海外研报

筛选

August HICP preview: target approaching

We expect Eurozone headline inflation to decline from 2.58% to 2.20% YoY in August, favoured by large energy-negative base effects. In

海外研报

2024年08月24日

Further advancement in South Asia and stronger FX contributed to a 1% gain in MXAPJ

MXAPJ gained 1%, led by Thailand and Philippines (+3%),while Taiwan, Korea and China-A (-1%) underperformed.

海外研报

2024年08月24日

GS TWIG Notes: This Week in Global Research - August 23, 2024

Jan Hatzius lowers the probability that the US will enter a recession in the next12 months to 20% from 25% in last weekend’s note, “Renewed Progress on

海外研报

2024年08月24日

We need it like a Jackson Hole in the headGlobal Daily

Unlike the key BLS revisions to April 2023-March 2024 payrolls estimates, at -818K the largest drop since the Global Financial Crisis, today’s Global Daily was released at the same time to all -

海外研报

2024年08月23日

The Structured Credit Trader No end to amend and extend

n Despite the rally across spread products, Freddie Ksenior tranches have lagged and now appear cheap vs.

海外研报

2024年08月23日

Foldable, AI server and satellite early-stage product cycles – initiate SZS, Chenbro, WNC at Buy

We further expand our coverage into 3 areas where we are positive and see the product cycle at an early stage: SZS(foldable), Chenbro (AI server), and WNC (satellite) are well positioned with leading technologies and customer bases. In

海外研报

2024年08月23日

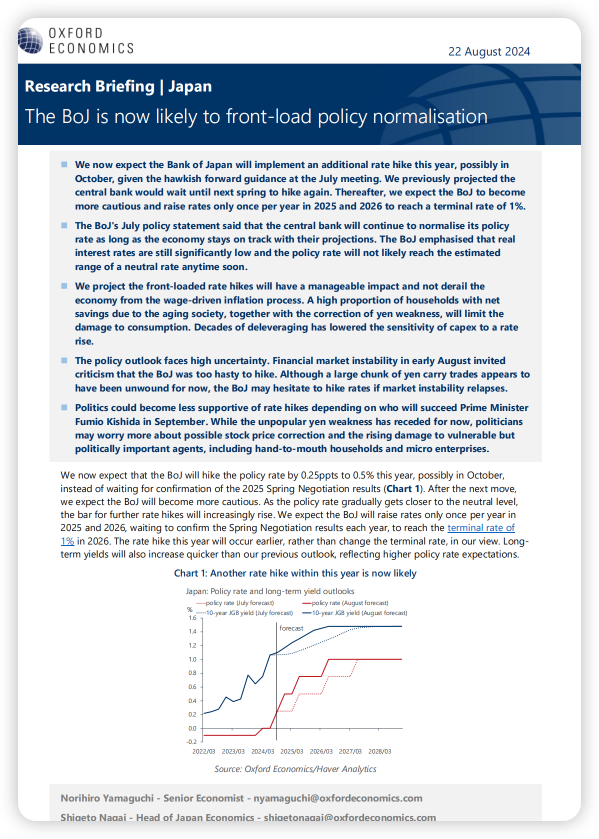

The BoJ is now likely to front-load policy normalisation

◼ We now expect the Bank of Japan will implement an additional rate hike this year, possibly in October, given the hawkish forward guidance at the July meeting. We previously projected the

海外研报

2024年08月23日

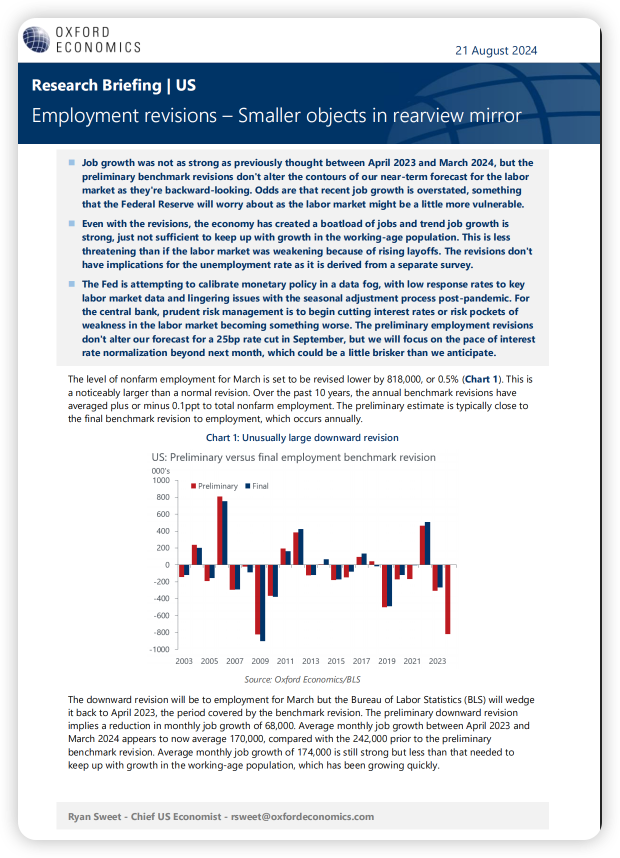

Employment revisions – Smaller objects in rearview mirror

◼ Job growth was not as strong as previously thought between April 2023 and March 2024, but the preliminary benchmark revisions don't alter the contours of our near-term forecast for the labor

海外研报

2024年08月23日

Japan: macro fair value of the Nikkei index

The Nikkei Index can be estimated using nominal GDP (JPY trn), net domestic fund demand (corporate savings rate + fiscal balance, % GDP,

海外研报

2024年08月23日

Korea: BOK signals conditions for easing

The Bank of Korea kept its base rate unchanged at 3.50% on 22 August as widely expected. We saw the BOK’s stance as somewhat dovish as the central bank

海外研报

2024年08月23日