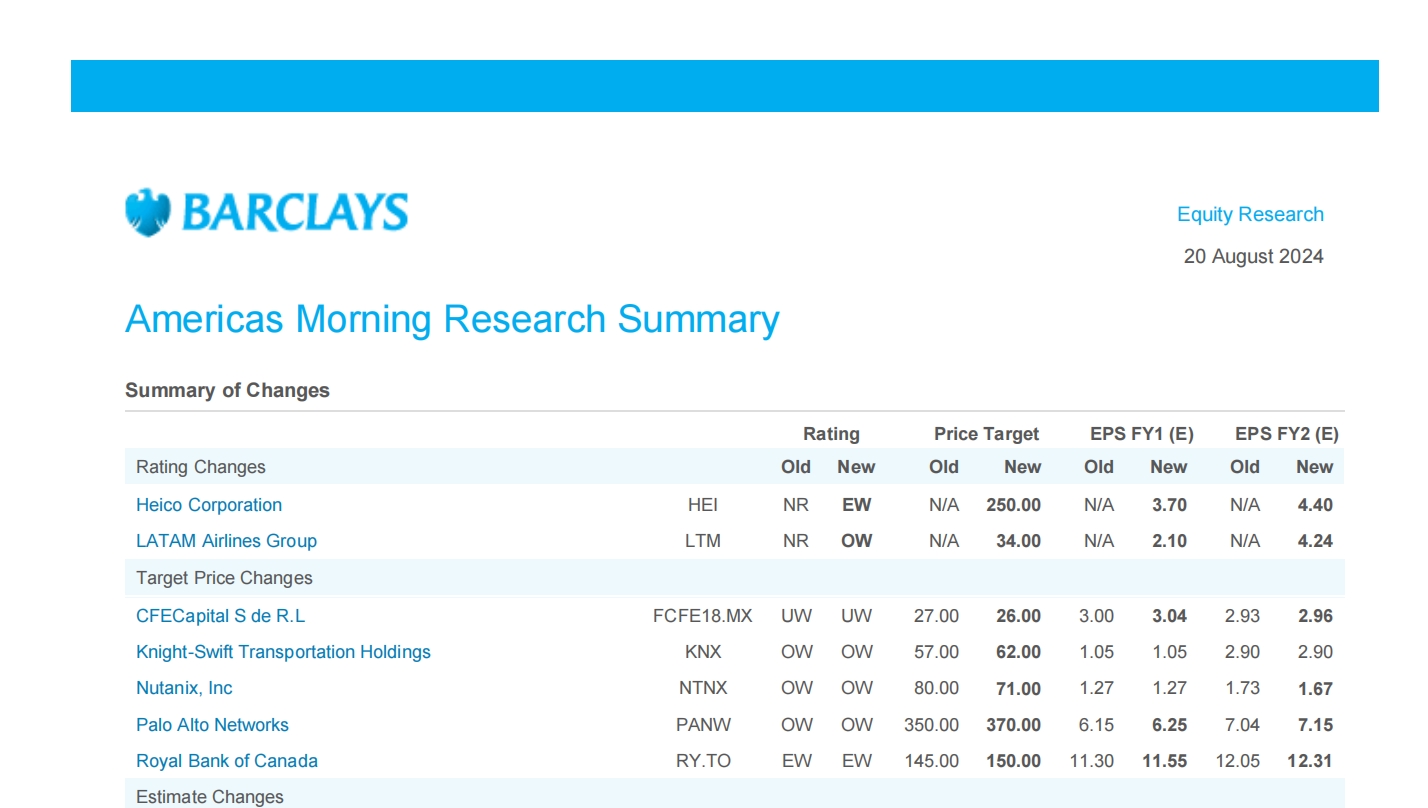

Americas Morning Research Summary

This summary is compiled from research reports previously published by Barclays Equity Research. A full list of all publications is available on

