海外研报

筛选

China: plotting the way ahead for USD/CNY

The recent turnaround of the CNYThe CNY has made a sharp turnaround against the USD in August after being

海外研报

2024年08月29日

Chile: IMF Extends Two-Year Flexible Credit Line for US$13.8bn

The International Monetary Fund (IMF) approved a SDR10.5bn (US$13.8bn) FlexibleCredit Line (FCL) for Chile. This facility replaces a prior FCL arrangement approved

海外研报

2024年08月29日

Firmer Consumer and Construction Sector Business Confidence

Bottom Line: Business confidence in the manufacturing sector did not change inAugust; remaining in above-neutral optimistic territory and consolidating the 5.2pt

海外研报

2024年08月29日

Hasta the last drop of oil – Initiating at Buy

Initiating coverage of Vista Energy with Buy RatingWe are initiating coverage of Vista Energy with a Buy rating and PO of US$70/ADR

海外研报

2024年08月29日

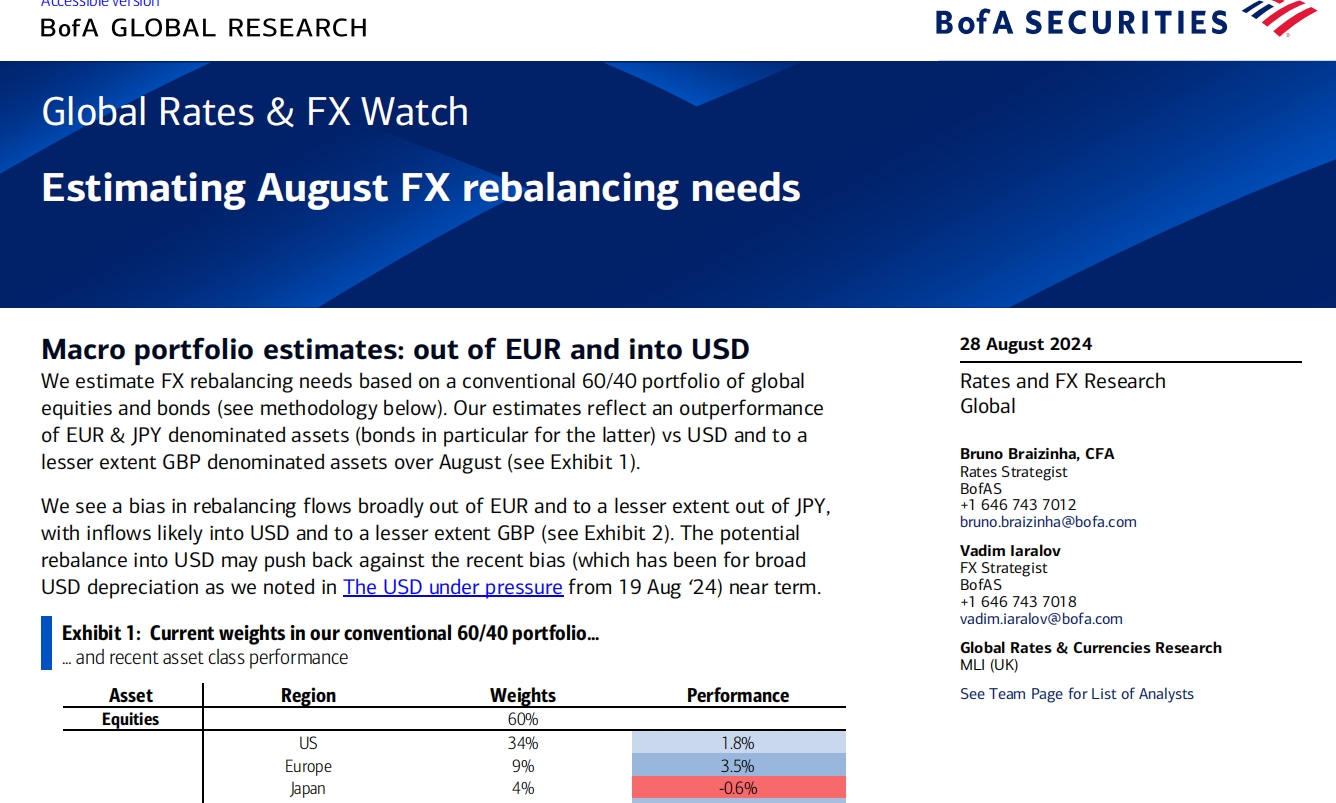

Global Rates & FX Watch Estimating August FX rebalancing needs

Macro portfolio estimates: out of EUR and into USDWe estimate FX rebalancing needs based on a conventional 60/40 portfolio of global .

海外研报

2024年08月29日

Trading Catalysts NVDA earnings, an underpriced risk

Economics: The time has comeAt Jackson Hole, Chair Powell sealed the deal for a September rate cut. Although Powell

海外研报

2024年08月29日

Divided shores

Supply risks in Libya have come to the fore but marketparticipants seem sanguine. Notwithstanding elevated

海外研报

2024年08月29日

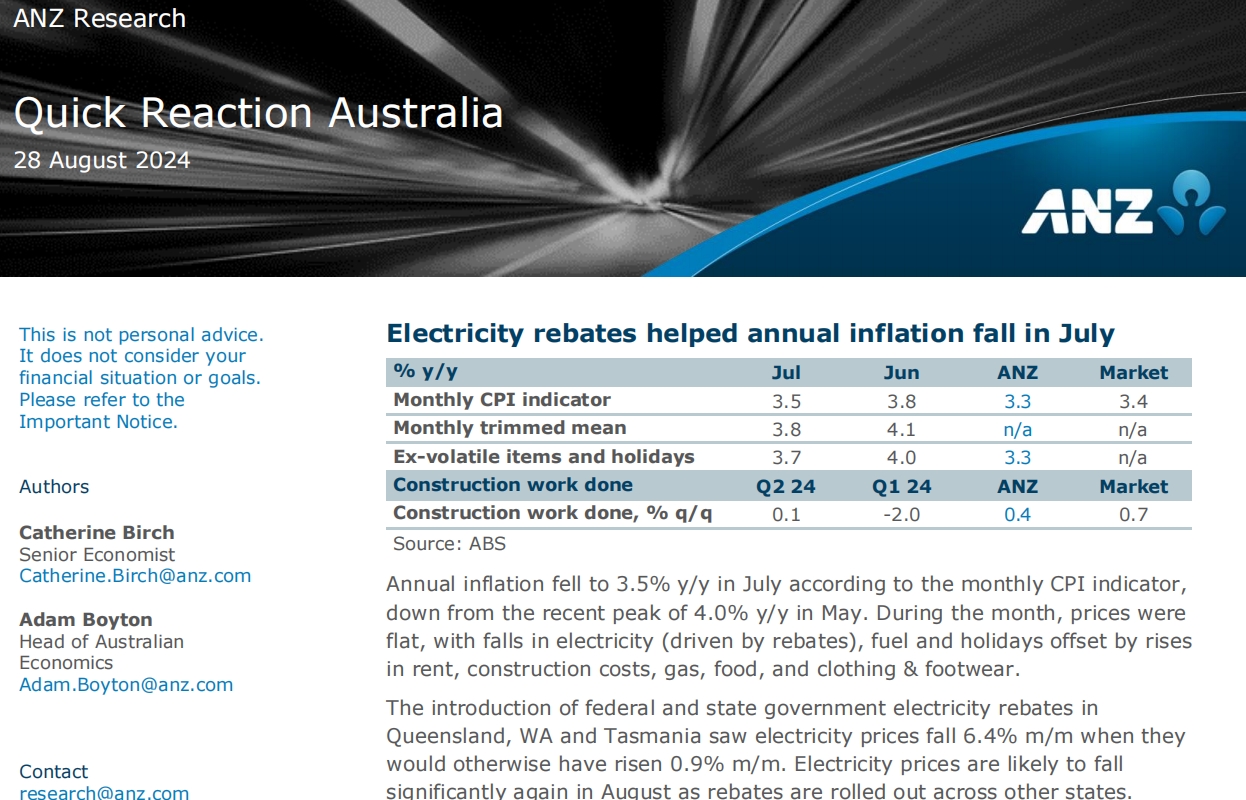

Quick Reaction Australia

Annual inflation fell to 3.5% y/y in July according to the monthly CPI indicator, down from the recent peak of 4.0% y/y in May. During the month, prices were

