海外研报

筛选

Five Stocks in Focus: HP, NESTE, PBF, CRK, and XOM

In this note, we highlight five stocks that are top of mind in investor conversations.(1) For HP (Sell), we discuss our updated US rig count forecasts, driving lower

海外研报

2024年08月30日

VISIBILITY ON THE IRAN VS ISRAEL REPRISE: NO OIL SHOCK

It was never a matter of ‘if’ – rather only ‘when’ and ‘how’ – Iran and its “axis of resistance” would retaliate againstIsrael after last month's strikes. From an investment perspective, the key question remained whether this latest

海外研报

2024年08月30日

FIGHT THE PBOC

Don’t fight the Fed” is a common market adage, but what about the PBoC? China’scentral bank and the CCP state apparatus are arguably a tougher matchup. However,

海外研报

2024年08月30日

Q2 GDP Growth Revised Up on Stronger Consumption

BOTTOM LINE: Real GDP growth was revised up 0.2pp to +3.0% annualized in thesecond quarter, above expectations and reflecting an upward revision to

海外研报

2024年08月30日

Tomorrow, back to only thinking "Rate cuts!"

Today, markets are only interested in one economy, one field, and earnings from one company,which may or may not be in a bubble. It makes a change from a focus on “Rate cuts!” I guess. But

海外研报

2024年08月30日

Precious Metals Trading Desk View

This publication was prepared by Bank J Safra Sarasin (BJSS) Trading department. The views or ideas expressed herein are those of the desk and/or the author only. The publication cannot be considered as investment research or a

海外研报

2024年08月29日

THE UNITED STATES ECONOMIC MONITOR

We look for a 0.13% rise in the July core PCE deflator, implying downside risk to the 0.2% consensus.Real consumption probably rose by 0.3% in July,

海外研报

2024年08月29日

THE EUROZONE ECONOMIC MONITOR

Destatis confirmed the decline in German GDP in Q2, despite still not publishing services data.

海外研报

2024年08月29日

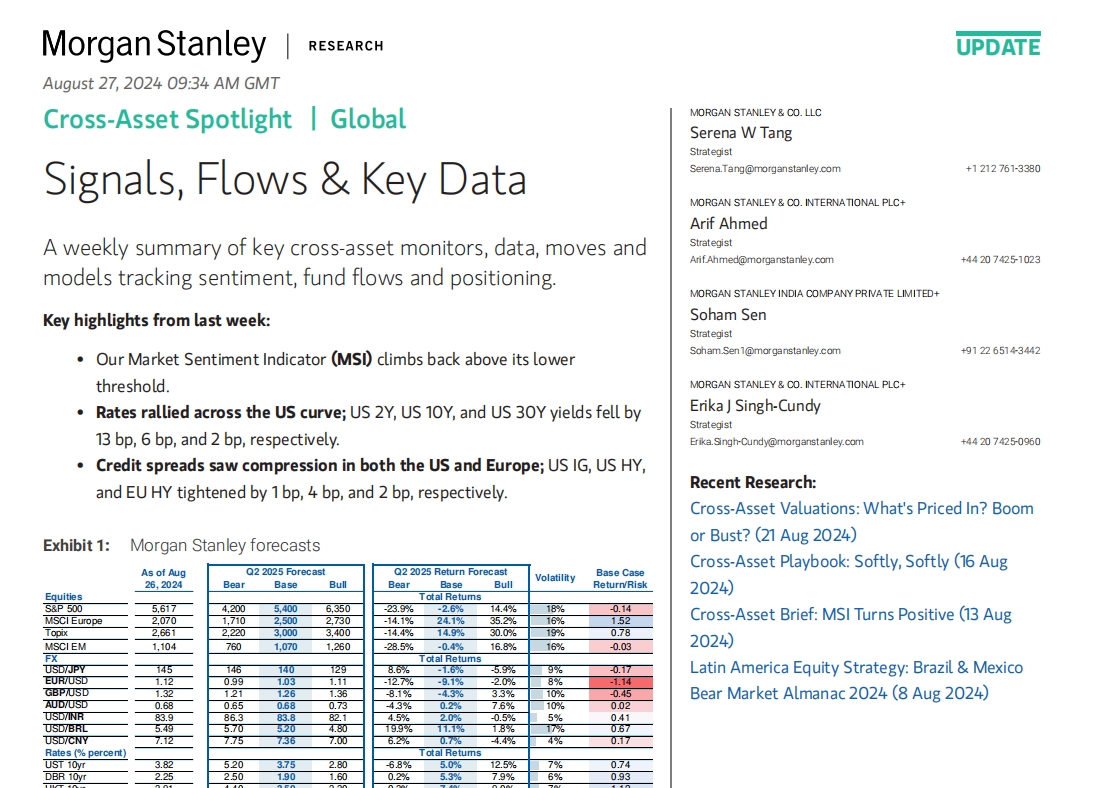

Signals, Flows & Key Data

A weekly summary of key cross-asset monitors, data, moves and models tracking sentiment, fund flows and positioning.

海外研报

2024年08月29日

Global FX Positioning: Short DXY Positions Stretched. Broad USD Positioning Short - Not Stretched

In the week ending Friday, August 23, options pricing data indicate investors added long NZD and GBP positions and increased short USD (DXY) positions. In futures,

海外研报

2024年08月29日