海外研报

2024年08月21日

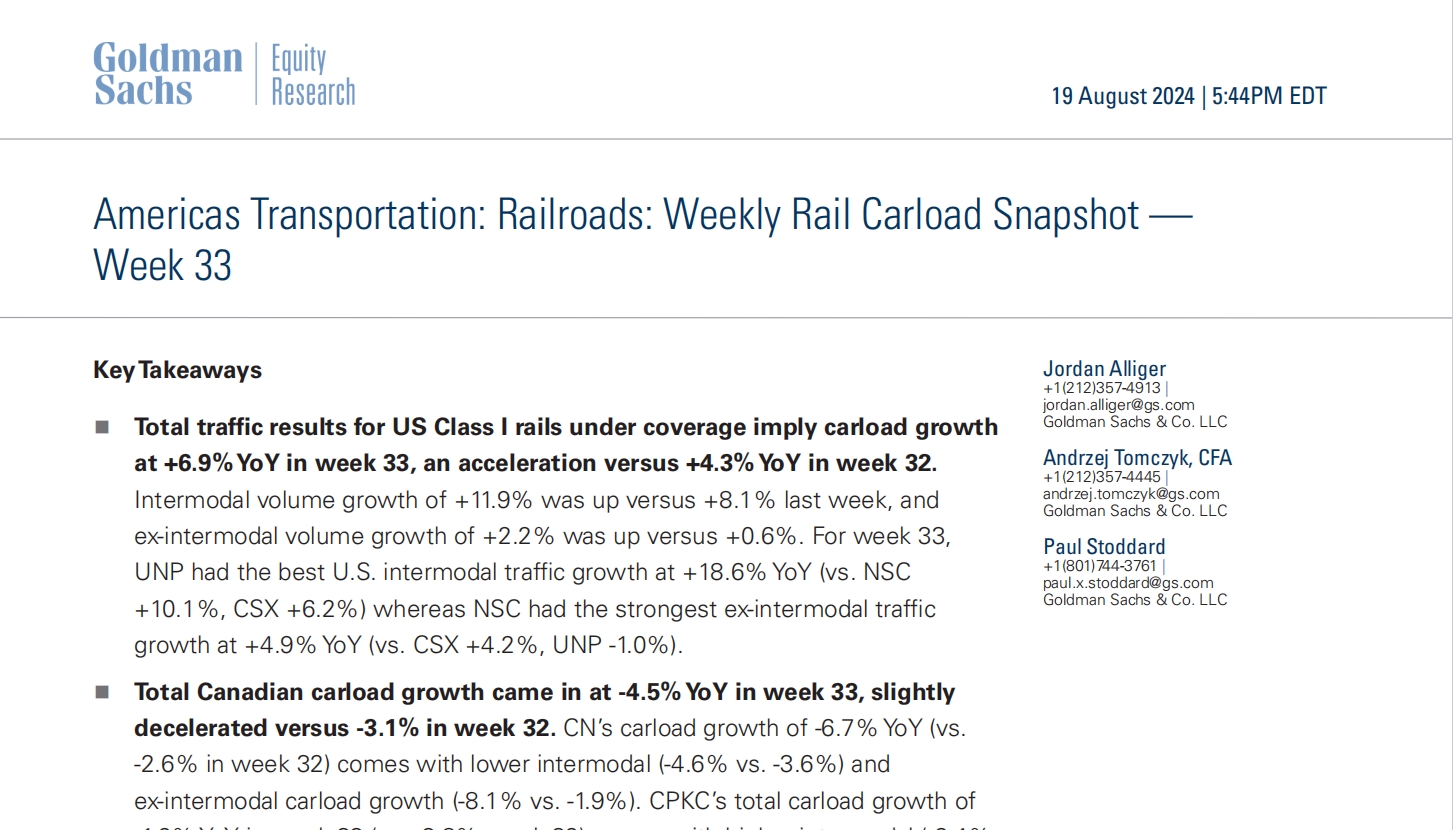

Americas Transportation: Railroads: Weekly Rail Carload Snapshot — Week 33

Total traffic results for US Class I rails under coverage imply carload growthat +6.9% YoY in week 33, an acceleration versus +4.3% YoY in week 32.