海外研报

2024年08月29日

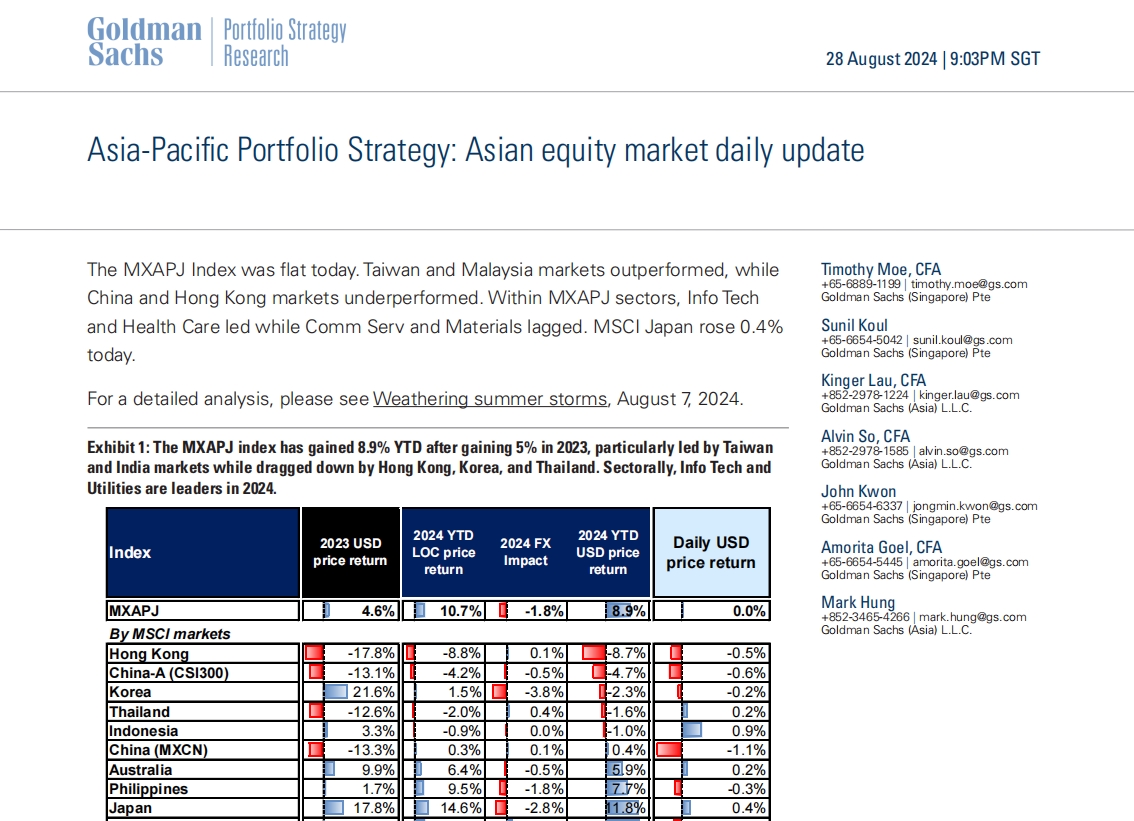

Asia-Pacific Portfolio Strategy: Asian equity market daily update

The MXAPJ Index was flat today. Taiwan and Malaysia markets outperformed, whileChina and Hong Kong markets underperformed. Within MXAPJ sectors, Info Tech