海外研报

2024年08月21日

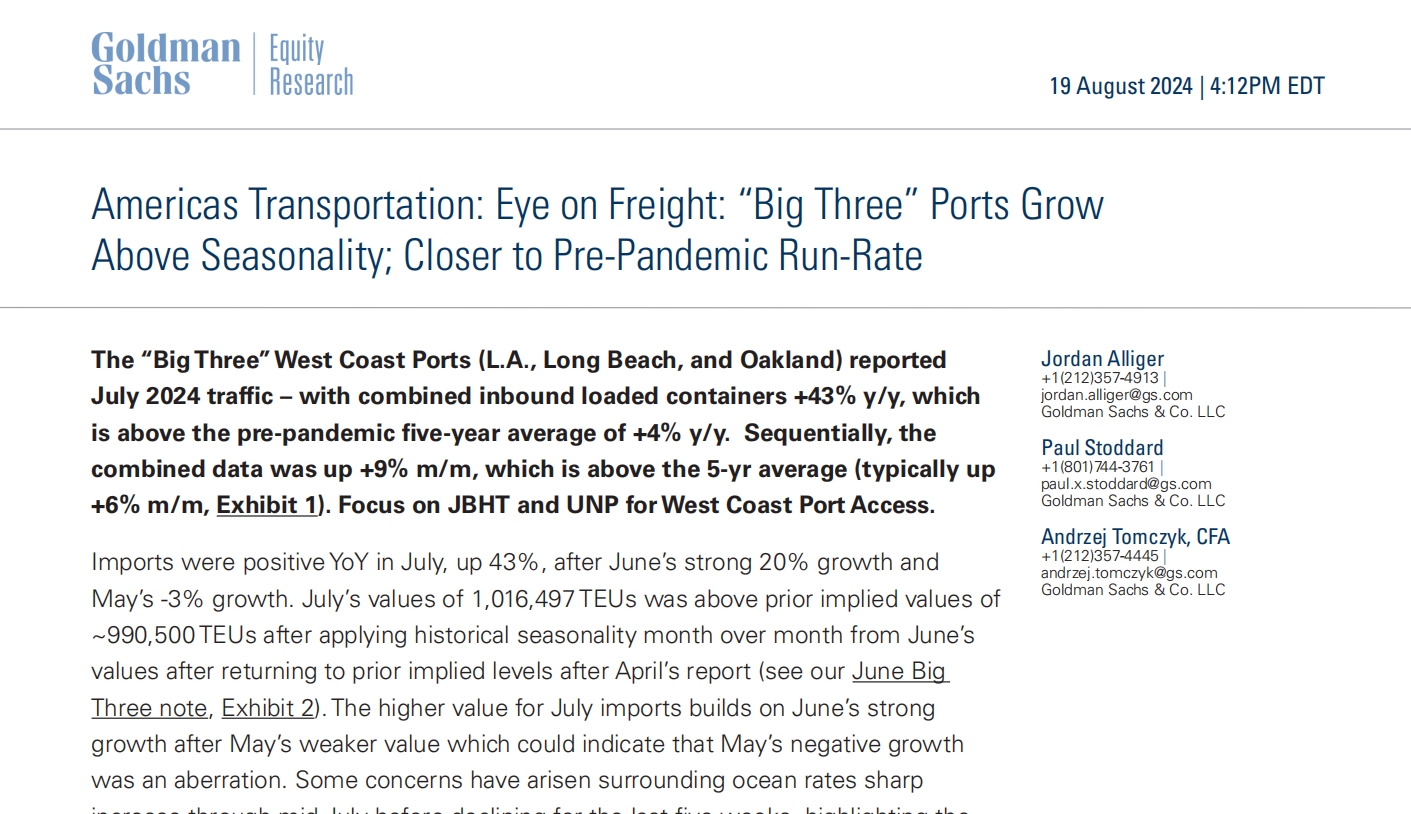

Americas Transportation: Eye on Freight: “Big Three” Ports Grow Above Seasonality

Imports were positive YoY in July, up 43%, after June’s strong 20% growth andMay’s -3% growth. July’s values of 1,016,497 TEUs was above prior implied values of

海外研报

2024年08月21日

Breaking with convention--Global Daily

Pity those having to make forecasts for the global economy right now. After all, they are having to do so less than 80 days from a US election in which two radically different policy platforms are

海外研报

2024年08月21日

Macro Insights Weekly Putting the inflation genie back in the 2% bottle

The market is watching closely for signs for US economic slowdown, pricing in about 100bps in

海外研报

2024年08月21日

FIRST ECB MIDSUMMER DATA CHECK: CUT

Sticking to “data dependence” ahead of the September decision, at the last press conferenceChristine Lagarde said the ECB will focus especially on “WPP” – Wages, Productivity and Profits

海外研报

2024年08月21日

The Major bond letter Free to View Fixed Income - Rates Global #52. Turning points

Head fake or the real thing? The question bond investors and traders are debating today is whether the events of the last few weeks will mark a decisive turning point

海外研报

2024年08月20日

What Companies Are Saying: StillWaiting And Seeing

Companies broadly report steady growth butnota lotofupward momentum as theyand their customers are still in a pervasive wait and see loop given lingeringuncertainties around inflation, interest rates, domestic politics, elections,

海外研报

2024年08月20日

The yen carry trade-what if Japaninstitutions decide to unwind?

Public pension funds. lhe GPlF is the big one here, with other smallerfunds believed to generally follow its lead. There's a growing view that theGPIFcould cutforeign bond exposure when it announces its next policy mixin 2025.

海外研报

2024年08月20日

Market expectations of the Fed's labormarket reaction

Today's chart explores how these changes as well as other dynamics over recentyears may have affected market expectations of the FOMC's reaction to the labormarket, drawing onaspecialquestiontheNYFed periodicallyincludesin

海外研报

2024年08月20日