海外研报

2024年08月29日

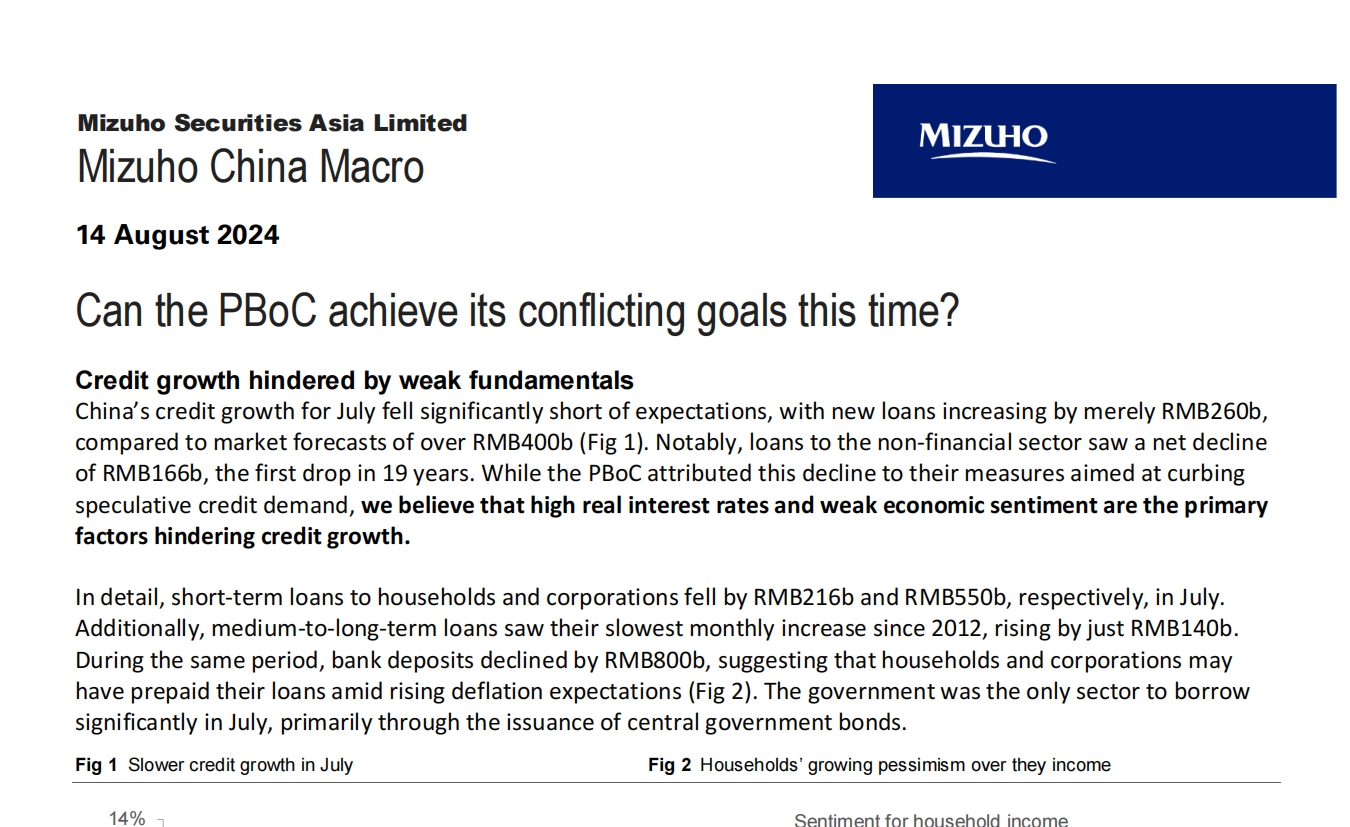

Can the PBoC achieve its conflicting goals this time?

Credit growth hindered by weak fundamentalsChina’s credit growth for July fell significantly short of expectations, with new loans increasing by merely RMB260b,

海外研报

2024年08月29日